Hi everyone,

I hope you are having a great weekend!

In this post I’ll concisely share my thoughts on the market health and leading groups.

This post is brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

I’m also very excited to announce that we have launched the special early bird discount for the upcoming Historical Analysis Masterclass with John Boik.

John is an extremely experienced trader, market historian, and educator.

He has been trading since the late 90s and has written several best selling trading books:

Lessons from the Greatest Stock Traders of All Time: Proven Strategies Active Traders Can Use Today to Beat the Markets

How Legendary Traders Made Millions: Profiting from the Investment Strategies of the Greatest Stock Greatest Traders of All Time

Monster Stocks: How They Set Up, Run Up, Top and Make You Money

Monster Stock Lessons: 2020-2021

His focus for the masterclass will be sharing his research on Legendary Traders, Monster Stocks, and Market Cycles to help you learn the blueprint for the markets and achieving success.

The Historical Analysis Masterclass will feature:

10 Comprehensive Live Webinars covering Legendary Traders, Monster Stocks, and Market Cycles

230 Page Textbook which culminates 20+ years of Research

460+ Slides compiling the material

2 Bonus eBooks for every student ( How To Make Money In Stocks and Monster Stock Lessons

Special Guest Appearances

Guided Workbooks for each Webinar

Challenges and Exercises to apply the material

Rare charts of Monster Stocks

It will take place July 8th - August 16th live on zoom and the recordings will be archived in the class for lifetime access.

This is the perfect class to take to level up your trading and learn how to identify and ride model book stocks, just like legendary traders like William O’Neil have over the decades.

The Early Bird Deal is available for only a limited time only so make sure to lock in your spot today!

Visit the sign up page to learn more:

Now let’s dive in ↓

Market Action

The QQQ continues to trend above the rising 21 and 50 sma. We pulled back last week which looks constructive and was much needed. I wouldn’t mind seeing us let even the 50 sma catch up to price. That would set up some great 2nd stage bases.

The SPY also pulled back, maybe the start of a nice consolidation letting the MAs catch up.

The IWO shows the most weakness, and we are seeing similar action in many charts. We broke below the recent structure and the 21 ema. Would like to see this recover and start to base out.

SMH, Semiconductor ETF showing a pullback towards a rising 21 ema on declining volume.

Key Stocks

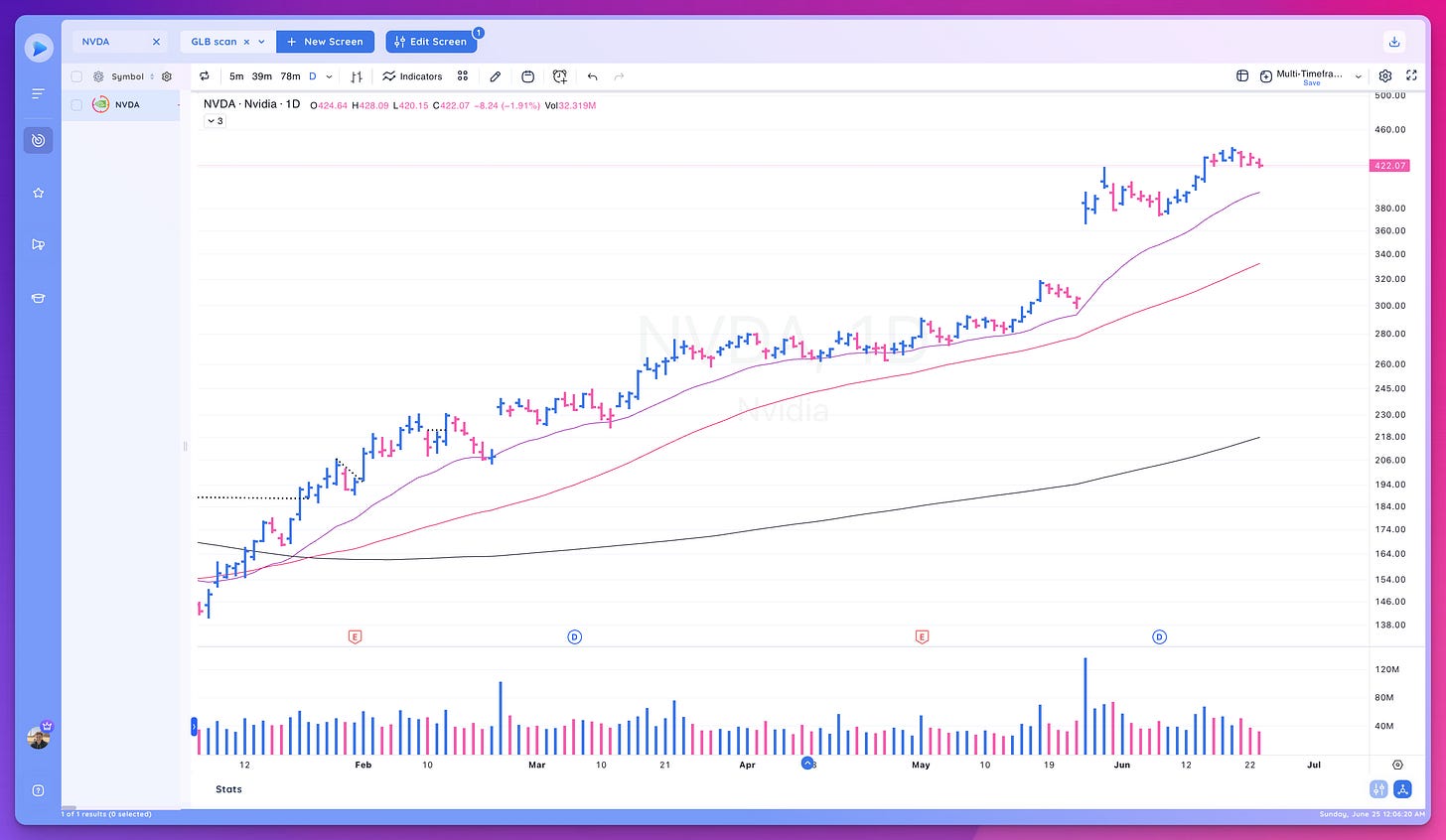

NVDA continues to act very strong, holding up well

SMCI a bit weaker, I don’t like its failed move higher up through the declining tops line

PLTR looks like it needs some time and consolidation after a strong up leg

IOT right at its 21 ema

MRVL potentially forming out a base here

Trends ( Based on QQQ)

Shortest - 5 Day SMA - down - Below declining

Short-term - 21 ema - Up - Above Rising

Intermediate term - 50 sma - Up - Above Rising

Longterm - 200 sma - Up - Above Rising

Group/Themes Action

Looking through my screens I noticed:

Semi conductors taking a breather and basing

Homebuilders continue to act strong

AI/Software pulling back

Market Thoughts

We’ve had a strong opportunity window that lasted several weeks. Last week was the first once since where we pulled back. At this time things look constructive but I would love some chop and base building which could set up a new move higher.

Remain focused on the leaders, those will give you the clues and the best performance if this rally continues.

Be ready for anything and manage risk!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Have a great weekend!

Richard

Thanks for the thoughts. I'm really looking forward to the upcoming masterclass! The previous ones have been super helpful and I'm a big fan of Boik's books.

Can you recommend a place that demonstrates how to use Deepvue? I am curious if it requires any programming skill or making an infinite number of selections like TC 2000.