Hi everyone,

I hope you are having a great Saturday!

I wanted to do something a bit different today and take a look at a bunch of top performing stocks from this recent move and identify how/when they could have gotten on your radar and how you could have traded them.

This post was brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

Now let’s dive in ↓

Market Timing with the 21 ema

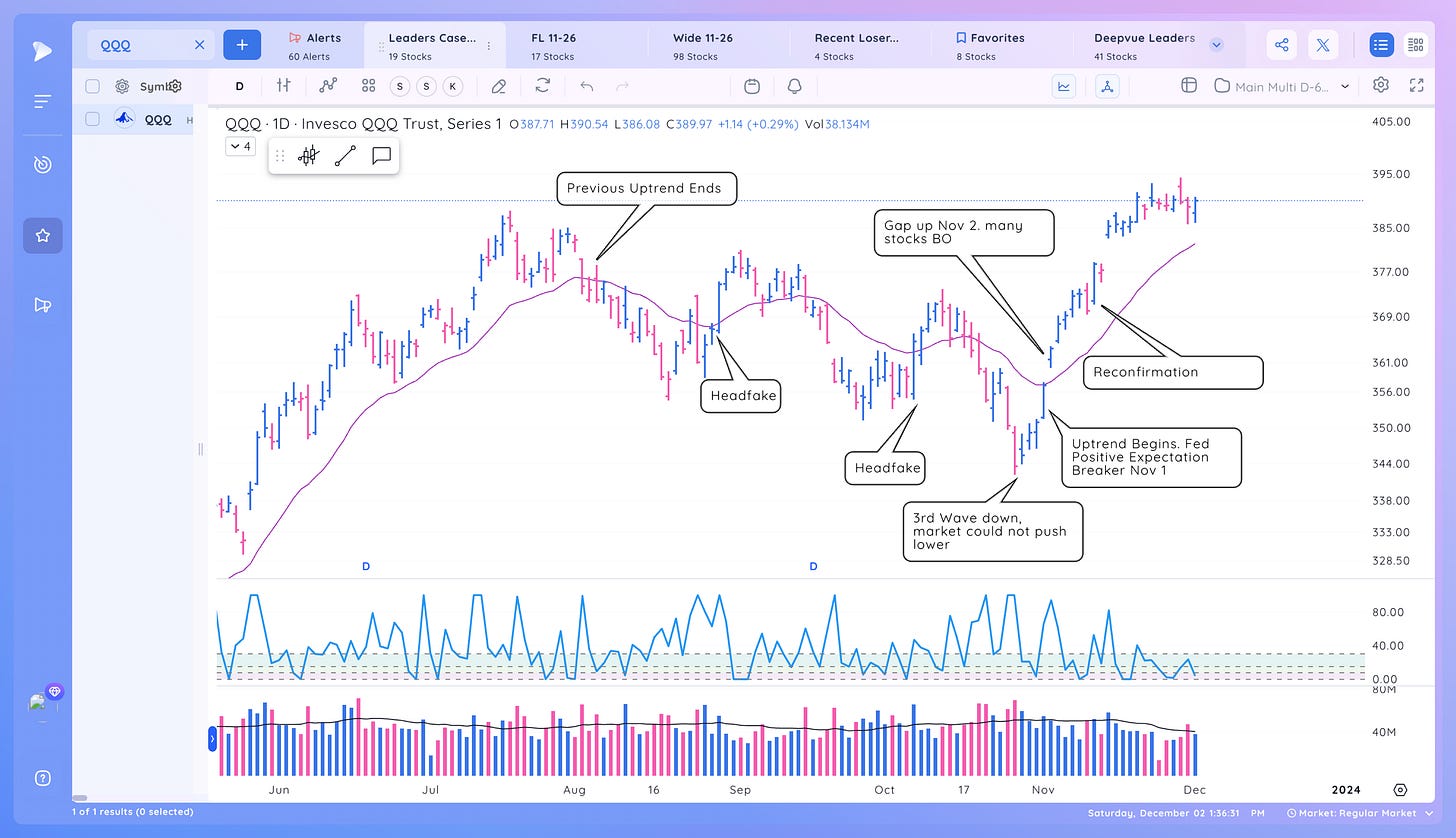

First, how could we have been ready for the recent powerful move up in the market. A simple way is to analyze the price and volume action of the indexes on a daily basis and use a moving average to define a market cycle.

