Hi everyone,

I hope you are having a great Friday!

In this post I’ll concisely share my thoughts on today’s action.

This post is brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

Also, be sure to leave a like on this article and subscribe so you don’t miss any future ones!

Now let’s dive in ↓

Market Action

The QQQ put in a constructive upside reversal bar today. Showing some support after yesterday’s selloff. We remain below the MAs.

The IWO also had a strong day off the 200 sma

SMH - Similar action and potential higher low forming

Volume

Volume was lower on the NYSE and Nasdaq.

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Mixed - Below Rising

Short-term - 21 ema - Down - Below Declining

Intermediate term - 50 sma - Down- Below Declining

Longterm - 200 sma - Up - Above Rising

Group/Themes Action

Decent action across growth groups. Seeing rotation into Bio/Pharma and some software. Oil and Gas stocks still look good

Here’s a Daily Group Performance chart from TraderLion Private Access:

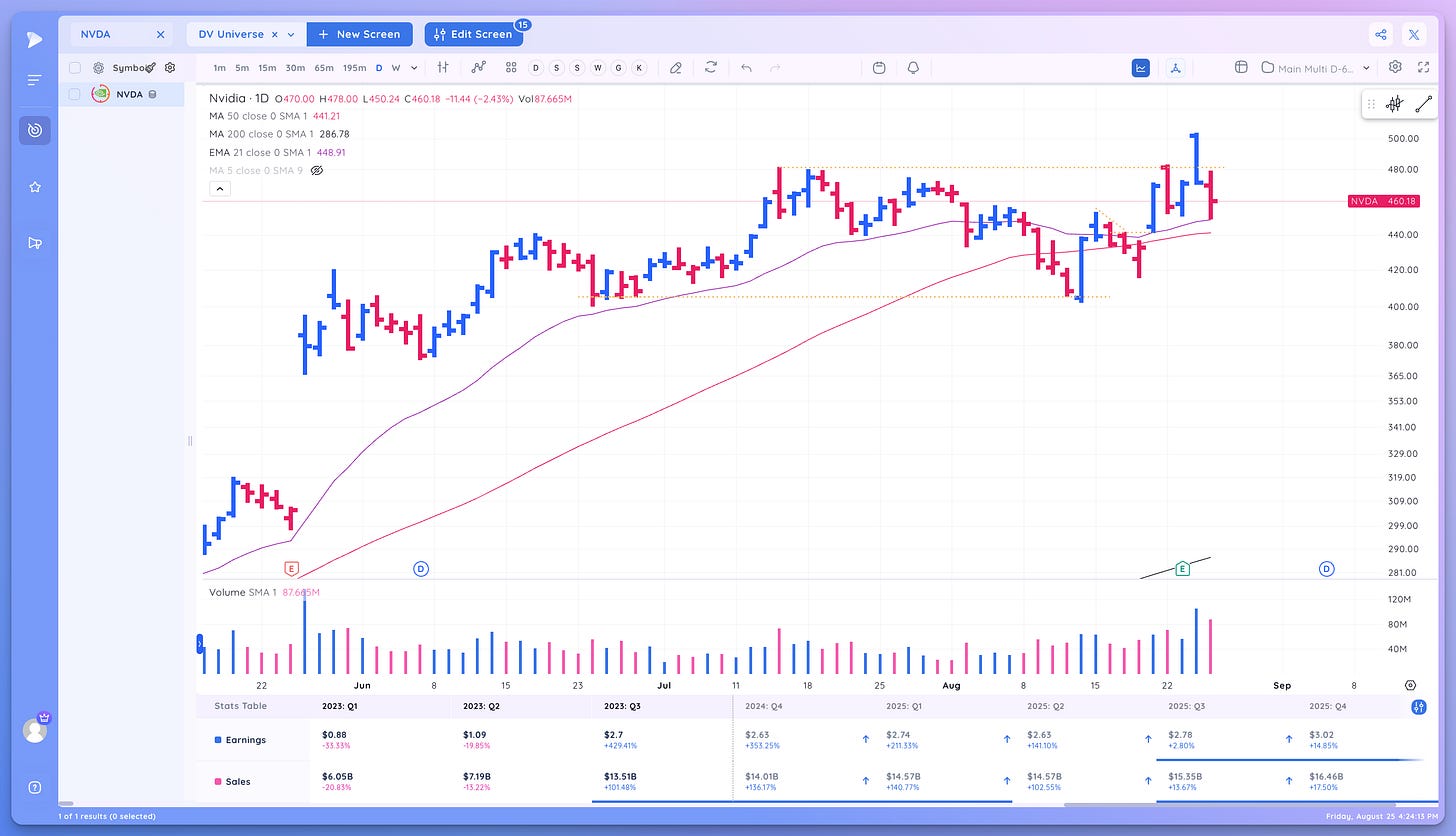

Key Stocks in Deepvue

NVDA nice close off the 21 ema, see if it can build a range here and setup an entry point.

UPWK - Upside reversal, still nice action

CELH This looks setup for next week

VRT - acting great

TSLA - watching for a wedge pop through the 21ema

Market Thoughts

Today was constructive, great close and many of the leaders acted very well. Ranges are still wide but this was a strong day after yesterday’s negative action

Next week we should have some more clarity. I would say right now individual stocks look better than the indexes.

Remain open to any scenario and continue to do your homework. Manage risk always and take it day by day.

What are your thoughts on today’s action? (Leave a comment below)

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Cheers!

Richard