Hi everyone,

Let’s dive right into today’s (Wednesday’s) action. We’ll cover the general market and then individual stocks that are standing out.

Make sure you are subscribed so that you don’t miss any future articles.

The General Market

Today the market continued to defend the key level marked by the highs in late June and early July. We saw constructive action although at the moment this is still just a bounce in the context of a downtrend.

The QQQ closed up 2% over yesterday’s high. Net new lows remain

.

The SPY finished up 1.8%. The NYSE continued to make new net lows.

The IWM increased 2.18%.

The VIX was down significantly and closed at lows.

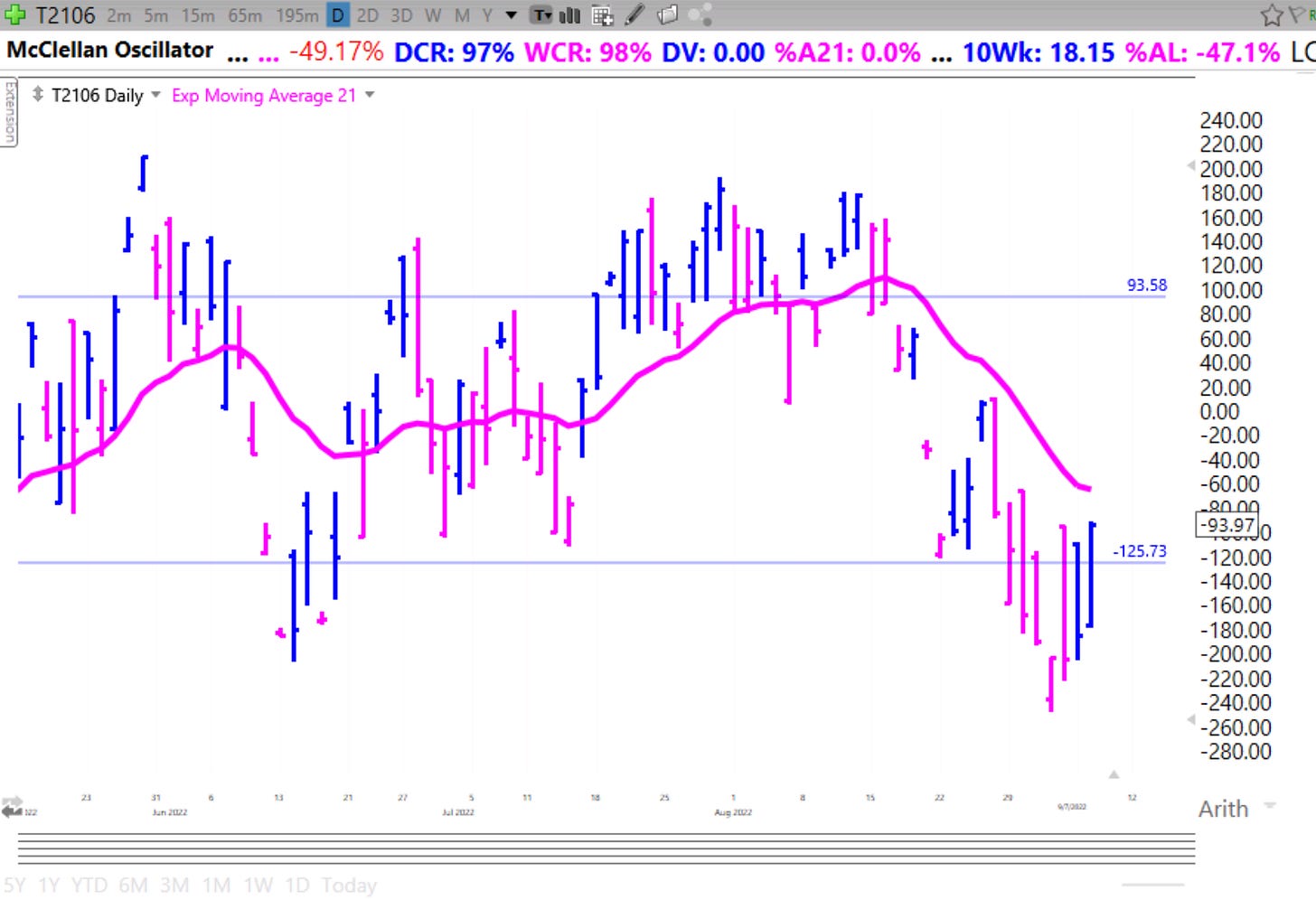

The McClellan Oscillator started to push higher.

Trends (2/4 Down)

Short-term: Mixed (Above the 5 sma but the sma is declining)

Intermediate-term: Down (below a declining 21 EMA)

Mid-term: Mixed (below 50 SMA but the 50 SMA is increasing)

Long-term: Down (below a declining 200 SMA)