Hey everyone!

This week I am highlighting Silicon Motion Tech (Ticker Symbol SIMO) as my Stock of the Week. SIMO is showing immense relative strength during this correction and pullback in growth stocks. It’s currently forming a flag on a daily chart after a strong breakout from a Stage 2 Base.

This article will analyze the stock through fundamental and technical lenses and also go in-depth into how you could have traded this name. As always, your main takeaways from these articles should be about the process. The same setups appear again and again based on supply and demand.

Before we get into the analysis of SIMO, make sure you are subscribed so you don’t miss any future articles. Tomorrow I will be releasing a comprehensive guide to using relative strength only for paid members.

Routines

SIMO first showed up on my screens when it made a price and relative strength new high on 12/7/2021. There was an earlier entry within the base and also of course the buyable gap-up. With this type of strength, SIMO moved to my universe list to watch for a post-breakout setup.

At this point, SIMO is now in my system and I am looking for a spot to enter where I can manage risk and when the market conditions are favorable.

The Fundamentals

SIMO is part of the Computer-Data-Storage Group which is ranked 39/197 and has been strong overall during this correction with PSTG STX and MU also showing RS.

SIMO posted triple digits earnings growth last quarter along with triple-digit revenue growth. This type of quarter immediately gets my attention. Earnings, Sales, and Margins have also accelerated for 3 straight quarters. ROE is also a strong 21%.

Fund growth is strong for the past 8 quarters and SIMO currently has one IBD flagship fund owning shares.

Annual EPS estimates are strong for 2021 with a further 19% increase expected in 2022. Estimate revisions are upwards as well.

From a fundamental point of view, the stock is in a leading group and showing strong growth in all the key CANSLIM metrics.

