Hi everyone,

Currently we have a potential tradable rally within an overall correction. If you are participating remember to use progressive exposure and manage risk using stops and position sizing.

Running through my weekend scans these themes stood out to me:

Biotech

Solar

Retail Discount

Medical

Defense

China

My weekly watchlist:

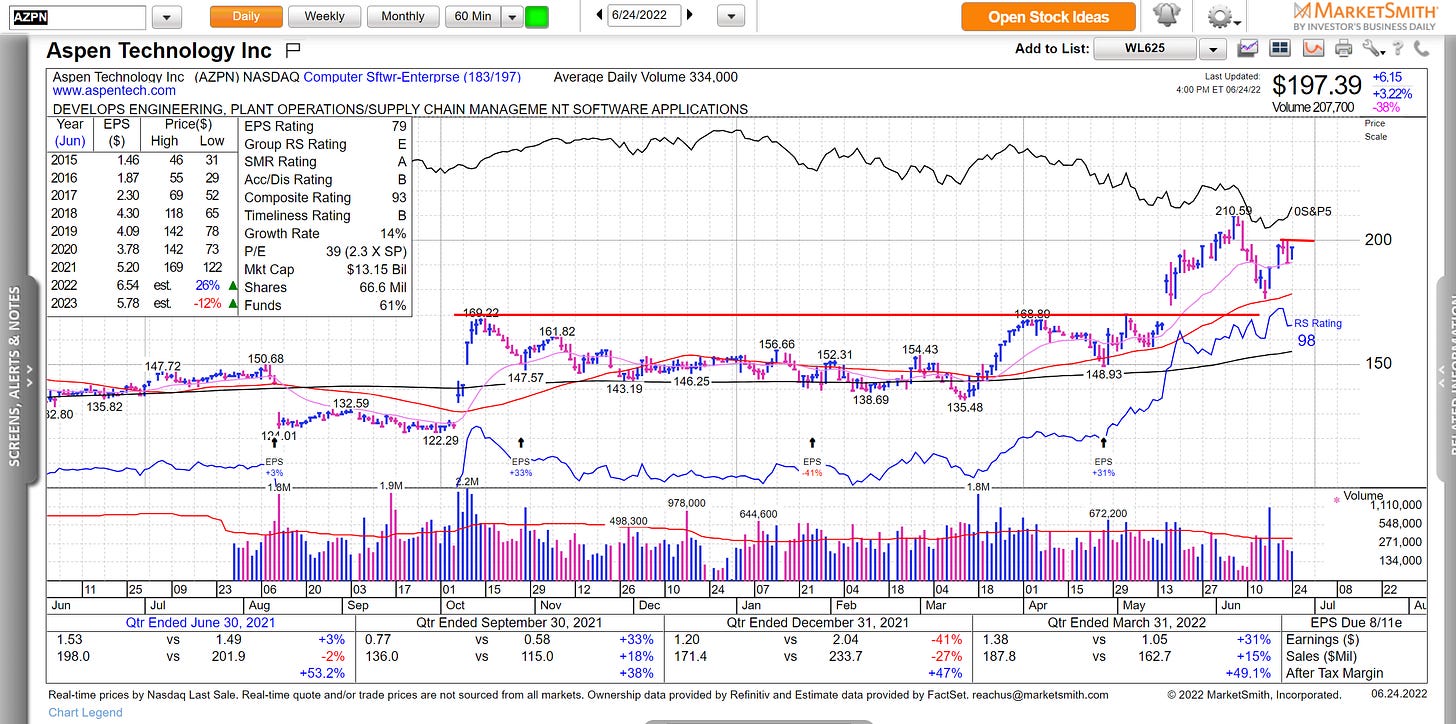

AZPN, Pivot near the 200 Level

CAL - Could use an inside day first

DQ - Has both the China and Solar theme working for it

DUOL - I want to see a big volume breakout and stick above 100

ENPH - Own this, looking to add, would like to see a push higher up the base on volume

GTLB - At a pivot, would like a short consolidation, then volume

HQY - Slower mover

NOC - Failed Breakout Reset

PLAB - If Semiconductors come into favor this could run.