I use the 21ema as my guide for interpreting the market action.

If the market closes above a flattening to uptrending 21ema it starts an uptrend.

If the market closes twice below the 21 ema it ends the uptrend.

Also important is price and volume action and market structure. Decisive moves up/down can lead to early starts of uptrends/early starts of downtrends.

The best use of this is when the market has been in a downtrend, tightens up and forms a range and then pops up through the 21 ema.

A quick look back at recent action the past 2 years shows how powerful a simple market cycle system using the 21 ema can be.

There will always be some headfakes, no system is perfect, but the 21ema gauge puts you in an uptrend mindset very close to turns.

2018-2019 Period:

2019-2020

2020-2021

2022

2023

Recent Market Move since Nov 1

The most recent uptrend began in force on Nov 1, when we had a positive expectation breaker after the Fed announcement. It was a strong move upward on volume after the market refused to push lower in the 3rd wave down of a correction.

Individual stocks also were acting great Nov 1 & 2 which is key. Just because the market was up huge does not, mean that individual stocks were setup/buyable/participating. A lot of stocks formed wedge pops Nov 2.

A day like Nov 1 signals the start of an uptrend. However, that does not mean you go all in on 200% margin. It’s more of a change in mindset to start taking some positions and listening to market feedback.

You want to focus buys early in a cycle with the strongest themes that are developing together, meaning stocks that have potential and are setting up all together indicating widespread institutional support.

The best stocks will develop shortly before or as the market turns but leaders will continue to show in the first few weeks after a major correction bottom.

