The Market Closes Strong. What now?

Hi everyone,

Let’s dive right into today’s (Thursday’s) action. We’ll cover the general market and then individual stocks that are standing out.

Make sure you are subscribed so that you don’t miss any future articles.

The General Market

After multiple consecutive days down we finally saw some relief as the indexes closed strong. The key question now is whether this is the start of a sharp relief rally or just one positive day in the context of a downtrend.

The QQQ closed up .04% after rallying over 2% from its lows. The Nasdaq continued to make net new lows. You can see how so far a key level has been defended.

The SPY finished up .31% after a similar strong intraday rally. The NYSE continued to make new net lows.

The IWM rallied from it’s lows but still finished down over 1%

The VIX finished down but remains above its moving averages.

The McClellan Oscillator remains in “oversold” territory

Trends (3/4 Down)

Short-term: Down (still below the 5 SMA)

Intermediate-term: Down (below a declining 21 EMA)

Mid-term: Mixed (below 50 SMA but the 50 SMA is increasing)

Long-term: Down (below a declining 200 SMA)

Stocks

Here are some key stocks I’m watching. Solar and Biotech remain the groups I’m most focused on.

RYTM strong breakout, we shall have to see if it holds. An inside day could set up another entry before the HTF breakout

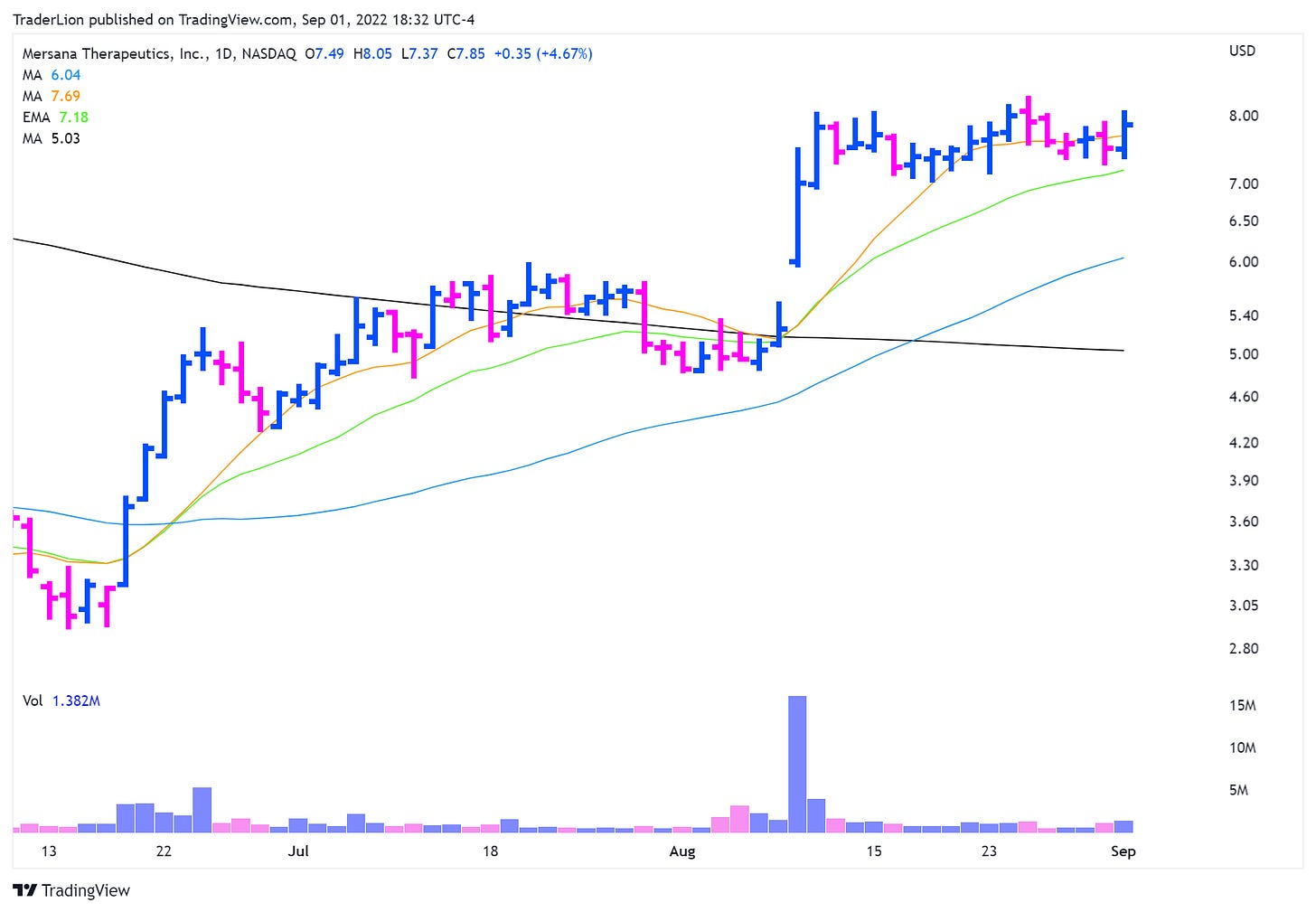

MRSN forming a flag sideways

CPRX strong action off the 21ema

ALNY pullback into the 21ema

DAWN nice action off the 21ema

NBIX strong rally off the lows

ARRY holding the 21ema and $20 mark. SHLS similar

ENPH Upside reversal. FSLR also looks very promising.

Overall Thoughts

Today was a strong rally off the lows but we are still in a downtrend even in the short-term. Many biotechs and solar names are setting up. If they follow through that would be a positive sign. However, if the sellers come back and we see large reversals that would suggest we need even more time. Today’s lows should be defended.

The longer-term trends remain downward. Keep watching the leading stocks and the indexes. Be ready for anything!

I hope you found this article helpful! Let me know your thoughts in the comments below.

Here is what you can do to help make them possible and support my work.

Share this post on Twitter using the button below

Leave a like on this post below

Have a great week!

-Richard