Hi everyone,

I hope you are having a great Sunday!

In this post I’ll concisely share my thoughts on the week’s action. And share a bunch of stock charts that caught my eye.

Now let’s dive in ↓

Market Action

The QQQ continues to trend above the rising MAs. We pulled back hard midweek but closed well.

IWO is still in this range and tightened up the last two days

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Up - Above Rising

Short-term - 21 ema - Up - Above Rising

Intermediate term - 50 sma - Up - Above Rising

Longterm - 200 sma - Up - Above Rising

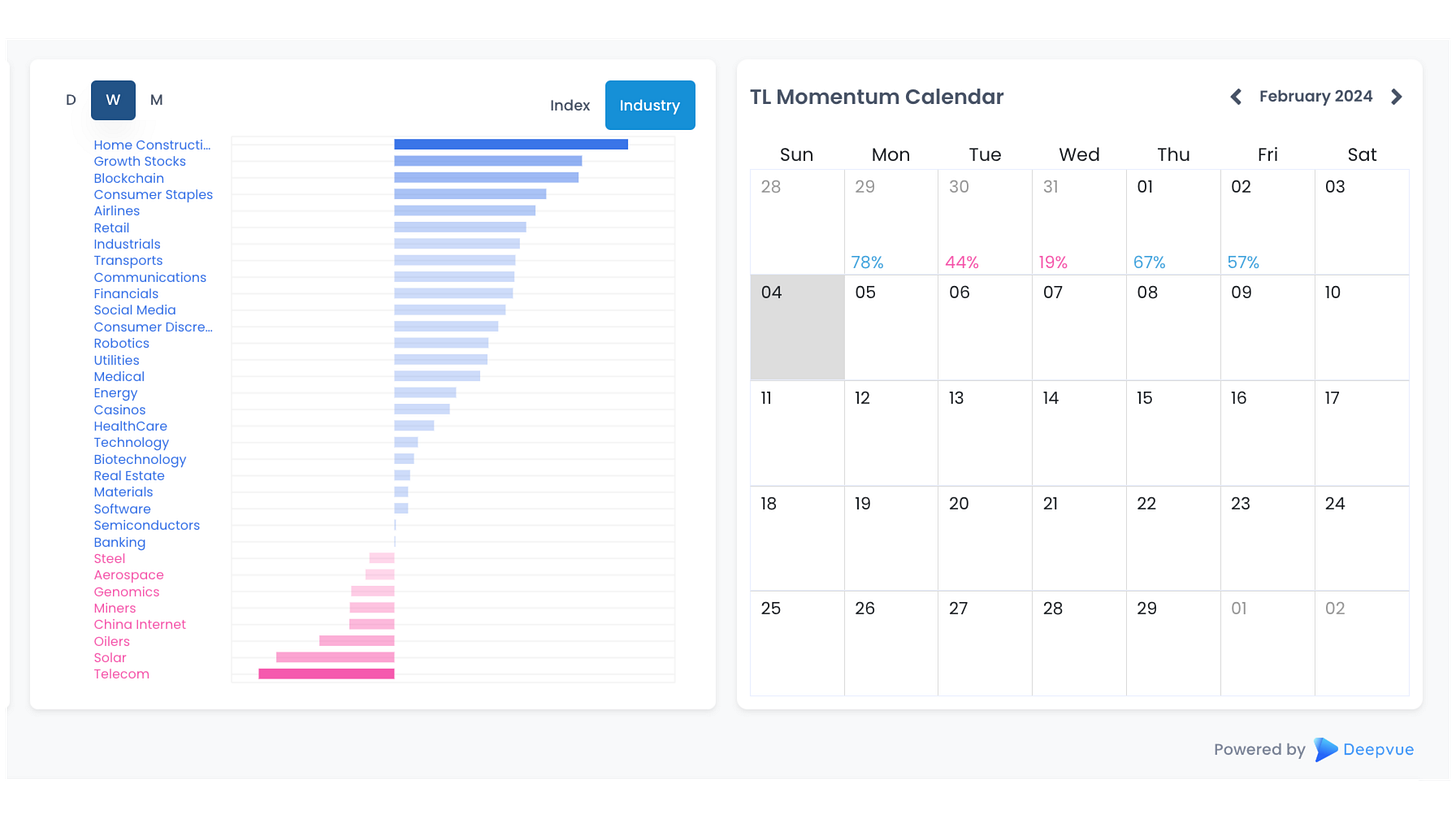

Group/Themes Action

Semis and AI lead the way.Homebuilders set up for another move?

Weekly Performance charts

Key Stocks in Deepvue

SMCI quick double. trending. Will pullback to the 10/21 ema at some point

NVDA reconfirmation bar friday. Trending

FSLY nice move from the inside day

META big earnings move

GTLB upside reversal

ELF continues its model book move

MNDY short consolidation

APP still set up nice on the weekly. can watch for a tight pattern

SNOW strong move

MDB powerful early breakout

NAIL home builder leveraged etf setting up

Market Thoughts

We continue to trend. Let cores work and keep an eye out for performance enhancers. We continue to see new breakouts.

Reminder:

Risk Management is Paramount

Refuse to enter randomly without managing risk and wait for the spots to develop, they will. Stocks during strong moves always pull back to the 21 ema, 50 sma multiple times. Look for a tight and logical entry point.

Have patience, focus on the best stocks with the greatest potential. These will telegraph the rest of the market.

Take it day by day and manage risk along the way. Be ready for anything

What are your thoughts on today’s action? (Leave a comment below)

This post was brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Cheers!

Richard

P.S. We just released a new free resource: The Ultimate Screening Guide

This will help you find top stocks faster and speed up your routines.

Thank you Richard. I remember markets that no matter when I sold it was always too soon. I'm feeling we may be talking off.