Hi everyone,

I hope you are having a great Tuesday!

In this post I’ll concisely share my thoughts on today’s action. And share a bunch of stock charts that caught my eye

Now let’s dive in ↓

Market Action

The QQQ moved well off the gap down open and closed above yesterday’s high. So far this has been a successful bounce off the 21 ema as we continue to consolidate the power move up in november.

The IWO was weaker but a tight day

Volume

Volume was lower on the NYSE and on the Nasdaq.

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Down - Below declining

Short-term - 21 ema - Up - Above Rising

Intermediate term - 50 sma - Up - Above Rising

Longterm - 200 sma - Up - Above Rising

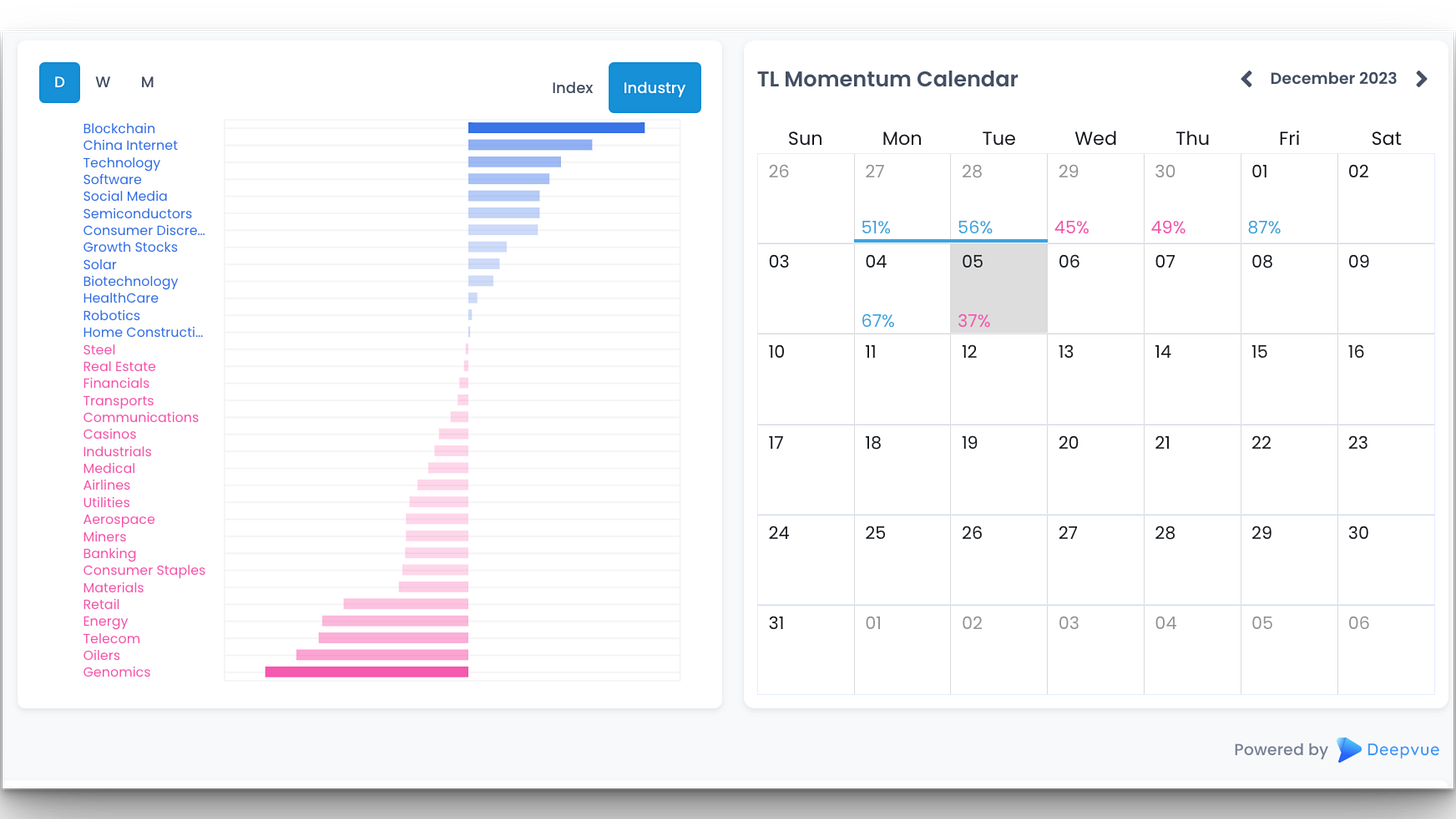

Group/Themes Action

Software continues to stand out

Here’s a daily Group Performance chart (% From Open) from TraderLion:

Key Stocks in Deepvue

ZS setting up a continuation spot. CRWD continues to trend well, is the leader. S up after earnings

IOT inside day

ROKU short pattern

SNOW still tightening

PATH tightening after gap

DUOL inside day

ESTC strong action

GTLB nice close after earnings

Market Thoughts

Good action from the slight gap down. Individual stocks are acting well. We’ll see how the recent EPS moves play out PATH IOT GTLB ESTC

Reminder

Refuse to enter randomly without managing risk and wait for the spots to develop, they will. Stocks during strong moves always pull back to the 21 ema, 50 sma multiple times.

Have patience, focus on the best stocks with the greatest potential. There will be many opportunities

Take it day by day and manage risk along the way. Be ready for anything

What are your thoughts on today’s action? (Leave a comment below)

This post was brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Cheers!

Richard

P.S. We just released a new free resource: The Ultimate Screening Guide

This will help you find top stocks faster and speed up your routines.

Richard I like the positioning of the RMV above the volume. I noticed the RMV for ZS and IOT is at or very near zero. If I understand that indicator it's likely there will be a significant move one way or the other within a day or two.