The Market Loses the 50 Day. What Next?

Hi everyone,

Let’s dive right into today’s (Tuesday’s) action. We’ll cover the general market, and then individual stocks that stood out today.

Make sure you are subscribed so that you don’t miss any future articles

The General Market

After a gap up, all the major indexes finished weak.

The QQQ was down 1.11%. and the NASDAQ had more net new lows. We undercut the 50 sma.

The SPY fell 1.10% and the NYSE also had more net new lows.

The IWM was similar down 1.4% although it remains over its 50 sma

The VIX remains above all its moving averages. Closed similar to yesterday.

The T2106 is short term “oversold”

Trends (3/4 Down)

Short term: Down (Still below the 5 SMA)

Intermediate Term: Down (below a declining 21 ema)

Mid Term: mixed (right at 50 sma)

Long-term: Down (Below a declining 200 sma)

Stocks

Some stocks I’m watching to the upside that have been holding up well.

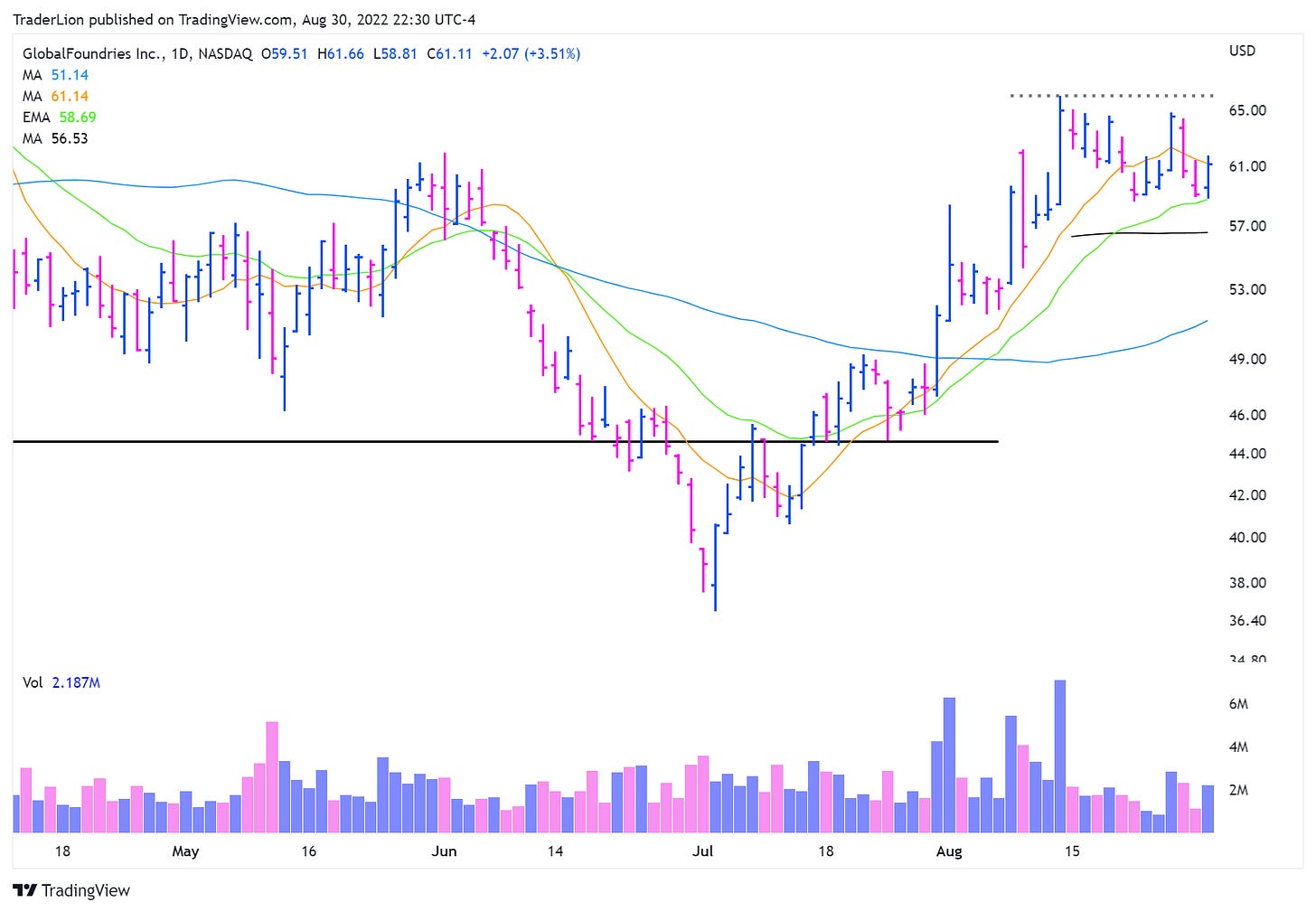

GFS Holding the 21 ema

ENPH undercut the bottom of the range and 21 ema but rallied into the EOD

DGII consolidation day after the big upside reversal Monday

ARRY watching for a break of this FLAG

SHLS also going sideways, a little looser

MRSN acting well

STEM could tighten a bit more

Overall thoughts

It’s certainly a negative that the indexes closed below their 50 smas. However, given that we have now been down strongly 2 out of the past 3 days and that the McClellan has pulled back sharply, I would not be surprised to see a strong very short-term rally in the near future.

The longer-term trends remain downward. Keep watching the leading stocks and the indexes.

Be ready for anything!

I hope you found this article helpful! Let me know your thoughts in the comments below.

Here is what you can do to help make them possible and support my work.

Share this post on Twitter using the button below

Leave a like on this post below

Have a great week!

Richard