The Story of Nicolas Darvas, Trading Legend

The Dancer who Made $2,000,000 Trading Stocks Part Time

Today I wanted to share the story of my favorite trading legend: Nicolas Darvas.

His book, How I made 2 Million in the stock market, was the first trading book I ever read. It’s a narative which follows his trading journey from novice to making $2,000,000 in just 18 months.

If you find this helpful please consider subscribing!

I also recommend watching John Boik teach Darvas’s story which is a sneak peek of the ongoing Historical Analysis Masterclass

This has been my favorite part of the class so far and if you are not signed up yet I highly recommend checking it out using this button:

Now let’s dive into Darvas’s Journey:

The story of Nicolas Darvas is a fascinating one and well worth studying for both traders and investors.

During the Bull market of the 1950’s, Darvas was able to turn $10,000 into over $2,000,000 in just 18 months.

However, what's most impressive is that Darvas was able to accomplish this astounding return while trading by telegram and dancing professionally around the world.

In this thread we will cover Darvas’s story and his Box Method which he used to great effect to catch revolutionary companies during their most dramatic price increases.

For many traders who have studied William O’Neil’s CANSLIM methodology you will notice certain similarities such as focusing on leading companies, with price and volume action suggesting relative strength.

Darvas’s Buy Points as well are akin to pivot point breakouts from O’Neil Type Bases. Darvas was one of O’Neil’s major influences.

Nicolas Darvas was born in 1920 in Hungary. At the University of Budapest, he trained as an economist but was forced to flee the country in 1943 due to the Impending World War.

After the war, Darvas began his career as a dancer and with his sister as his partner, danced successfully in the United States and Europe

Darvas's interest in the Stock Market was piqued after being offered 6000 Shares of a company named BRILUND as payment for a performance.

Darvas ended up not being able to attend but paid $3,000 for the shares at 50 cents/ share as a nice gesture.

2 months later, Darvas was reading the newspaper when he was astonished to see that BRILUND was listed at a price of $1.90.

He immediately sold and netted a profit of $8,000

This initial success had him hooked and Darvas was determined to learn how to navigate the markets successfully.

However, for an extended period, Darvas struggled to find any consistency.

He tried many methods and followed tips from friends and brokers.

Darvas went through the same emotions many new traders experience. Elation, a sense of control, and pride when a trade would work, and blaming his broker and anyone but himself when things went wrong.

However, he soon realized that he was slowly losing money, he would have some wins but then would give it all back and more including commissions.

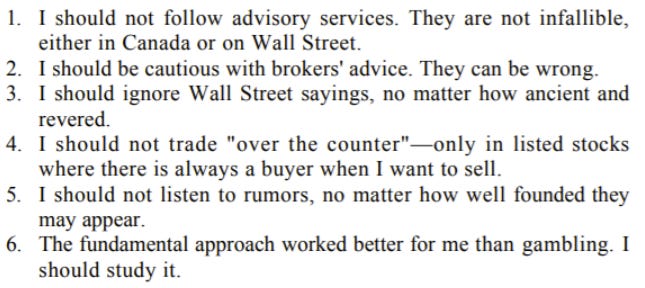

Frustrated, Darvas wrote a few rules to himself.

During this time Darvas also felt the need to trade every day, to always be looking for the next opportunity.

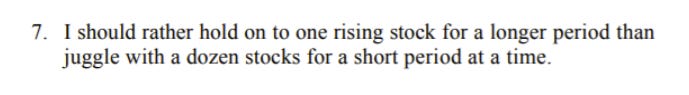

Eventually he would realize that action does not equal progress in the markets and that often if he had just stuck to his original purchases, he would have yielded a much higher return.

This realization came into place when he purchased 100 shares of Virginia Railways at 29 ¾.

Darvas held this stock for 11 months, ignoring it for the most part while constantly churning much of the rest of his account.

One day he realized that it stood at 43 ½, he sold it and realized “ Without any effort on my part, or even any anxiety, it had made me $1,303.68”

From this experience he created his 7th Rule:

Darvas started to learn to watch for leading industry groups and notied which groups were acting the strongest and also had the best earnings.

