Hi everyone,

I hope you are having a great Wednesday!

In this post I’ll concisely share my thoughts on the day’s action. And share a bunch of stock charts that caught my eye.

This report is brought to you by Deepvue - The Best Screening and Charting Platform for CANSLIM Position and Swing Traders

You can now try 2 Months of Deepvue for only $39 using the button below

Now let’s dive in ↓

Market Action

QQQ - The Market followed through down after yesterday’s pause. We are now definitely below the moving averages.

With this sharp decline I would not be surprised to see some rally back towards the declining MAs.

IWO close near lows

Trends ( Based on QQQ)

Shortest - 10 Day EMA - Down - Below Declining

Short-term - 21 ema - Down - Below Declining

Intermediate term - 50 sma - Mixed - Below Flattening

Longterm - 200 sma - Up - Above Rising

Group/Themes Action

MSOS, JETS rallied. Miners continue to consolidate after their move up.

Semis got hit hard

Key Stocks in Deepvue

NVDA was looking promising but another downside reversal today. Right at a key area of the 50sma and base lows, see if it can be supported here. Would love a shakeout and rally.

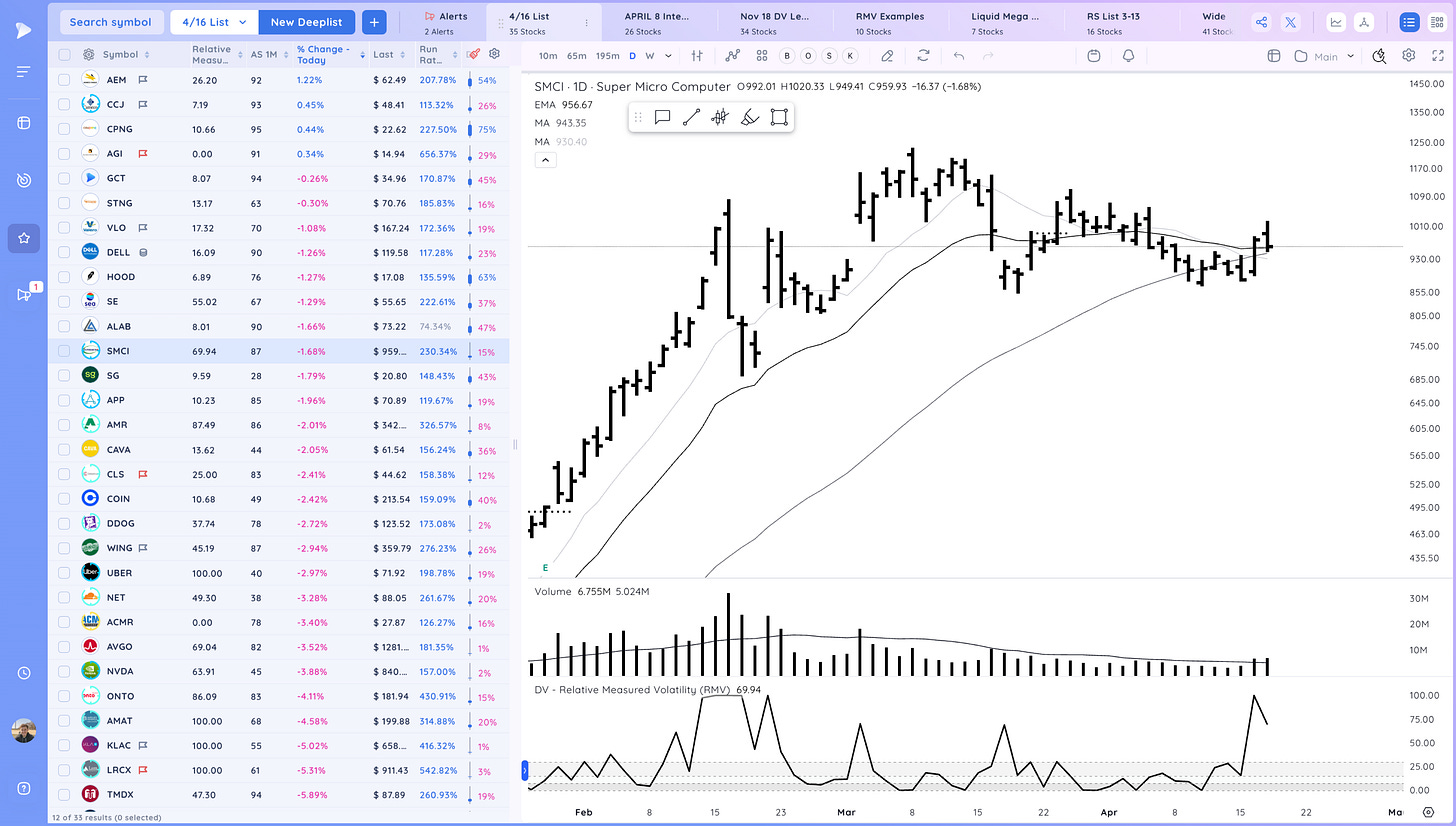

SMCI on a relative basis showing short term RS. holding near the 21ema and well above yesterday’s low. A flag sideways on lower volume would be constructive

CPNG still acting well

COIN see if we can form an undercut and rally here

ALAB still holding well. but if the group leader NVDA cant stabilize this is unlikely to work

AGI still a lot of Miners that are holding up (albeit a little choppy) AEM PAAS…

Market Thoughts

More corrective action today. Semis reversed hard. NVDA down and ARM down over 10%. Volatile action and no clear setups. Can watch for some undercut and rally/pullback spots. Less is more.

Before you place a trade ask yourself: Is this the type of environment where I’ve made a lot of money/progress in the past?

There are times to trade, times to sit, and times to sit out. Work on your plan, do post analysis, keep those watchlists up to date

Reminder:

Risk Management is Paramount

Refuse to enter randomly without managing risk and wait for the spots to develop, they will. Stocks during strong moves always pull back to the 21 ema, 50 sma multiple times. Look for a tight and logical entry point.

Have patience, focus on the best stocks with the greatest potential. These will telegraph the rest of the market.

Take it day by day and manage risk along the way. Be ready for anything

What are your thoughts on today’s action? (Leave a comment below)

This post was brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Cheers!

Richard

P.S. We just released a new free resource: The Ultimate Screening Guide

This will help you find top stocks faster and speed up your routines.

Thanks Richard

Thank You