Hi everyone,

I hope you are having a great Tuesday!

In this post I’ll concisely share my thoughts on the week’s action. And share a bunch of stock charts that caught my eye.

Now let’s dive in ↓

Market Action

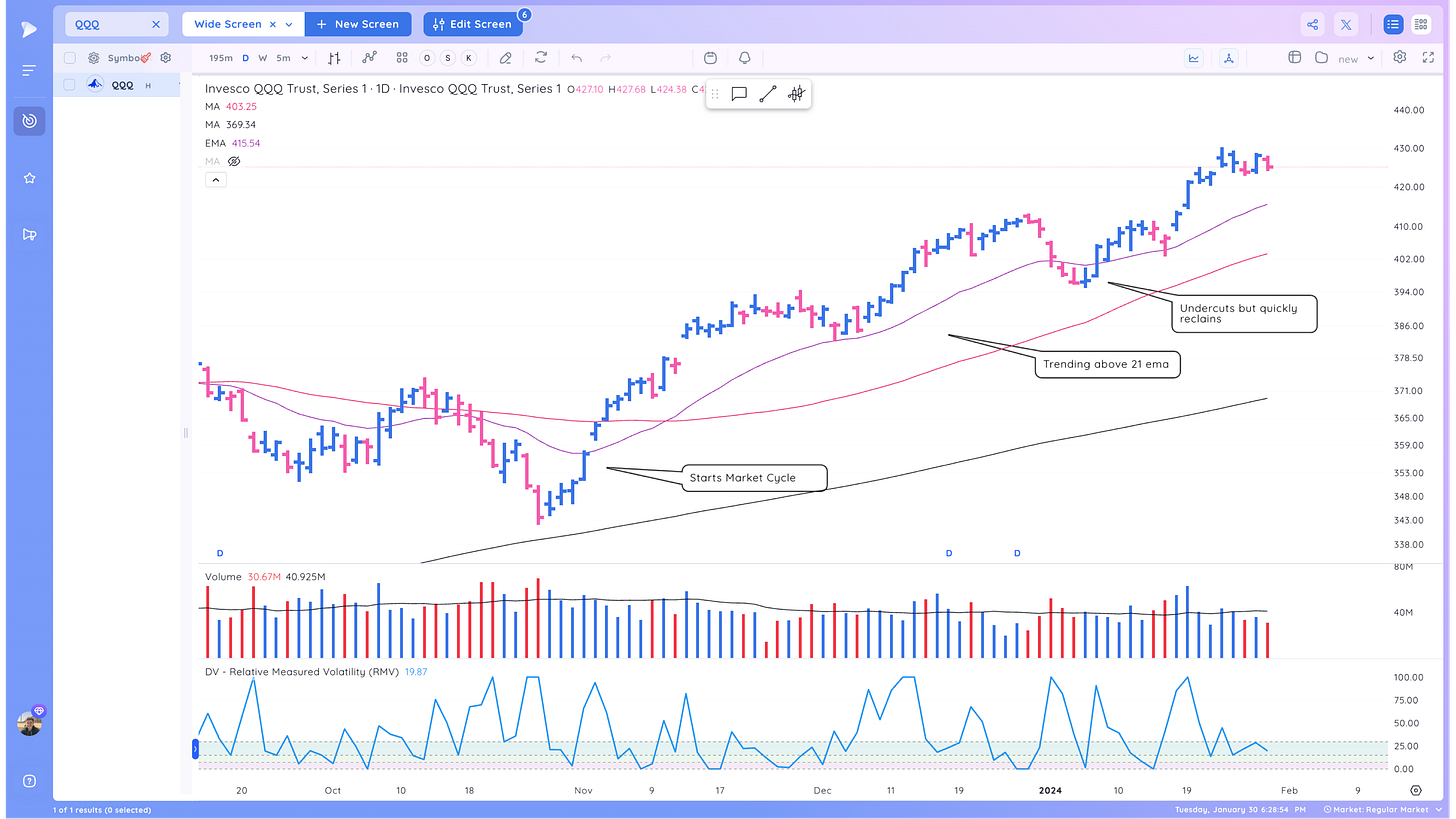

The QQQ put in an inside day. No follow through after yesterdays action

After hours however with a few key stocks reporting including MSFT. The QQQ is undercutting the range. We will see how it opens tomorrow and handles a gap down if that occurs

