Hi everyone,

I hope you are having a great Sunday!

In this post I’ll share my wide watchlist and my focus list going into next week.

Deepvue Black Friday Sale

There are only a few hours left of the Deepvue Black Friday Sale. You can try a month for $14 or an annual at the fantastic price of $390.

If you are a Marketsmith subscriber, this is a great time to make the switch.

We have some amazing features on the way that you don’t want to miss including:

Fully Customizable Dashboard Module

Deepvue Mobile App

Deepvue Formula Builder

Enhanced Screener Interface (With Secret Features)

Additional Fundamental Data Points and Estimates

Dashboard Apps and Breath Metrics

Conditional Alerts

Enhanced Deeplist Workflows

Journal Module and Trade Analytics

& More!

Now let’s dive in ↓

Last Week’s Market Action

The QQQ, Nasdaq 100 ETF:

The uptrend continues and many stocks seemed primed for continuation upwards. The QQQ is resting above it’s July highs although was a bit choppy during the holiday week

Let's cover each day's action:

Monday - Strong move from the short consolidation, making fresh yearly highs

Tuesday - Gap down and but tight action near the pivot

Wednesday - Gap up but failed to push higher

Friday - tight day above the pivot

The IWO has work to do but looks constructive

Wide Watchlist

The first step in my process is to go through my main weekend screens in Deepvue as well as my previous weeks watchlist and pick out stocks that catch my eye, are developing, current leaders, or are showing significant strength.

The Screens I Run

Deepvue Universe Screen (Preset)

Liquid Strength ( Looks for high $ Volume names with strong RS Scores)

Wide IPO Screen ( Looks for recent IPOs in past few years with decent RS Scores

Tight Range Screen ( Looks for High Momentum movers that are now tight)

AAOI ABNB ACLX AFRM AMAT AMD AMPH AOS APP ARM BEAM BLD BLDR BRZE CAMT CDNS COIN COUR CRM CRSP CRWD CUBI CYBR DASH DDOG DHI DKNG DOCS DT DUOL ENTG EXPE FIVN FLR FOUR FROG FRSH FSLY FTAI GNRC GPS GTLB IBP INTC IOT JBL KBH KD LMND LRCX MBLY MDB META METC MMYT MNDY MOD MPWR MSTR NAIL NVDA NET ONTO ORCL PANW PATH PINS PLTR RCL RMBS ROKU RPD SKYW SMCI SN SNAP SNOW SONO SOXL SPOT STNE SYM SYNA TAL TMDX TT TSLA TTWO UBER UPWK UUUU VRT WING WIRE XP XPEV ZS

The # of stocks on this wide list as well as the groups they are in inform me on rotation and the health of the market. This week there are 95 names

I also look at the common themes in the charts. Crypto, AI/Semis, Homebuilders, Airlines, Genomics stand out

Focus List in Deepvue

From the universe list I make several cuts to focus on the highest potential, most actionable names for the next week:

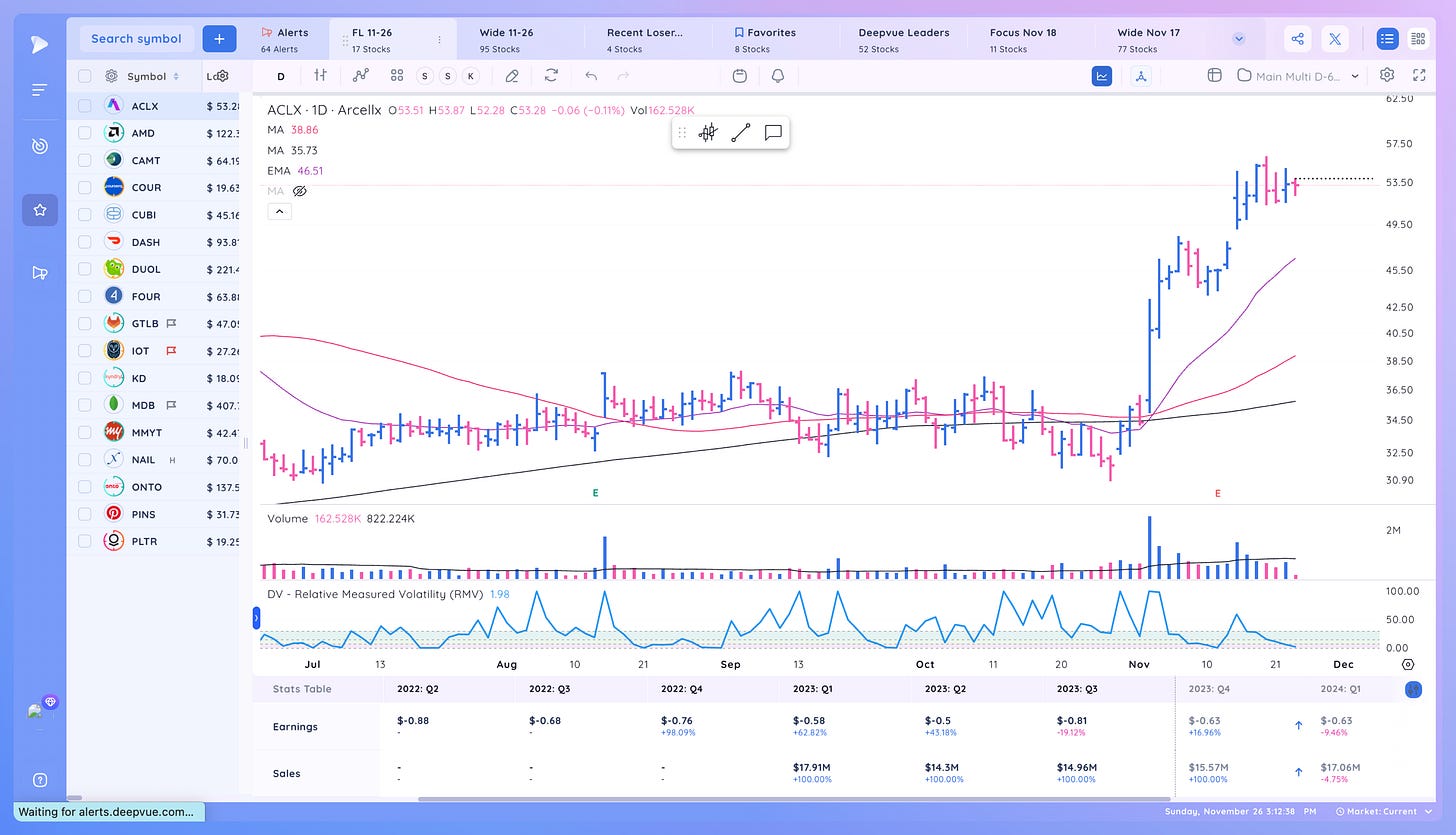

ACLX AMD CAMT COUR CUBI DASH DUOL FOUR GTLB IOT KD MDB MMYT NAIL ONTO PINS PLTR

ACLX swing trade type name & setup

AMD watching for a push higher on volume

CAMT watching for a base breakout

COUR watching for continuation up

CUBI noticed a lot of banks setup

DASH looking for another step up from the range

DUOL watchin for push higher, ideally contracts one more time

FOUR watching for push higher

GTLB see if it can move up the right side of the base

IOT see if it can move up the right side

KD watching for CU

MDB watching for continuation up (CU)

MMYT more speculative name

NAIL etf for the homebuilder theme

ONTO looking for CU

PINS watching for CU, nice tight

PLTR watching for pullback buy. Pivot or at 21 ema if it shows respect.

What stocks are on your focus list? Leave a comment below

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Cheers!

Richard

Thanks once again for sharing your thoughts. What does CU mean? And $14 a month, but $390 a year? Doesn’t sound right.