PRM - Recent Chemicals IPO

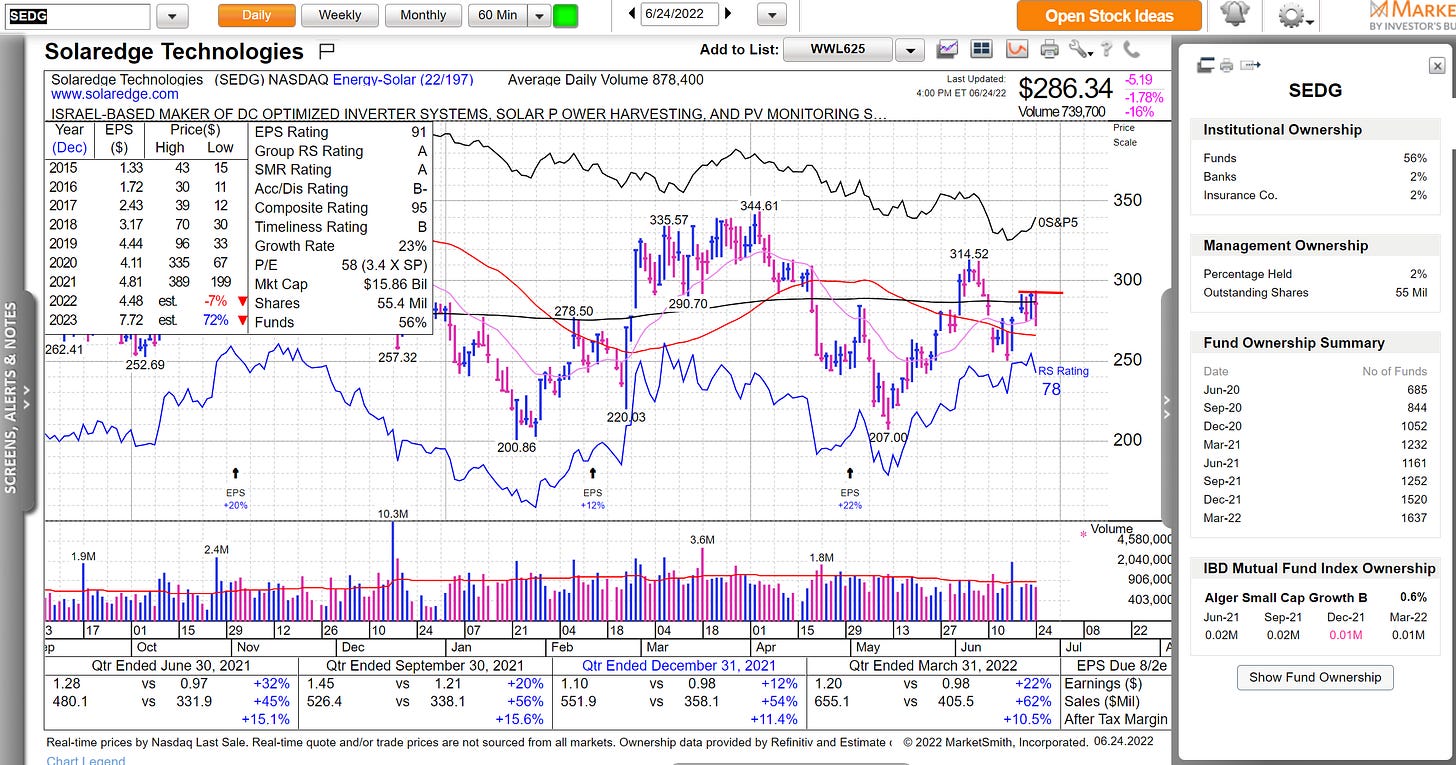

SEDG - ENPH looks stronger

SIGA - Most speculative name on this list

VERU - Speculative and News driven

I hope you found this post helpful! Let me know your thoughts in the comments

Here is what you can do to help support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Have a great weekend!

-Richard

Good work Richard!

Richard, how does KWEB chart look to you? Thx