The IWO put in an inside day

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Mixed - Below Rising

Short-term - 21 ema - Up - Above Rising

Intermediate term - 50 sma - Up - Above Rising

Longterm - 200 sma - Up - Above Rising

Group/Themes Action

Some rotation into energy, steel, shipping, Banks

Performance charts

Key Stocks in Deepvue

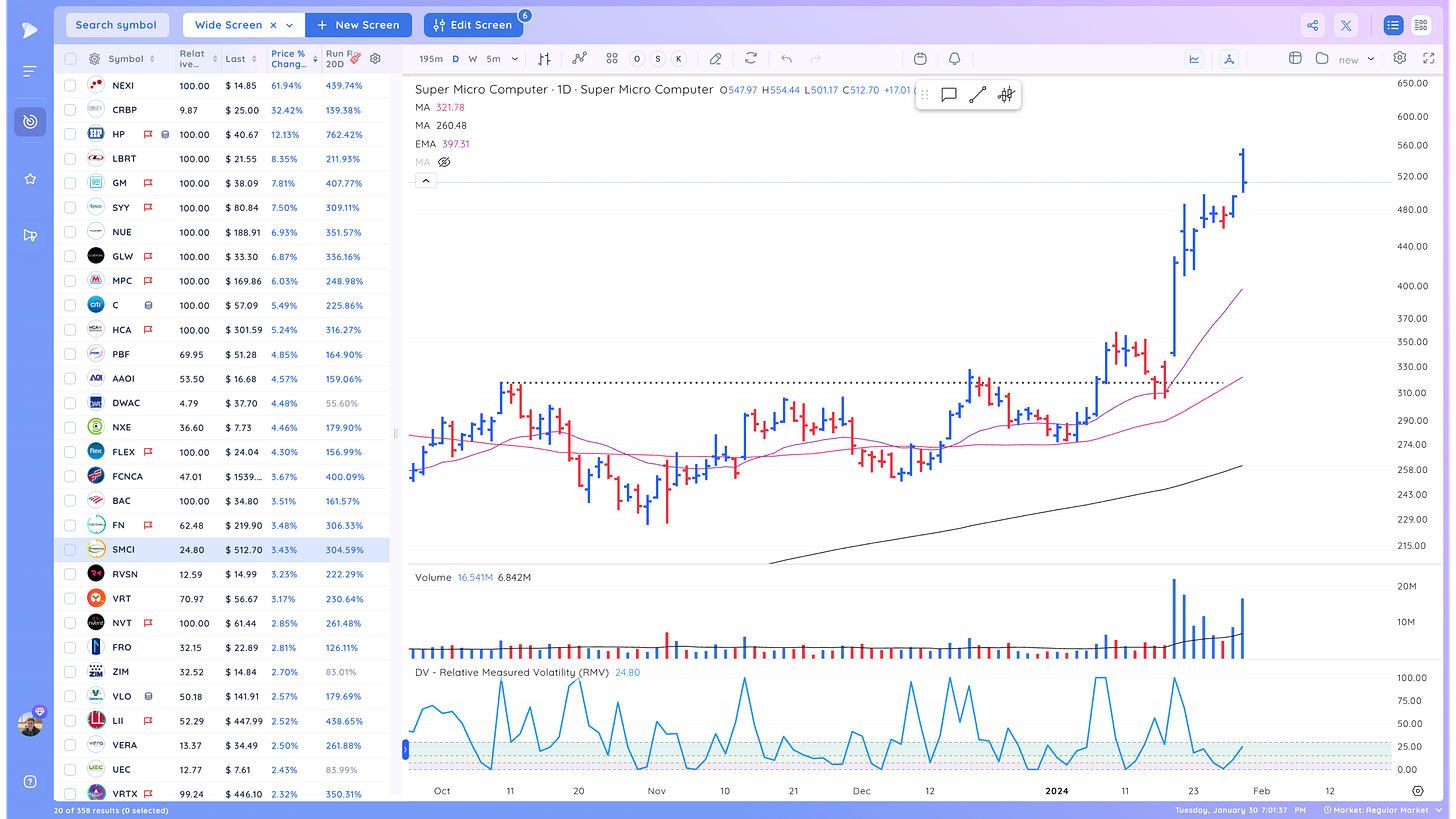

SMCI reversal off the gap. see if it holds or starts pulling in

NVDA trending. Down after hours with AMD

AMD to the 21 (this includes post market action.)

AFRM holding near the 50 day

ZIM Looks primed

NUE breakout on volume

BTU forming a range

LBRT from oil and gas theme

Market Thoughts

No real follow through from the software names. Semis down after AMD MSFT earnings. Rotation into more cyclicals. See if that trend continues.

Reminder:

Risk Management is Paramount

Refuse to enter randomly without managing risk and wait for the spots to develop, they will. Stocks during strong moves always pull back to the 21 ema, 50 sma multiple times.

Have patience, focus on the best stocks with the greatest potential. These will telegraph the rest of the market.

Take it day by day and manage risk along the way. Be ready for anything

What are your thoughts on today’s action? (Leave a comment below)

This post was brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Cheers!

Richard

P.S. We just released a new free resource: The Ultimate Screening Guide

This will help you find top stocks faster and speed up your routines.

Will the bull continue with new leaders.

Sector Rotation into Cyclicals. Any rules/strategies to use this sector rotation. This happens several times during the year. How can intermediate term investors use this type of action to help maximize returns? Thank you for the market update! Precise, concise and insightful as always.