Stock of the Week : SQQQ

Inverse ETF Trading Strategy

Hey Everyone!

This week I will be highlighting SQQQ which is the 3X leveraged inverse ETF of the QQQ. Last week the SQQQ rose 16% from its lows and presented a few strong buy points. I’m primarily writing this article because I want to improve upon my ability to trade the SQQQ and profit from declining markets.

Some traders I know use a simple moving average system to trade the TQQQ/SQQQ. In this article, I build off of these types of methods and use price action setups in key areas near those MAs, most notably near the 21ema on the daily timeframe.

To be clear, the majority of the time the market is in an uptrend. Being able to short or trade inverse ETFs is not an essential skill but it is one that I want to improve upon to diversify my skill set. I’m long biased, and I believe this exercise will help me look for SQQQ trades at key turning points in the market.

Before we get too far into the article, make sure you are subscribed so you don't miss any future articles!

Routines

When do I want to make use of the SQQQ? From now on I will be looking to trade it when the market becomes extended on the daily & weekly timeframes or the ETF is forming a setup when the market is in a correction.

I’ll look to establish a position on a wedge drop on the QQQ or a prominent downside reversal/stalling day when the indexes are extended.

Prior Setup

When did the current correction start in earnest? In my view the market weakness was confirmed on 1/4/2022 as the QQQ gapped up and had a full negative outside day undercutting the tight range it had been forming. It did rally off the 50 day but the damage had begun.

The market followed through to the downside the next day as the weakness accelerated. On the SQQQ this same action was an oops reversal and then a strong breakout on 1/5/2022.

Establishing a position on days like these can not only yield a strong trade but can also stabilize a portfolio of high growth names which would be declining and hitting stops.

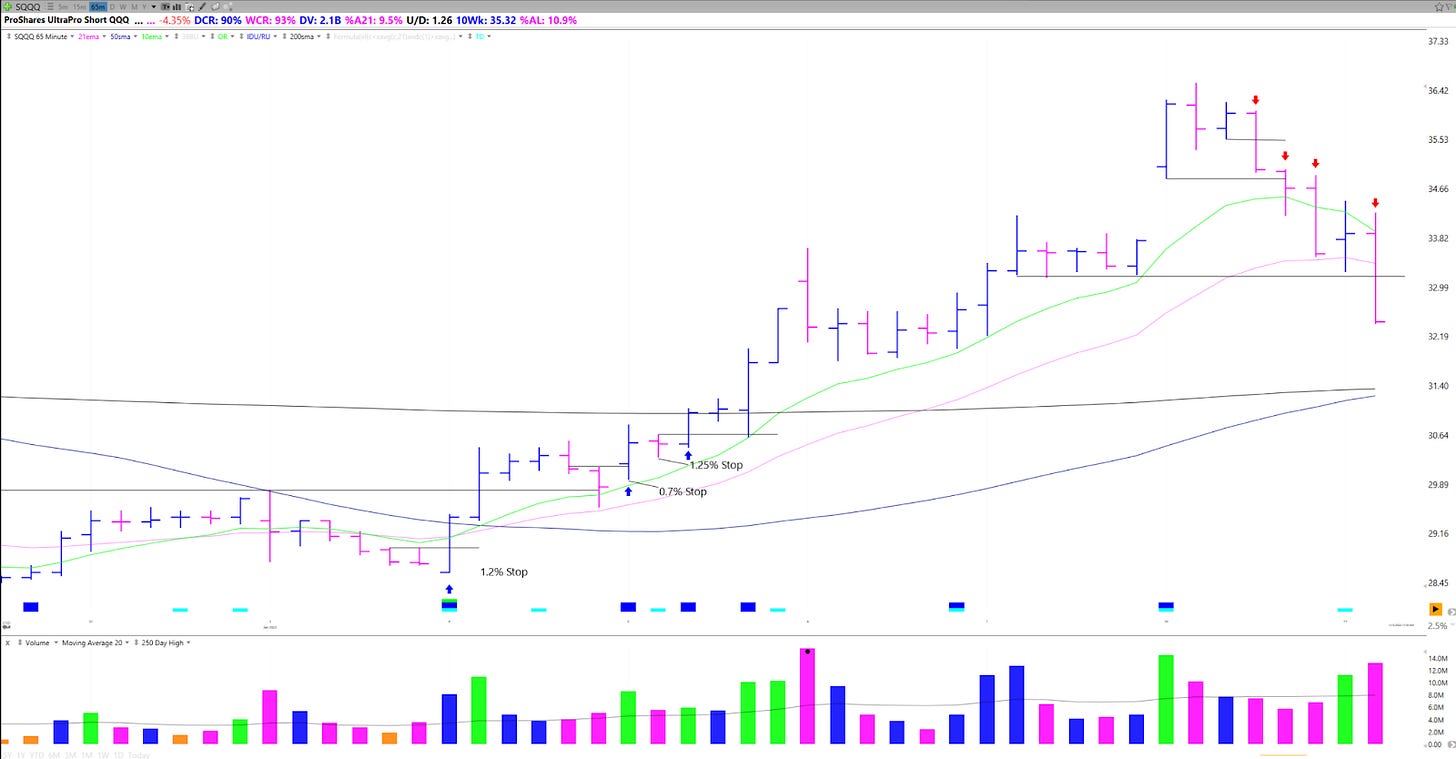

The best spots for a trade would have been on the oops reversal and bullish outside bar on the 65 minute timeframe. Setting the stop at the low of the day would have been around a 1.2% stop.

Then you have the undercut and rally through the last 1/4/2022 65 minute bar’s high. Entering through this 2-2 reversal with a stop at the low of the day would be a 0.7% risk.

Lastly, on 1/5/2022 you have an inside bar on declining volume yielding a decent inside bar and up entry with a 1.25% stop using the low of the inside bar and 0.6% using the low of the entry bar. For this one, your cost was tested but you did not take too much heat.

For exits, there are few options in this case. The SQQQ trended nicely above the 10 ema and then got extended with a gap up. The bars I have marked presented a few exit points.

Extended on the daily, inside bar and down

Extended on the daily losing the lows of the day

Extended on the daily confirming break of the 10 ema on the 65

Breaking the 21 ema on the 65

The key is to be ready to execute with the SQQQ as the market breaks the tight range to the downside. I need to remember to think about the short side of things.

Last Week’s Setup

The SQQQ had broken the range to the downside on Wednesday although on lighter volume. Would it follow through downwards or find support near the prior low set on 2/2?

The next day we had a gap up, fade, but then a strong close. This was the day where there was a news catalyst with the FED.

On the 65 minute timeframe we see the inside bar and up setup with a 1.6% risk.

Taking it one more level intraday to the 15 minute charts, there are two good low risk entries. One was a 2-2 reversal and the other was an inside bar and up setup.

Currently we are trending above the key moving averages and have just broken above resistance. Potentially we base for a bit and retest that level. A gap up would get us a bit short term extended here.

Key Takeaways

This article is a mental exercise to force me to consider the short side of things as well. The best opportunities on that side of things during this current cycle are past but this is good practice for the next correction.

I hope you found this article interesting/helpful. If you did make sure to share it on twitter!

Have a great weekend!

Richard