What is the Best Moving Average?

This article is my 2nd Atomic Essay. I will be writing 30 Essays in 30 Days about trading concepts and risk management. If there is a topic that you would like me to cover drop it in the comments below. Enjoy!

Also let me know what your go to moving average is in the comments section and please share if you found this helpful!

Moving averages play a central role in many traders' systems. They are an objective way of determining the trend of a stock over a certain period.

If a stock is above a rising 50 day simple moving average, then over that period the stock is in an uptrend. However, it's important to remember that moving averages are simply a guide, a reference point.

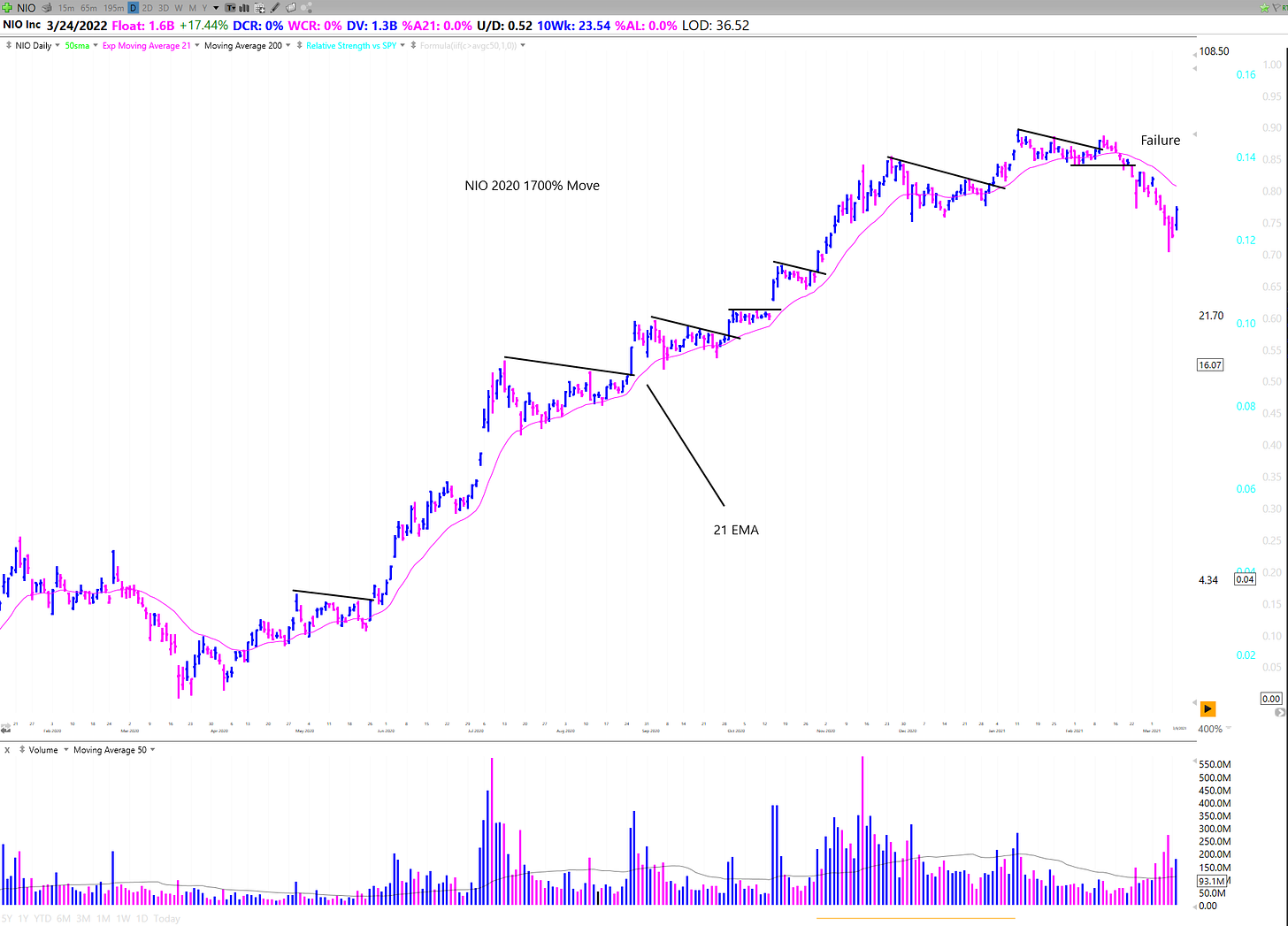

What's more important than moving averages is the character and behavior of the stock's price action. In a strong uptrend it should be making a series of higher highs and higher lows and move in sprints, consolidate, then push higher on above average volume. This is the general nature of stocks under accumulation by institutions.

So what is the best moving average?

