Hi everyone,

I hope you are having a great Wednesday!

In this post I’ll concisely share my thoughts on today’s action and highlight key stocks.

This post is brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

Also, be sure to leave a like on this article and subscribe so you don’t miss any future ones!

Now let’s dive in ↓

Market Action

The QQQ dropped over 1.4% after the Fed announcement and closed near lows. We lost the short term level and continue to stay below MAs.

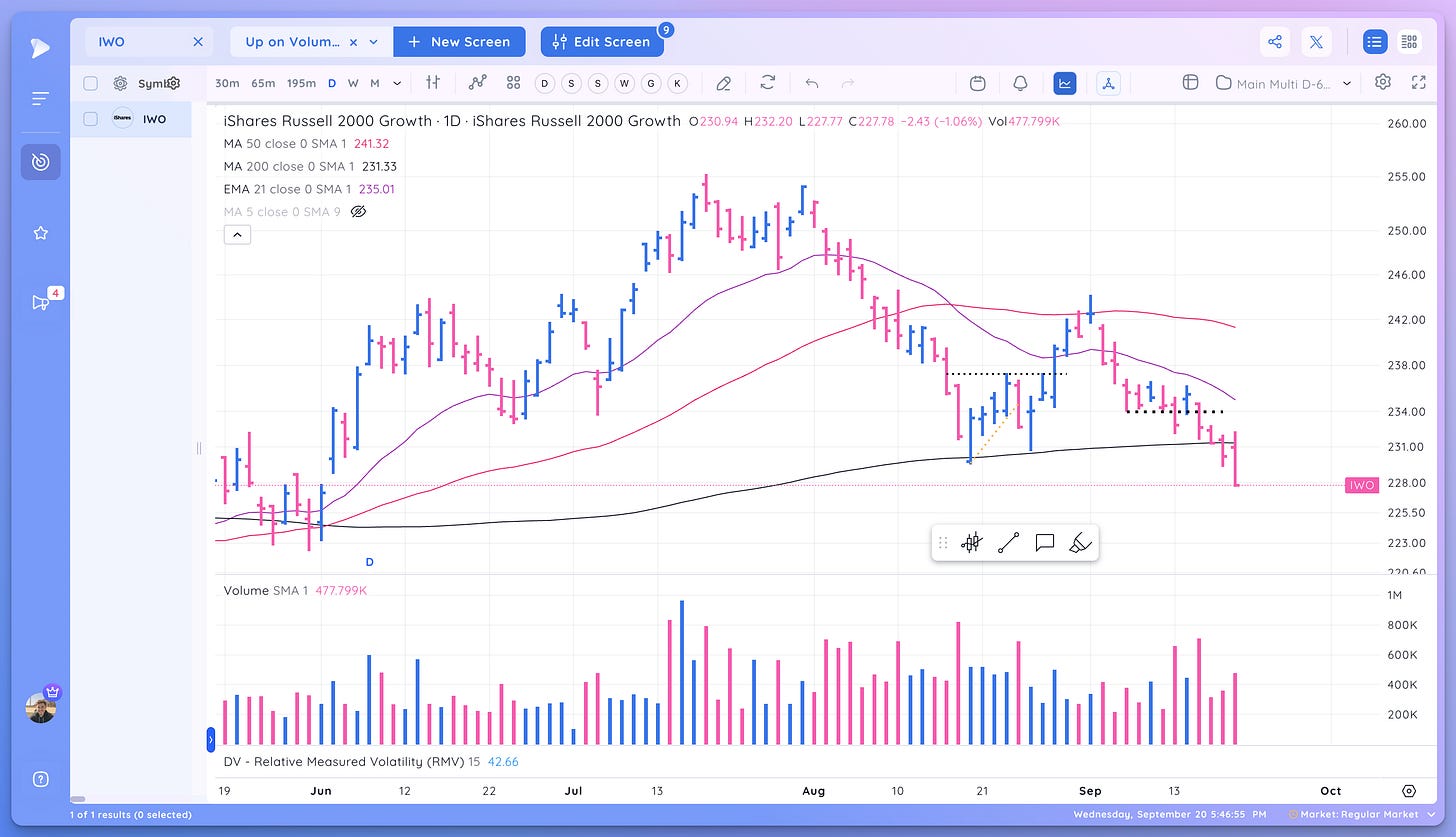

The IWO is still weaker, definitive close below the 200 day

Volume

Volume was lower on the NYSE and higher on the Nasdaq.

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Down - Below Declining

Short-term - 21 ema - Down - Below Declining

Intermediate term - 50 sma - Down- Below Declining

Longterm - 200 sma - Up - Above Rising

Group/Themes Action

Today we saw distribution pretty much across the board. A few packaged software names stood out.

