Hello everyone,

I’ll be posting a similar market update every single week from now on. Make sure you are subscribed so you don’t miss any future updates or educational articles.

Last Week’s Action

Last week we saw continued distribution in the major indexes and stocks. We broke down from the tight area we had been forming and leadership took a hit with once again energy names being the last ones standing.

There have been multiple opportunities for quick swings to the upside as well as great points to short this year.

However, with this high volatility, I would say most people are better off with the majority of their trading accounts in cash until we get strong leadership group action and market support.

In this market, if you are trading, you risk chopping yourself up with gap ups and gap downs and you have to be very active and attentive with little progress to show for it.

Day traders and faster swing traders may love this environment, but I prefer when trends last a bit more than a few days.

The CPI data seemed to have spurred the accelerated selling on Friday as it may mean that the FED will become more aggressive.

The major indexes are all in Stage 4 downtrends but are approaching the 200 week moving average which has been an area of support in prior corrections.

My watchlist from last week offered some opportunities but largely showed distribution. Many stocks resumed downtrends, undercutting price structures that they had been building. The shipping group in particular broke down.

Big cap names also suffered with the FANG names showing heavy distribution.

Sentiment

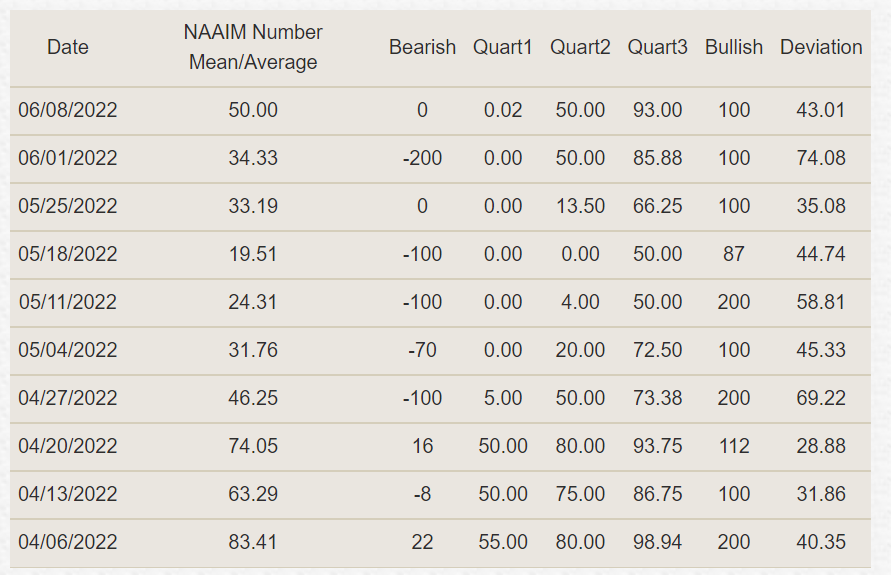

Sentiment is starting to show increased fear, we will see if we get some capitulation. We still have a ways to go on the NAAIM and Put Call Ratio.

Remember the action of the stocks and indexes is always much more important than sentiment.

The IBD Big Picture resumed a market in correction and the GMI signal will have turned back to red on Friday.

Stock Market Outlook

Overall my stock market outlook is once again a market in correction. There will likely be opportunities to the short side although the best entries were on Thursday and Friday in most cases.

If shorting, look for broken stocks rallying on light volume into potential resistance areas such as down-trending 50 SMAs or for stocks that are about to break through the lows of a price structure.

Remember that the most important thing at the end of the day is to watch the price and volume action of the stocks themselves as well as the indexes.

What To Look For

When it is time for a new bull market we will see divergences as groups decouple from the indexes and show relative strength.

Keep an eye out for this type of action if we make a lower low on the indexes and whole groups make higher lows.

When the market is ready it will be obvious, and it may happen when the news and sentiment is the absolute worst.

The leaders in the next bull market will once again have the potential to quickly double and triple and they will likely be completely new names that are unfamiliar. Try not to become biased and focused on last cycle’s winners.

Follow the sector, industry group strength, and look for the strongest stocks coming out of these strongest areas. As the market bottoms these future winners will likely be completing bases and may even be making new 52-week or all-time highs.

Keep an eye out for turnaround plays with excellent earnings and sales growth as well as recent IPOs within the past 2 years forming out their first proper bases.

Have patience, preserve your mental and financial capital, and be ready. Stocks can shape up faster than we think.

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Have a great weekend!

-Richard

Thank you Richard!! Great insight during very tricky trading time!!

Great write up. Thanks, Richard