He developed a rating system which considered ratios, dividends and industry groups.

This systematic process gave Darvas an immense sense of confidence. From his rating system tables he found one stock which seemed to meet all his criteria: JONES & LAUGHLIN

Darvas wrote “A tremendous enthusiasm came over me. This undoubtedly was the golden key.... This was the stock to make me wealthy. This was a gilt-edge scientific certainty, a newer and greater BRILUND. It was sure to jump 20 to 30 points any moment. "

"I had only one great worry. That was to buy a large amount of it, quickly, before others discovered it. I was so sure of my judgment, based on my detailed study that I decided to raise money from every possible source."

Darvas piled as much money as he could into the stock buying 1000 shares at 52¼ with leverage, however to his dismay and confusion, this perfect stock started dropping and dropping.

Darvas ended up selling at 44, crushed with a $9,000 net loss.

He was in despair close to bankruptcy and wondered how his fundamental, scientific approach could have failed so terribly.

Determined, he watched the stock tables closely to find his next opportunity. A stock called Texas Golf Producing caught his eye.

It did not have the strongest fundamentals but it was consistently performing well and increasing in price.

Darvas bought in and watched it tensely., and held it as it continued its upward trend.

Finally, he sold, making back some of his earlier losses and getting back on firmer financial footing.

He considered what had happened, his intense research had led him to a seemingly perfect stock which had caused him large losses while simply buying a stock which showed strong price action had yielded a good profit.

At this point, Darvas decided to focus solely on the technical action of price and volume.

"In the same way, I decided that if a usually inactive stock suddenly became active I would consider this unusual, and if it also advanced in price I would buy it."

-Darvas

"I would assume that somewhere behind the outof-the-ordinary movement there was a group who had some good information. By buying the stock I would become their silent partner."

-Darvas

Following this method, Darvas bought PITTSBURGH METALLURGICAL, a fast moving stock meeting this criteria. The stock soon fell hard and Darvas sold, once again confused.

Looking at the price action, Darvas realized that he had bought the stock after it had already risen quickly 18 points. He had bought the right stock but at the wrong time

Darvas committed himself to studying the price action of stocks to try to find a way to identify the correct time to buy.

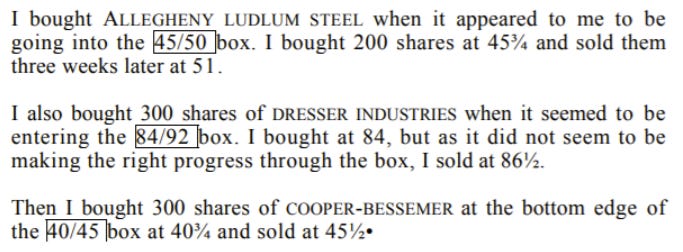

He noticed that stocks would move up and down in patterns or boxes, a stock would move up, bounce back and form a range before either moving up from that box to form another higher one or fall through the floor and break down.

This realization formed the basis of his Darvas box theory. He started trading using these floors and ceilings to good effect using stop orders to buy at precise moments and had a series of strong trades.

However, an important turning point in Darvas’s trading came when he purchased NORTH AMERICAN AVIATION as it was establishing a new box in his mind. After purchasing, the stock quickly started to fall. Darvas, committed to his strategy, held on believing it would work.

"I could have sold it when it gave up a point. I could have done the same when it lost another point. But I decided against it and stubbornly held on. My pride did not let me act. The prestige of my theory was at stake. I just kept saying this stock cannot go down any further."

"I did not know what I learned later, that there is no such thing as cannot in the market. Any stock can do anything. By the end of the next week, the profit from my three previous operations was gone. I was back where I had started."

This experience led Darvas to some important realizations:

Darvas started to incorporate stop loss sell orders in addition to buy orders to automatically sell and protect most of his capital if a stock reversed from his buy point.

He would also start trailing his stop up as a stock advanced for him, ultimately selling if a stock broke expectations

While traveling and dancing around the world, Darvas started to trade by cable, coordinating his buy and sell stops with his broker.

