Weekly Focus List 3/13

Hey everyone,

Below is my focus list along with short commentary. The charts are from MarketSmith, which is sponsoring this post. These are simply ideas for educational purposes only, not trading advice.

Currently the market is in a correction. I will most likely just watch to see how these setups develop.

Make sure you are subscribed so you don’t miss any future articles!

Watch my focus list video:

BTU

Leading group and extended from the base pivot, would like to see this consolidate and let the 21 ema catch up. Inside day Friday. Powerful volume.

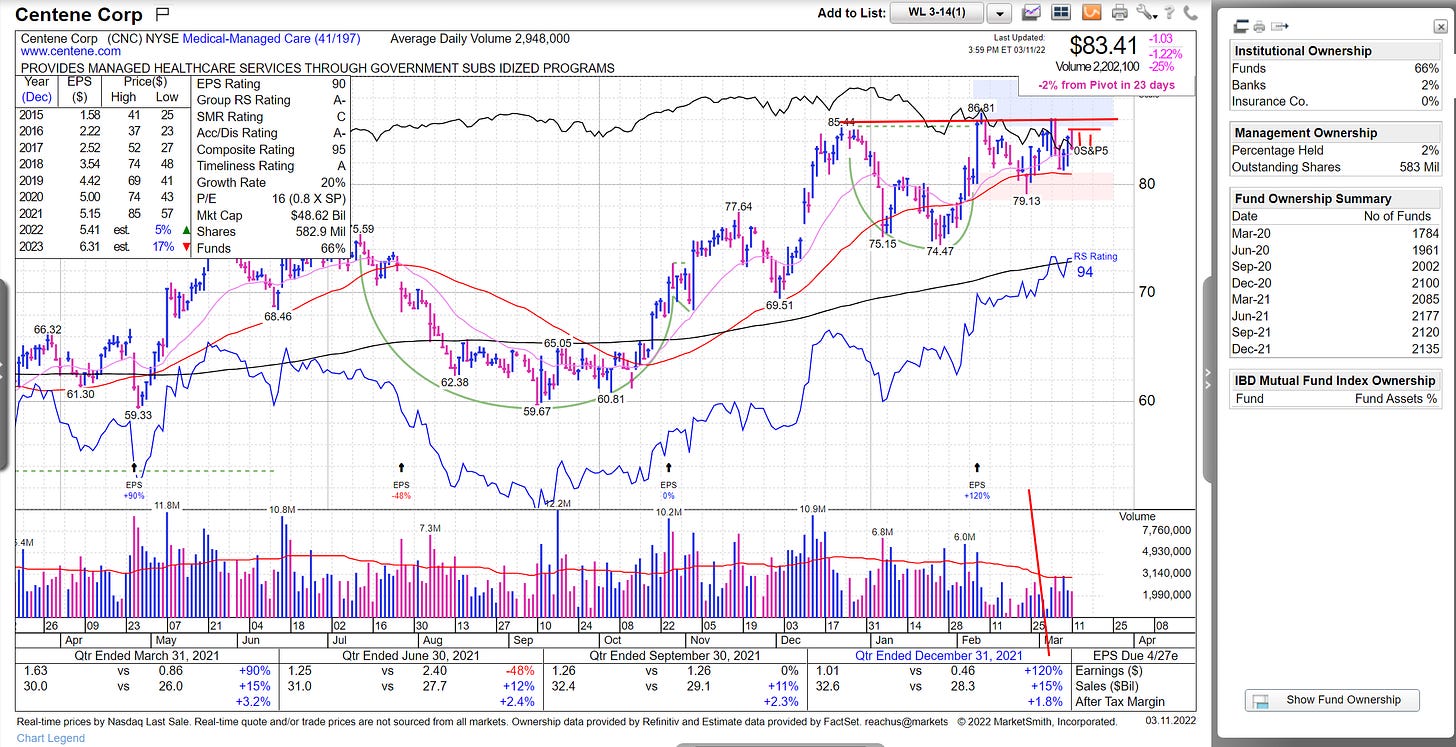

CNC

VCP forming here, I would like to see a few days tightness to really prime it for a breakout. Strong earnings last quarter.

CRDO

Powerful IPO pattern, can it muster another move? A few downside reversals so I would want to protect profits quickly if it does breakout.

EXTN

Powerful move from a neglect phase. Pulling back into a pivot and pretty tight. Lower DV name.

LMT

This LDOS and RTX look very similar, short term extended after strong moves. I would like to see sideways action.

LNTH

Powerful Gapper on huge volume. Failed breakout but now it’s back in the range. Will it continue to hold up?

NEM

Very strong move here but short term extended, would like to see sideways action.

NUE

Steel is also a leading group. This broke out and then retested a long base. Can it push out into new highs?

NVCT

Speculative play that reminds me of TSP’s IPO setup. This is not quite as tight and is drifting higher. Lower DV play so adjust accordingly.

PANW

This lost the pivot but held the 50 day and tightened constructively.

PCRX

Large base and tight action. Good volume coming in on that breakout.

SEDG

Solar names have started shaping up and this one is a liquid leader.

SG

Very strong RS recently, I would like to see tightness now and ideally a shakeout day before a move higher.

VNOM

Leading group. This has been trending strongly but is trading a bit choppy.

I hope you found this post helpful! Let me know your thoughts on these setups and drop one stock you are watching in the comments below.

Take care and feel free to share this post!

Best,

Richard