Simply put, the best moving average to use is the one that most closely matches your timeframe. If you are a swing trader, an 10 sma or 20 sma/ema might fit you the best. For position traders and investors, the 50 daily sma/10 week sma and the 40 week will keep you in the strongest trends.

You also want to match the character of the stock. If you notice that in the past after a breakout, the stock trends above its 21 ema, take note, and use that moving average to trail your stop or manage your position.

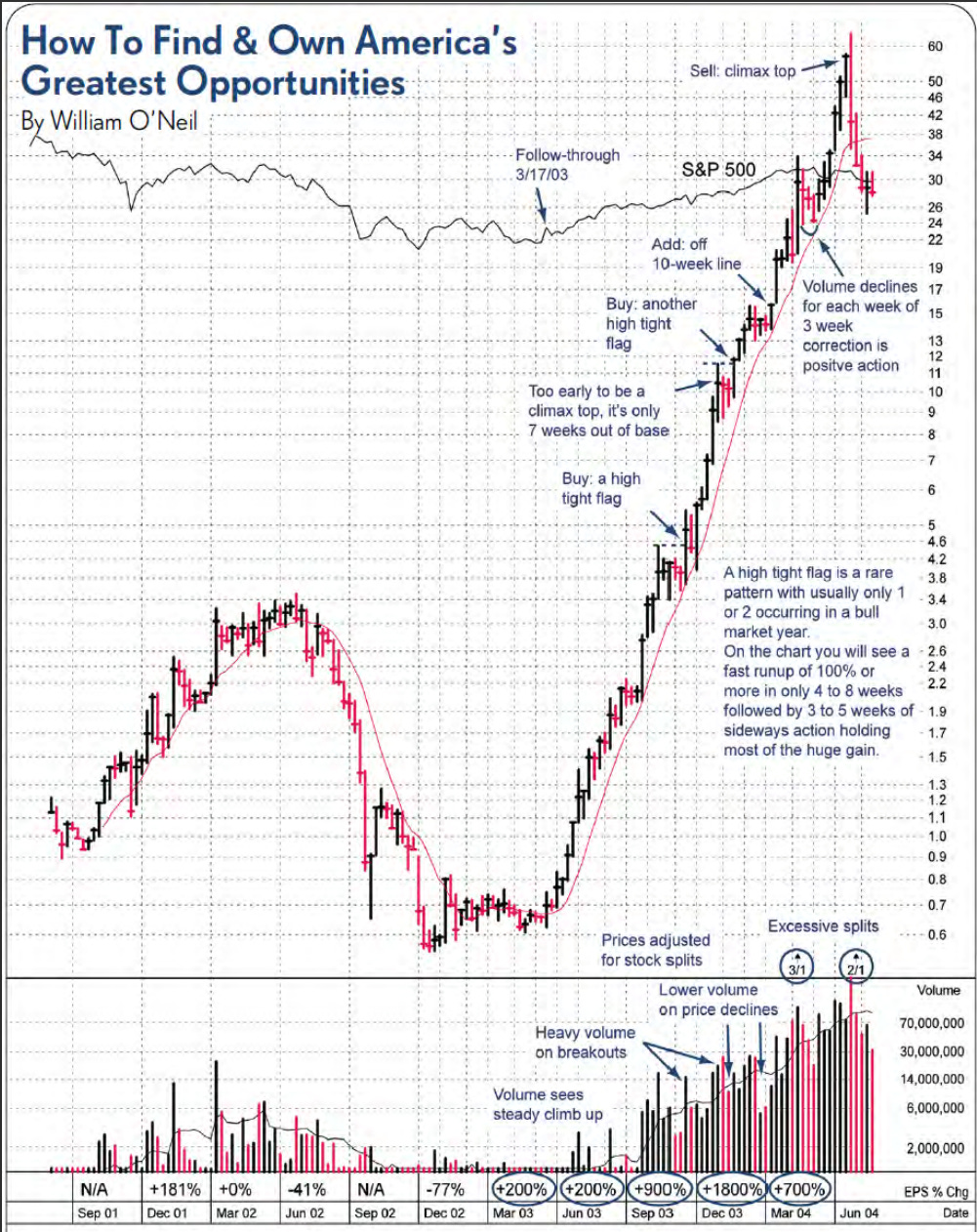

Going back and studying history, many Model Book Stocks held the 10 week line on a closing basis for a significant amount of their uptrends.

Taser is just one example during it’s incredibly powerful move in 2003. Many leaders like to hold the 10 week line during trend but they may undercut it during basing periods.

This is most applicable coming out of a large correction, and many leaders can double, triple, and even quadruple without ever living below the 10 Week MA.

In short, the best moving average is the one that most fits with both your style, timeframe, as well as the character of the stock. Find what works for you!

What are your thoughts? Let me know in the comments and leave a like if you enjoyed. Also please share if you found this helpful!

Take care!

Richard

How about a VWAP chart essay?

Well said. Concise and cogent.