Themes in Early November

Semis were acting well with NVDA/AMD moving off the bottom. AAOI

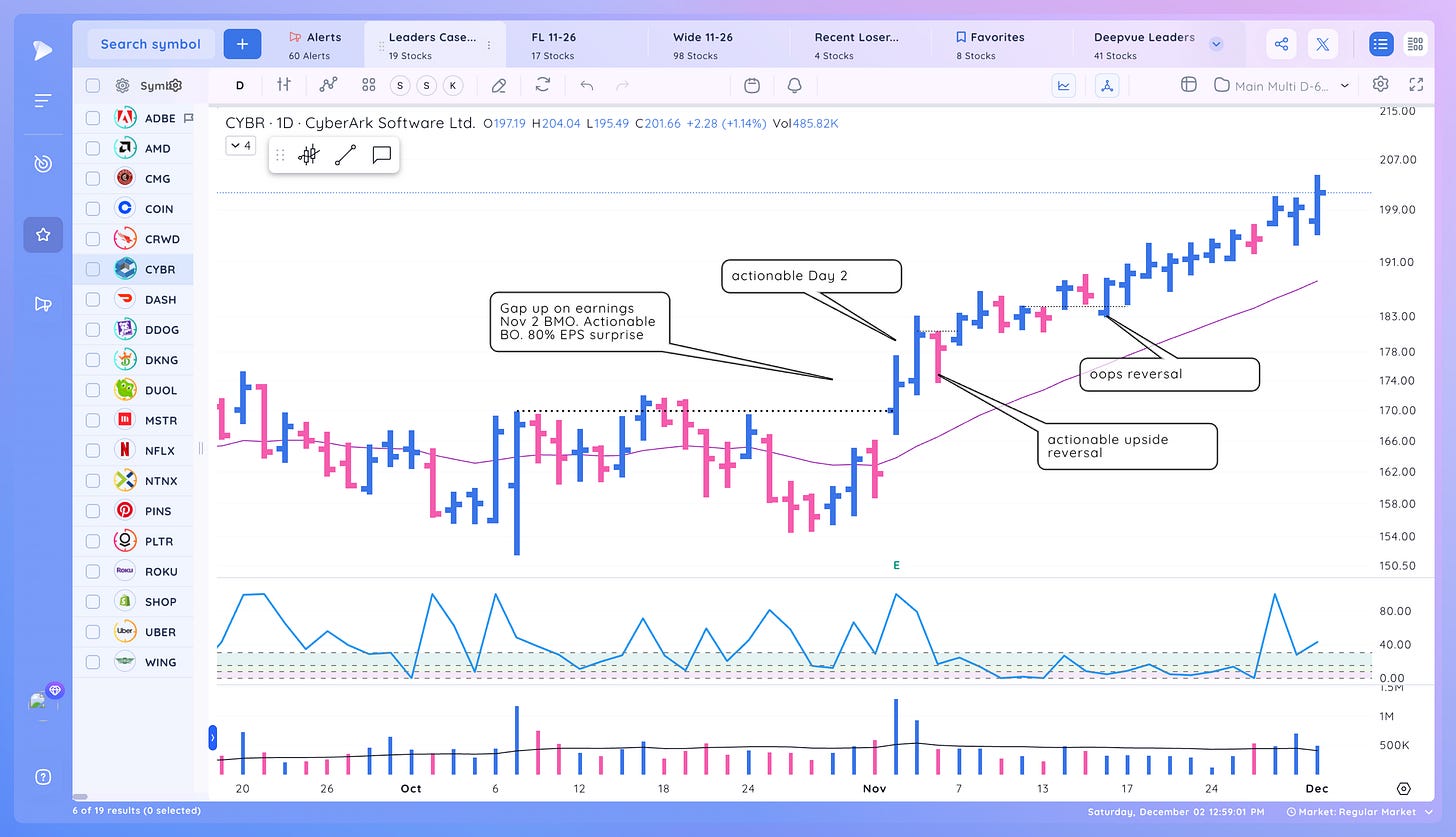

CRWD CYBR ZS also other cyber security names had stayed strong near their 21emas during the correction. NET powerful move off lows Nov 3

Bitcoin related names MSTR BITO had already pushed off base lows with COIN RIOT forming the bottom of bases

ADBE AMZN NFLX and other larger caps had been showing strength

UBER PLTR Gap ups Nov 2

Online/commerce AMZN PINS AFRM PDD STNE MELI DASH SHOP LULU

Software stocks shows up a bit later around Nov 7-9 DDOG DUOL NTNX

Biotech / Genomics CRSP EDIT

Food WING CMG DASH UBER

Case Study Leaders

For the case study, we will use stocks that were showing significant strength early in the market cycle.

AMD ADBE CMG COIN CRWD CYBR DASH DDOG DKNG DUOL MSTR NFLX NTNX PINS PLTR ROKU SHOP UBER WING

For each of these 20 stocks I’ll share what they looked like the day they showed signs of leading, and analyze their moves afterwards.

