Hi everyone,

I hope you are having a great Monday!

In this post I’ll concisely share my thoughts on the day’s action. And share a bunch of stock charts that caught my eye.

This report is brought to you by Deepvue - The Best Screening and Charting Platform for CANSLIM Position and Swing Traders

You can now try 2 Months of Deepvue for only $39 using the button below

Now let’s dive in ↓

Market Action

QQQ - Reaction Bounce. Is the low in? No one knows. Expect more volatile action until we get back above a rising 21 ema

Also, was experimenting with a Deepvue Dashboard setup for monitoring intraday action and movers if anyone is looking for ideas

IWO slightly stronger but still an overall downtrend

Trends ( Based on QQQ)

Shortest - 10 Day EMA - Down - Below Declining

Short-term - 21 ema - Down - Below Declining

Intermediate term - 50 sma - Down - Below Declining

Longterm - 200 sma - Up - Above Rising

Group/Themes Action

lots of tech bouncing, blockchain the strongest. Miners negative gap downs

Key Stocks in Deepvue

NVDA bounce but still a lot of damage to heal

COIN setting up a range here. CLSK, MSTR strong today

APP pulling back to the 50 day

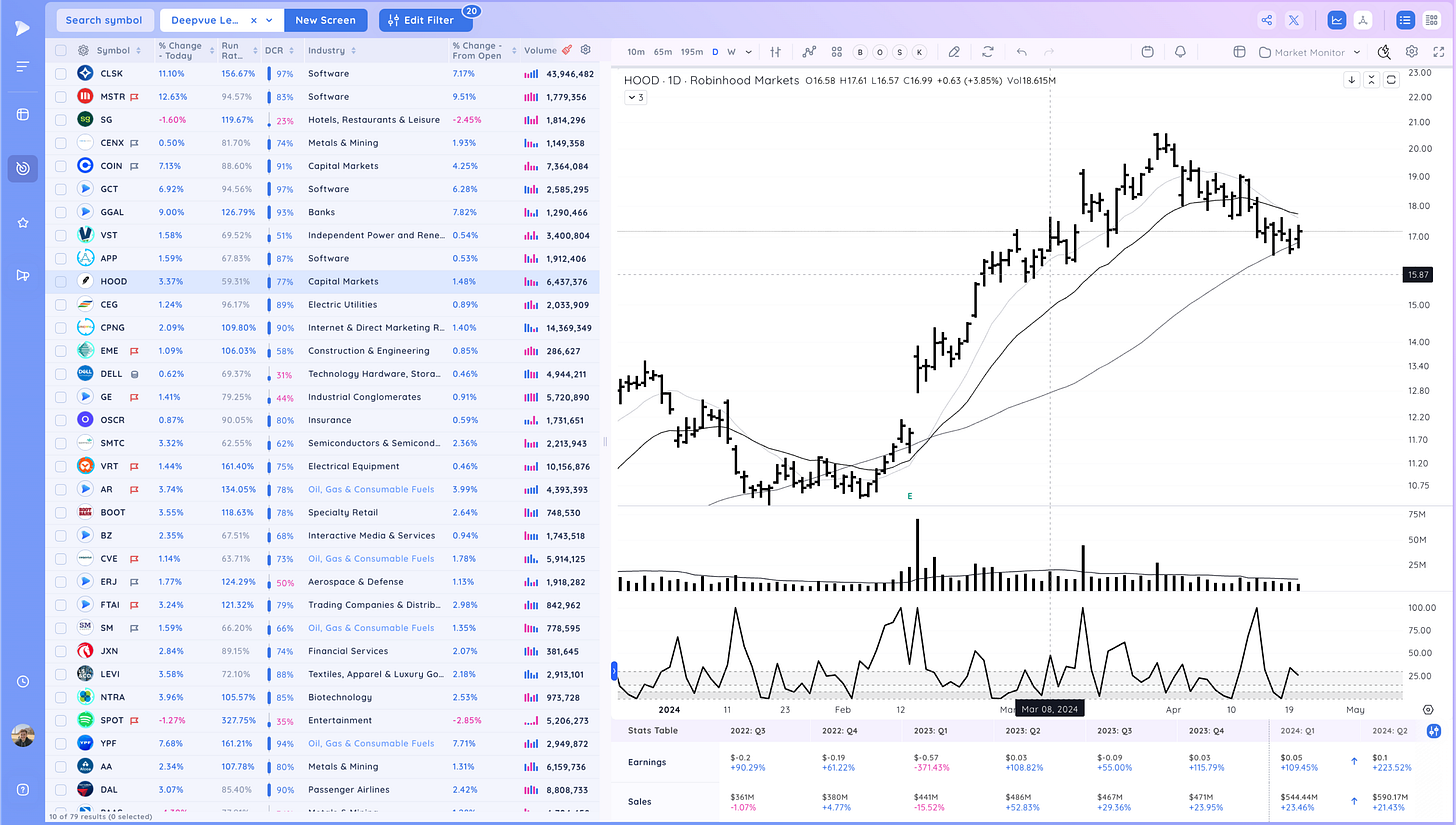

HOOD same

CEG inside day under the 21

CPNG continues to show RS

SMTC, secondary semi name holding the 21

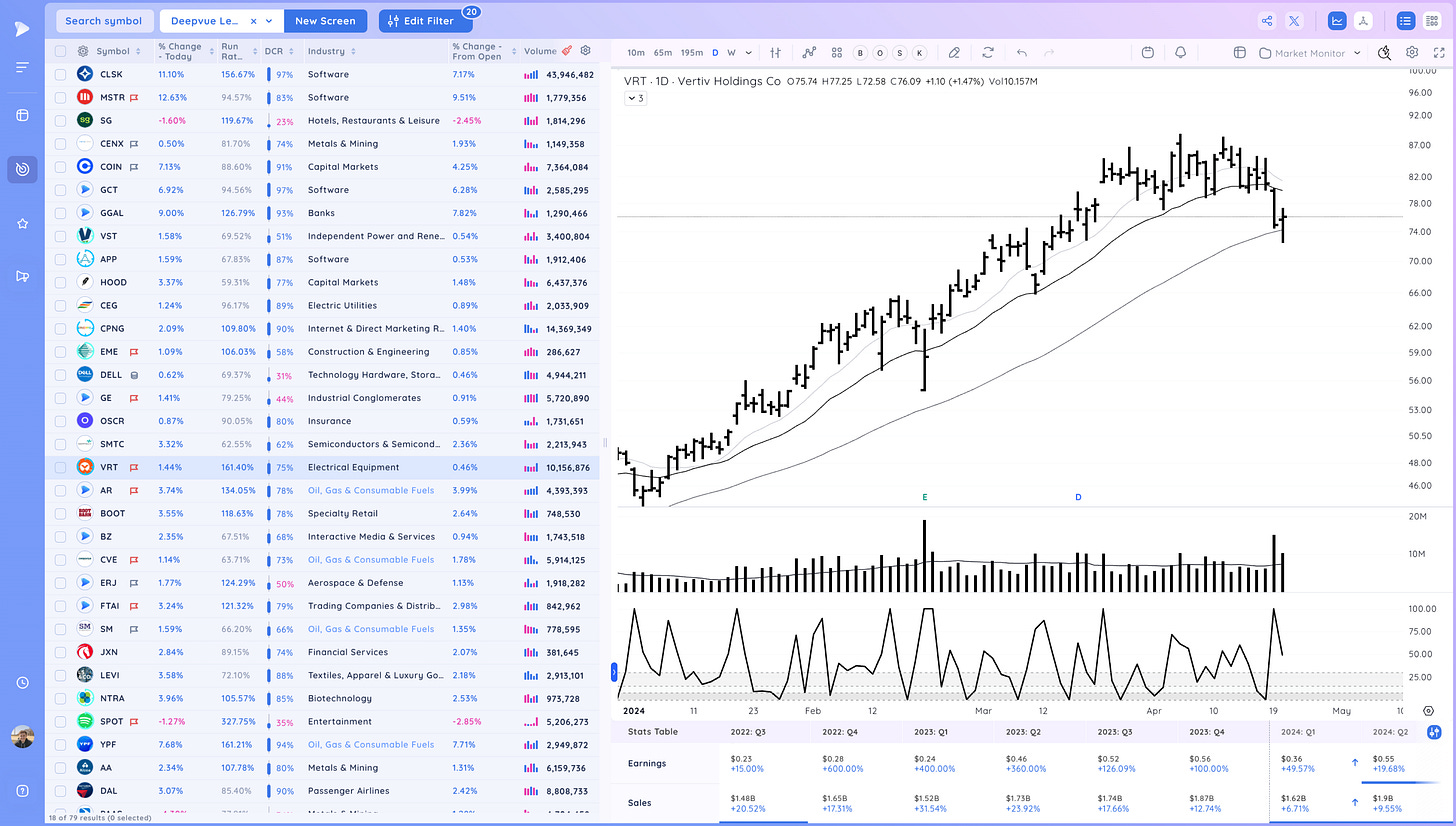

VRT at the 50 day

WING basing near the 50

Market Thoughts

A bounce in the context of an uptrend is guilty until proven innocent.

Reminder:

Risk Management is Paramount

Refuse to enter randomly without managing risk and wait for the spots to develop, they will. Stocks during strong moves always pull back to the 21 ema, 50 sma multiple times. Look for a tight and logical entry point.

Have patience, focus on the best stocks with the greatest potential. These will telegraph the rest of the market.

Take it day by day and manage risk along the way. Be ready for anything

What are your thoughts on today’s action? (Leave a comment below)

This post was brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Cheers!

Richard

P.S. We just released a new free resource: The Ultimate Screening Guide

This will help you find top stocks faster and speed up your routines.

I still own EDU from the massive volume breakout, from last July. No chart violations yet, (surprisingly) although I always draw a trendline from all the lows since then and sell when that line is broken decisively. EDU and TCOM are the only 2 Chinese stocks acting well. That's pretty pathetic for China!

I like your dashboard presentation and will add one. I was stopped out on CLSK. I chose to set my stop tight from an entry of $18.115. Normally I would choose a recent support area which is lower providing price action responds favorably. This was a lesson learned. I may reenter tomorrow knowing today broke resistance and there isn’t any recent resistance at today’s close.