Hi everyone,

I hope you are having a great weekend!

In this post I’ll concisely share my thoughts on the market health and leading groups.

This post is brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

You might notice the new dark mode that we just added last week. Many new features to come!

Click the button below to learn more:

Also be sure to subscribe so you don’t miss any future articles

Now let’s dive in ↓

Market Action

The QQQ remains below a declining 21 ema

We attempted to rally a few time but were rejected. We are just below the 50 sma and have been basing now for a few weeks.

The IWO has fallen sharply and is below a declining 21 ema.

SMH - The semiconductors were the leading group, they remain in a down cycle.

Key Stocks

NVDA Is now below the 21 and 50 sma. It’s approaching a key level, below that it would challenge the gap HVC and gap lows. It’s in a downcycle.

A positive would be a large undercut and rally bar, then progression back up to the moving averages.

PLTR is also in a downcycle, not acting well after earnings

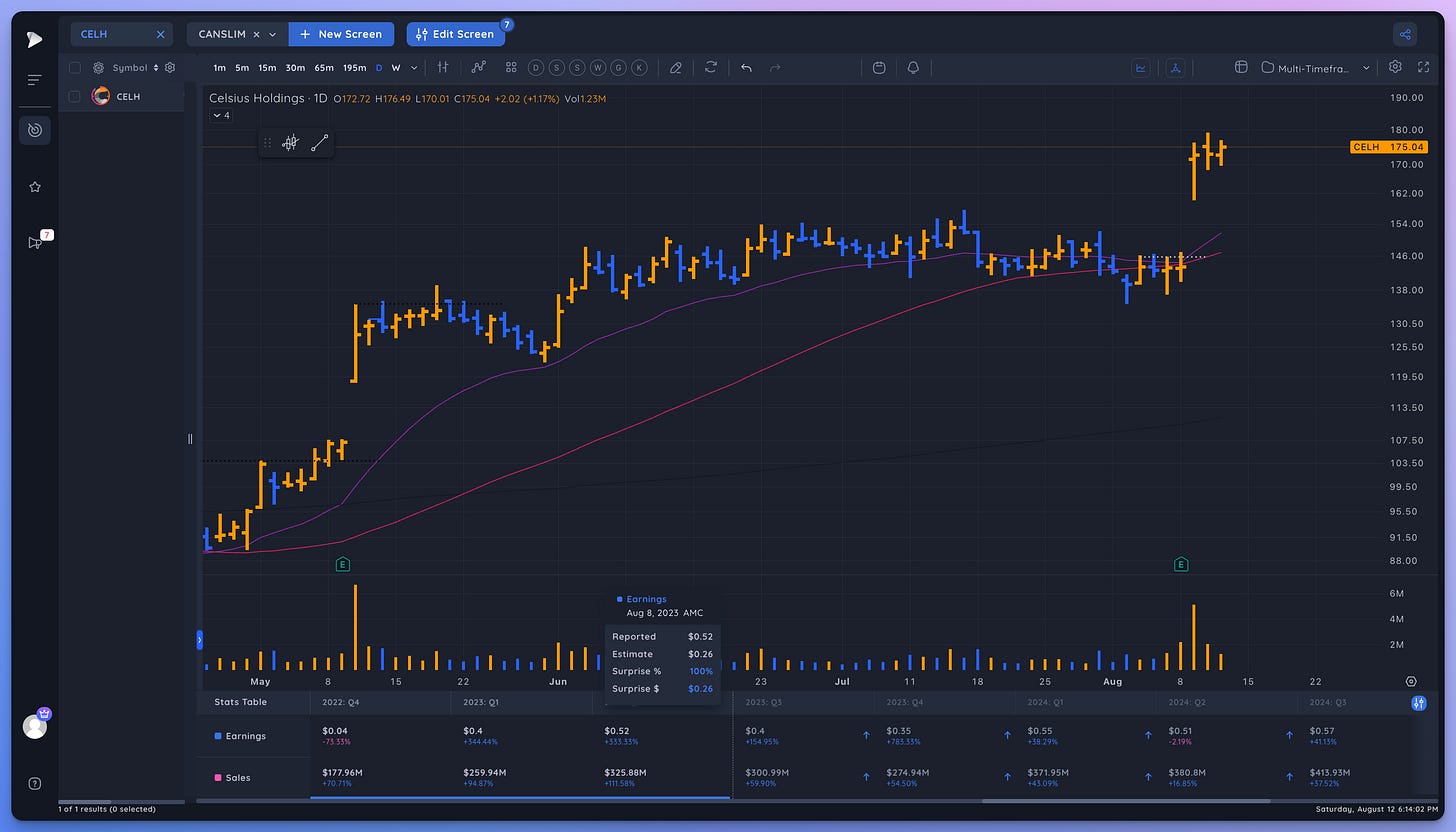

CELH - there are a few names acting well, this gapped up after a 100% EPS surprise. It’s a later stage gap.

LLY another recent gap up acting well. AMGN also.

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Down - Below declining

Short-term - 21 ema - Down - Below declining

Intermediate term - 50 sma - Mixed- Below Rising

Longterm - 200 sma - Up - Above Rising

Group/Themes Action

Looking through my screens I noticed:

Semi conductors in downcycles

Banks still acting well

Bio/Pharmas acting well

Wide List via Deepvue

These are stocks that caught my eye from the Deepvue Universe Screen, Liquid Strength Screen, Power 21 Screen, and IPOs. Not all are completely ready.

AMGN APP ARRY AZEK BKNG BROS CAT CELH CFLT CLS DBX DPZ DWAC ELF ETN FLS FLT FRPT FRSH FSLY FTAI GEN GTLB IONQ LLY MAT MNDY MSCI ODFL ONB REGN RPD RPM SAIA TOST TSLA TW TXT UPWK VRT WAL

Market Thoughts

Last week more leaders declined sharply. We’ve been correcting/basing for a few weeks now. Watch out for either continuations downwards or the start of ranges if stocks build sideways.

On a gap down if we see strong upside reversals across the board that could be the start of the bottoms of bases.

The leading stocks will tell us if more time is needed.

Be ready for anything and manage risk!

Share Your Market Thoughts

What do you think about this market? What stocks are you watching?

Let me know below in the comments. And leave a like!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Have a great weekend!

Richard

Hey Richard; Note many key important stocks testing critical support. If it breaks, look out below.

Also, rates and dollar will seriously pressure equities should they continue uptrends. Op Ex week will add to any break lower (which is overdue). With the massive treasury issuance a big rate spike higher is very possible, which could trigger a panic equities sell off. Note that the AI bubble looks to be breaking (NVDA/MSFT/APPL/AMD/SMH). Weak VIX at support. Failed rallies/gap ups ominous for bulls. Critical week will determine next trend move. Been all bulls for too long. My bet is for equities down. (hard)