AMD - Nov 1

ADBE - Nov 1

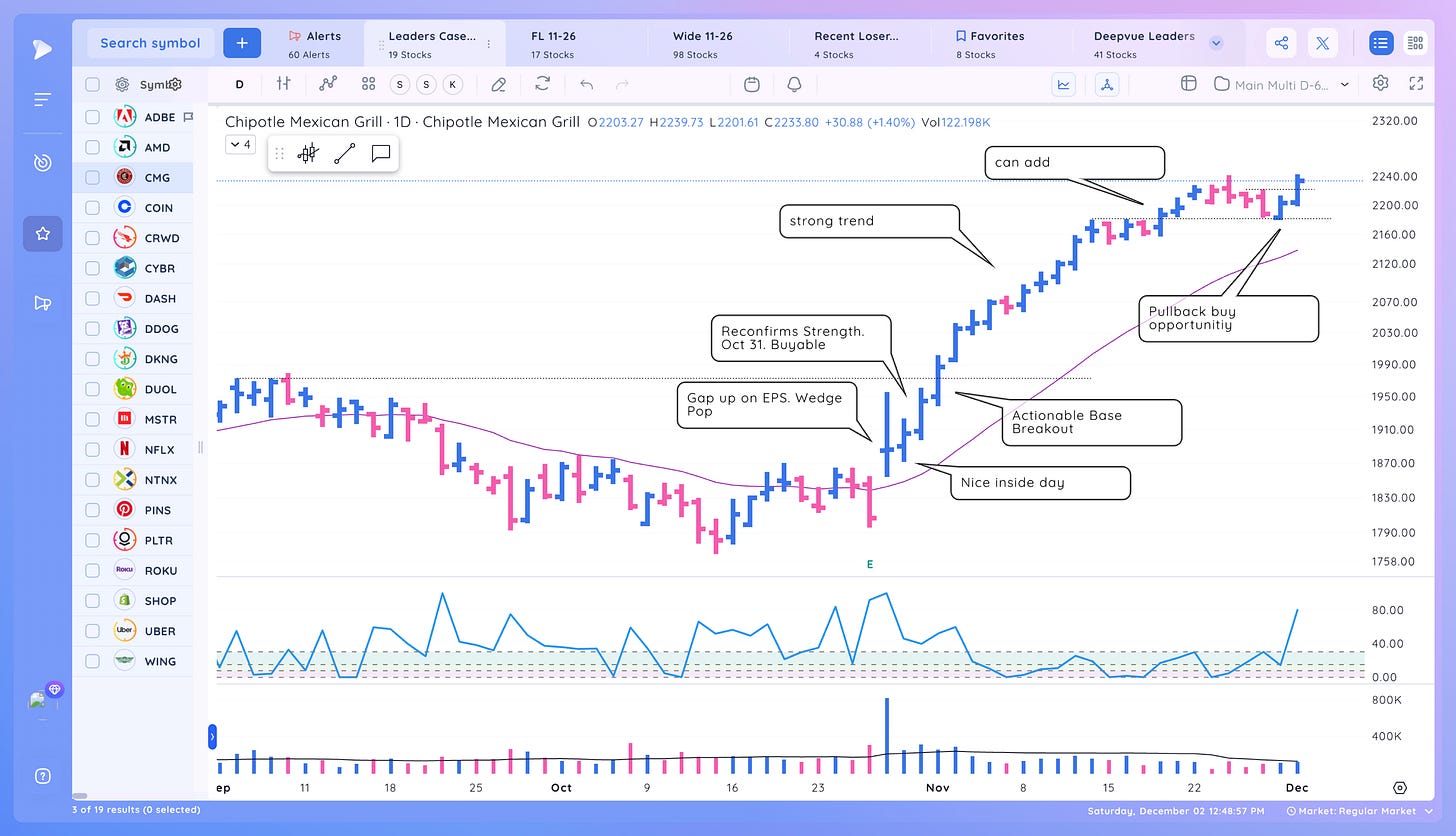

CMG - Oct 31

COIN - Nov 2

CRWD - Nov 2

CYBR - Nov 2

DASH - Nov 2

DDOG - Nov 7

DKNG - Nov 3

DUOL - Nov 9

MSTR - Nov 2

NFLX - Nov 2

NTNX - Nov 2

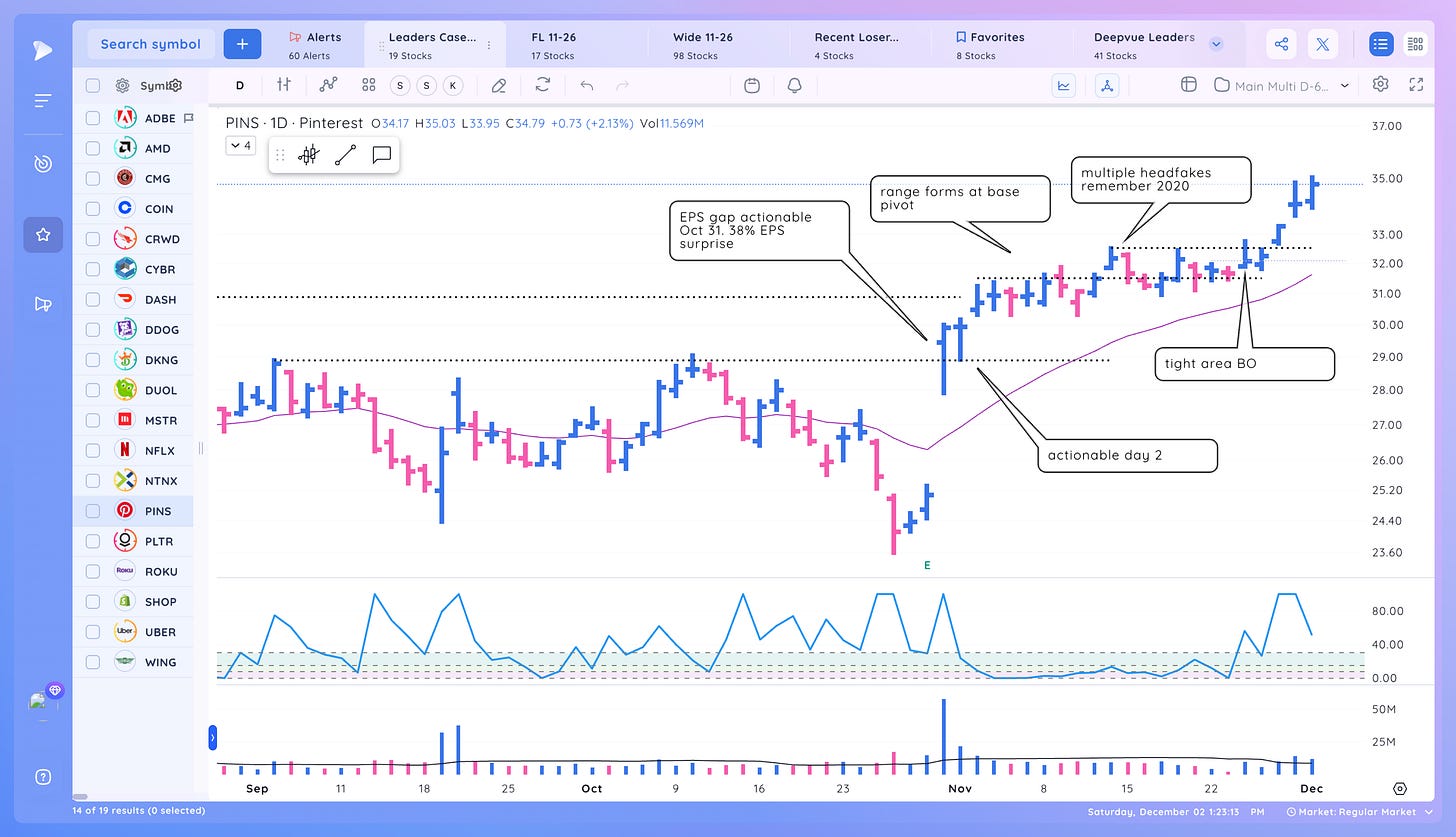

PINS Oct 31

PLTR - Nov 2

ROKU - Nov 2

SHOP - Nov 2

UBER - Nov 2

WING - Nov 1

Conclusions

Some of the best entries in hindsight were on that Nov 2 gap up day. Mindset switch to be very aggressive would be tough since just coming off bottom of correction but the opportunities were there.

Lots of gap ups after EPS and EPS beats.

Another window opened up Nov 7-13 for tight area entries and fresh moves especially in software.

Here is a graphic showing dates of base breakouts, earnings gap ups, moves from tight areas of many of the top performing stocks of this cycle. Basically, when did they start their moves in earnest.

I hope you found this post helpful. If you did, please share!

I hope you found this article helpful!

Here is what you can do to help support my work.

Leave a like on this post below

Cheers!

Richard

P.S. We just released a new free resource: The Ultimate Screening Guide

This will help you find top stocks faster and speed up your routines.

Nicely done Richard! A nice retrospective, gives one some good examples of what to look for going forward

This is great! Thanks Richard!