Hi everyone,

Let’s dive right into today’s action. We’ll cover the general market, and then individual stocks that stood out today.

Make sure you are subscribed so that you don’t miss any future articles

The General Market

Today the major indexes initially rallied after the gap down, but the strength faded into the close.

The QQQ was down .99%. and the NASDAQ had net new lows

The SPY fell .66% and the NYSE also had net new lows

The IWM was similar down .92%

The VIX remains above all its moving averages

Trends (3/4 Down)

Short term: Down (Still below the 5 SMA)

Intermediate Term: Down (below a declining 21 ema)

Mid Term: Flat (right at 50 sma)

Long-term: Down (Below a declining 200 sma)

Stocks

The best ideas have been shorts over the past week and a half. However, it’s important to keep doing your homework and identifying potential leaders to pounce on when the market pressure finally lifts.

Some stocks I’m watching:

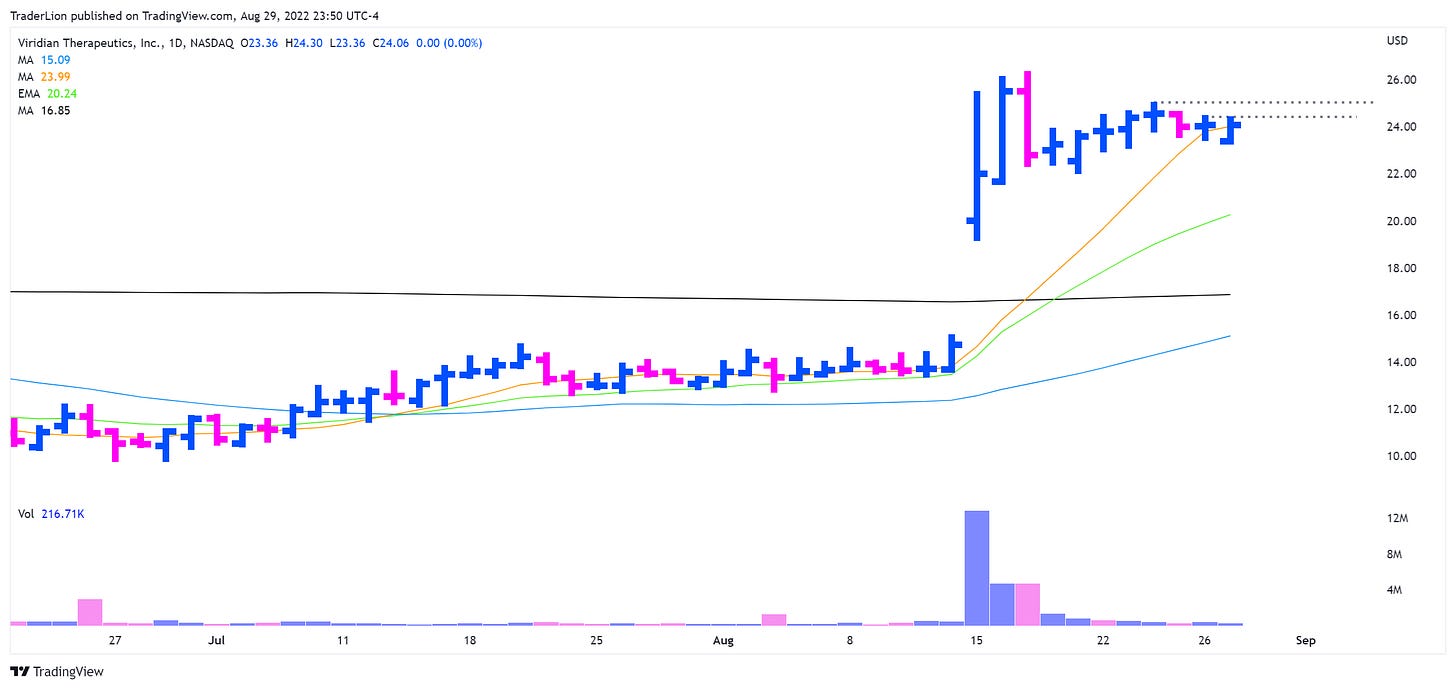

VRDN nice tight action

ENPH poor close but holding the range. A break of the Aug 22 low would indicate that it needs much more time.

FSLR continues to act well

OXY nice price and volume action, could have closed better

DVN moving up the right side

TMDX nice bar today

Overall thoughts

The indexes attempted to recover today but failed to close strong. Many stocks did the same. The short-term trend remains down. However, we are not right at the 50 sma which could be an area to watch for some potential support to come in.

If we pierce this line, close negatively on high volume, it’s further evidence that the market needs more time.

Be ready for anything!

I hope you found this article helpful! Let me know your thoughts in the comments below.

Here is what you can do to help make them possible and support my work.

Share this post on Twitter using the button below

Leave a like on this post below

Have a great week!

Richard

Thank you, Richard. What do you think of uranium stocks?