In August 1957, Darvas noticed that all his stocks had been stopped out.

On the sidelines, he started to watch as a bear market started to unfold. He was astonished as stocks he had owned continued to drop far from his sell price, some even 50% or more.

He had escaped the destruction simply by watching the behavior of his stocks.

As the Bear Market continued he resisted the calls from his broker to trade and waited.

He started to notice that some stocks were still falling with the market, but seemed to be resisting the decline.

Analyzing these names, he realized that many of them showed strong fundamentals and earnings trends.

This analysis convinced him to add fundamental analysis back into his process, pairing it with his technical buys and sells

Darvas began focusing on stocks with both promising fundamentals (with strong earnings and in a growing industry like electronics or missiles) as well as showing strong price action relative to other names.

This is when his techno-fundamental theory was born.

Darvas started putting his theory into practice, and made a buy of a company called Lorillard, a cigarette company which popularized filters and was forming a 24/27 box and showing strength versus the rest of the market during the overall market decline

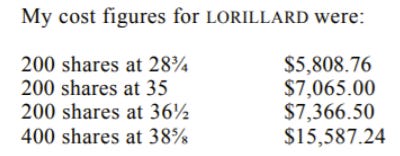

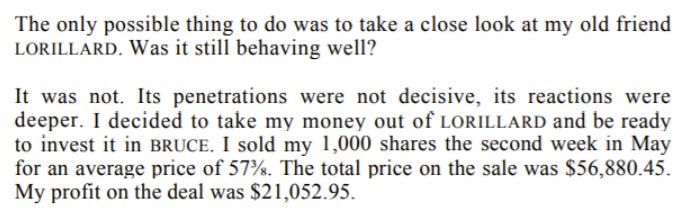

Darvas was actually stopped out initially but quickly recovered and Darvas entered again at 28 ¾. As the stock made progress and broke out of more boxes, Darvas added to his position as Lorillard started a strong move upward

During this time, Darvas was also trading two other stocks in a similar manner, Diner’s Club and BRUCE. When LORILLARD started faltering. Darvas decided to cash in netting over 20,000

One day Darvas received a call from his broker.

His Broker told him that trading on the NYSE of BRUCE had ceased. At the time Darvas’s entire capital was invested in the stock

Stunned, Darvas took some time to listen to what his broker was actually saying.

He had bought the stock at near 50 but now had he lost his entire capital?

Quite to the contrary, a fund in New York had started to short BRUCE since it was in the 40s.

However, unknown to both Darvas and the short sellers, a manufacturer named Edward Gilbert had been buying as many shares as he could to take control of the company.

This buying pressure forced the short sellers' hands and they had to buy back the stock they shorted at higher and higher prices.

This volatility caused trading in BRUCE to be halted and moved to the OTC market.

On the OTC market, Darvas now had the choice to sell his shares at 100 and double his initial investment of 60k.

However, decided to hold for the time being as the short sellers were getting more and more desperate to buy back shares.

He ended up selling his position for an average cost of 171

Darvas’s net profits from following price and volume and unknowingly trading along with Mr Gilbert during the hostile takeover?

$295,000

Darvas continued to trade to great effect and built up his capital to half a million. However, he did have one more major crisis to bring his ego back down.

His success had come by staying objective and following his system.

He had used cables to send in his orders after studying price and volume. This had kept him far removed from the noise and rumors on wall street.

However, after a move to New York, Darvas decided to get closer to the exchange and press his luck, confident after all his recent success.

He started becoming influenced again by rumors and lost his system and objectiveness.

After a few disastrous weeks Darvas suffered nearly 100k in losses.

Darvas was shaken, and he realized that being close to wall street and succumbing to ego was a detriment, and he left to Paris to regain himself.

Darvas would once again find his groove and started trading UNIVERSAL CONTROLS. TEXAS INSTRUMENTS. THIOKOL CHEMICAL. and other names to great effect.

These trades would yield him profits which totaled over 2,000,000 dollars, which would be 18 million today.

I hope you enjoyed this article! if you did please leave a like and share it on twitter!

Have a great weekend!

-Richard