Here’s a Daily Group Performance chart from TraderLion:

Key Stocks in Deepvue

NVDA still in a downtrend and inside day and down

TSLA Looked promising but finished at lows

DUOL lost the pivot

CYBR a name to keep watching

AMGN good day

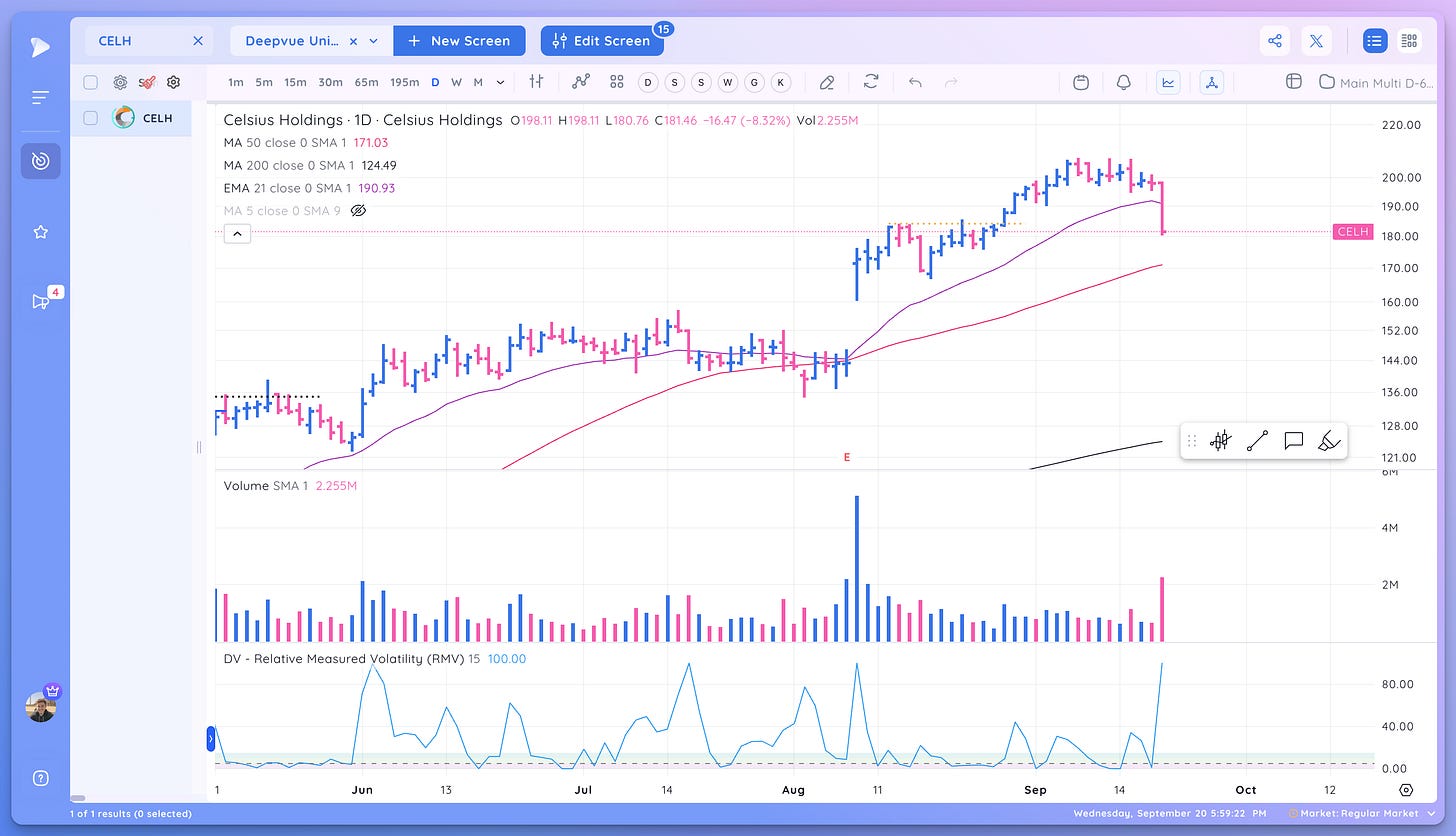

CELH Wedge Drop

Market Thoughts

The weakness that we’ve seen was definitive today after the Fed announcement. Managing risk and preserving capital is Job #1.

Keep a list going of stocks showing RS. This homework will serve you well when we get back above the MAs

What are your thoughts on today’s action? (Leave a comment below)

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Cheers!

Richard

Some support for the QQQ at 355 ish, but higher for longer won’t be helpful. And after 355, look out below.