The Easy 5 Steps of a Champion Stock Trader's Weekend Routine

This article is part of my 30 Essays in 30 Days about trading concepts and risk management. If there is a topic that you would like me to cover drop it in the comments below. This article is based on my interviews with top traders and US Investing Champions and how they prepare each weekend.

Enjoy!

Also let me know what your favorite part of your weekend routine is and make sure your are subscribed so you don’t miss any future articles!

1. Review Your Trades and Positions

Perform post-analysis on every trade you made over the past week. Plot your entry and exit points on the chart and grade your execution of your plan. Note any mistakes you made and brainstorm ways to improve. Also mark up any setups you missed and should have executed on. Ask yourself why did you miss it? How should the stock have gotten onto your universe list? Where should you have entered? How would you have traded it?

For your existing positions. Review their charts, your % Gain, and determine your plan for them next week. Are they extended? Near potential sell points? Are they acting strong?

2. Analyze Market Conditions

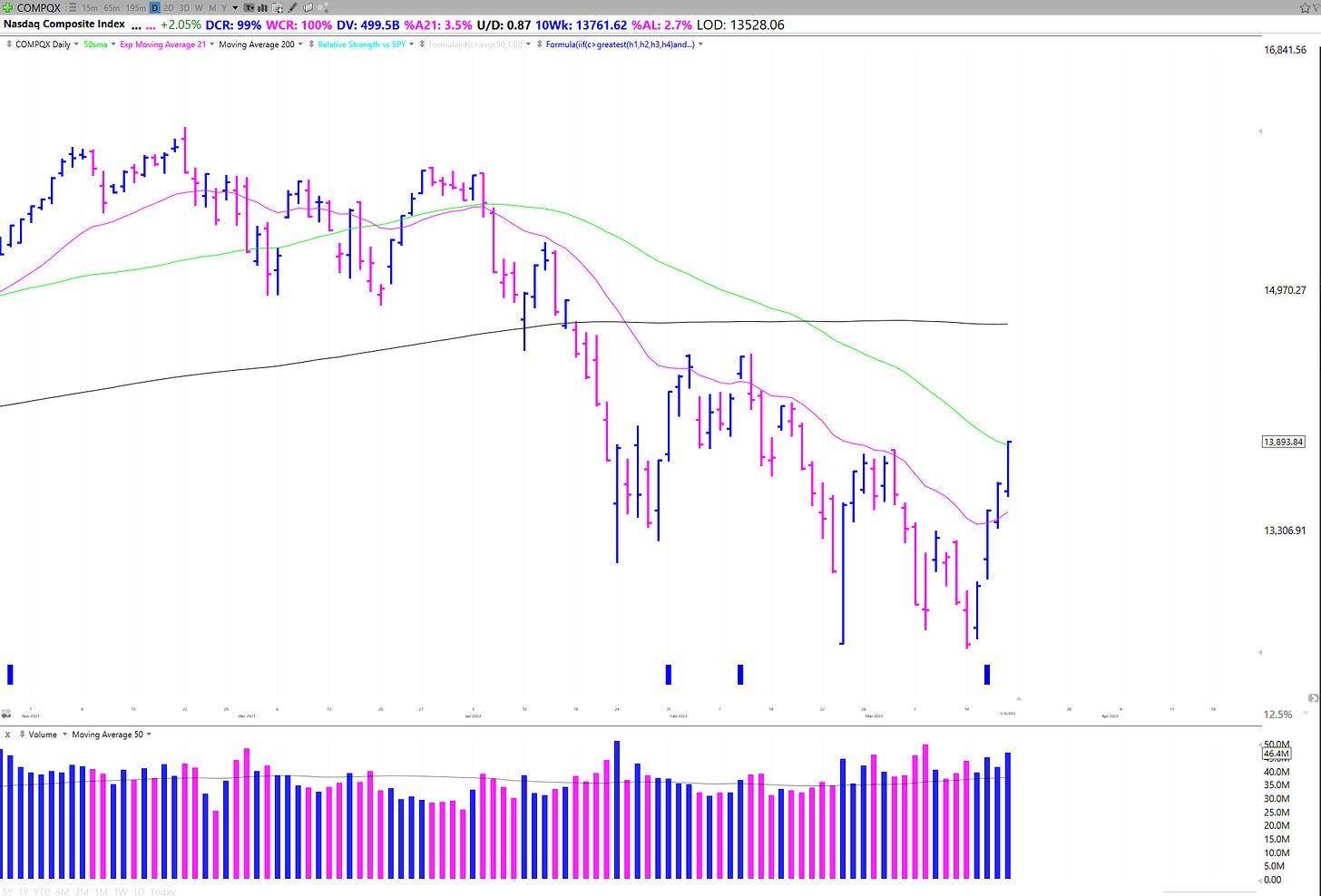

First, the indexes. Consider their trends, where they are with respect to their moving averages, signs of distribution & accumulation, volatility, and recent performance. I like to review the COMPQX, S&P 500, IWO, IWM, and the FFTY.

3. Cast a Wide Net

Next, let's dive deeper into the stocks themselves. Go through your existing watchlists and screens. Track Rotation and look for groups shaping up together and seeing accumulation. Curate your list of True Market Leaders which show the best combination of Price Strength and Fundamentals.

Going through this process will give you the best perspective of how stocks are actually performing and the health and breadth of market leadership.

4. Build a Universe List

From your screening, build a list of ~100 ideas that are setting up. Consider trends, group strength, and fundamentals. Based on your strategy what defines a setup could differ immensely, but focus on the best of the best.

5. Narrow your Focus

From this Universe, build a subset of the absolute best setups that you have the most conviction in. The length of this list should change based on market conditions but the key is to focus on the leaders and the highest potential stocks for your method.

And that's it, you are now in-sync with the market, have worked to improve your trading, and have prepared for the next week. Now get off the screens!

What are your thoughts? Let me know in the comments and leave a like if you enjoyed. Also please share if you found this helpful!

Take care!

Richard

How can we track the rotation of groups? Through ETFs or would it be better to track some stocks that are leaders in their groups and how they are performing?

Enjoyed this article... as usual. Thanks.

One thing I struggle w on this topic is:

I do well taking universe (~100-150) down to focus list of about 20-35, with plans of just establishing 2-5 positions (maybe capital limited, or maybe putting speed limit on myself for market conditions). If market has a hot day, about 5-10 of the focus list will pop up to buy. I struggle w which ones to buy. The first few that pop? Then no capital left for the others. Maybe a lot of conviction in some that don’t pop first but then do later. Trying to let the market tell me but then I miss a few resulting in some FOMO. Any suggestions on how to handle this?? Any mindset tips to handle it???