The Setup

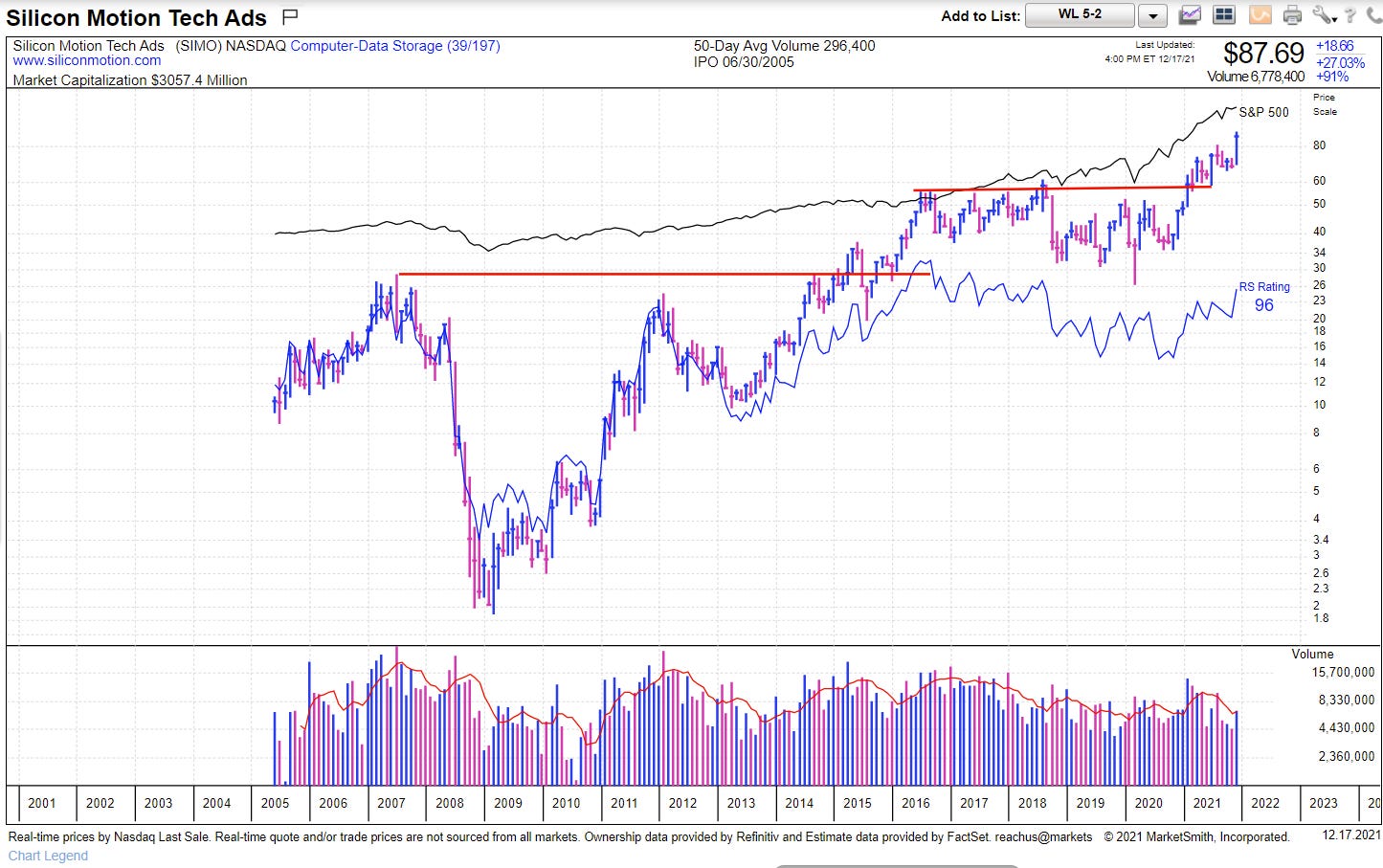

Let's start with the big picture. On a monthly chart, you can see that SIMO is not a young company. However, it is trading right at all-time highs after moving above a long-term consolidation.

Monthly Chart:

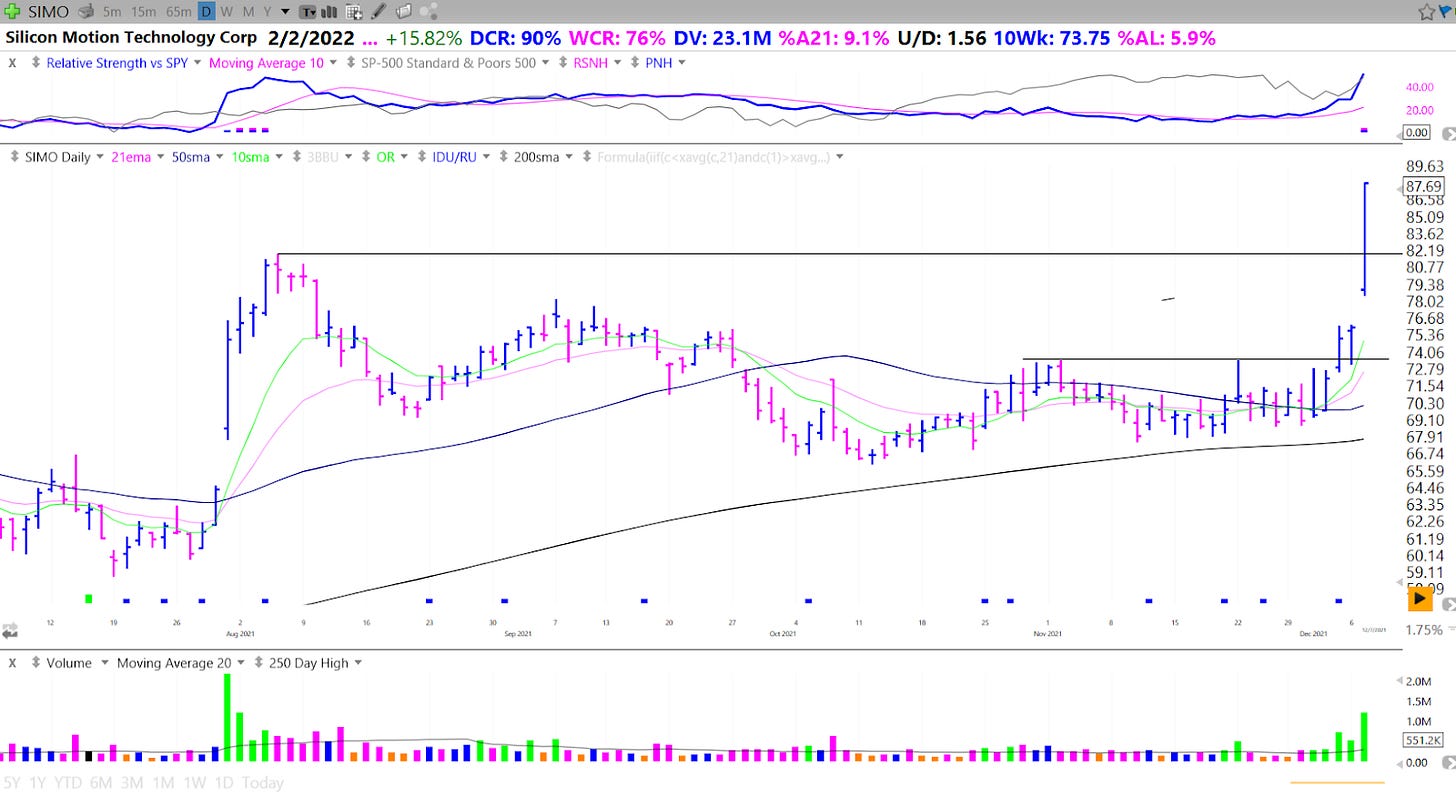

Looking at a daily chart, SIMO has just broken out of a well-formed base on volume. It is now consolidating the move on declining volume.

SIMO also showed strong RS as the market pulled in, breaking above the 73.40 Pivot within the base which was a launching pad setup. It also had a momentum burst in price and RS.

SIMO recently pulled back into the 10ema and responded strongly, completely normal action after a 25% move in 6 days. This Friday it presented an oops reversal setup although it is still below the downward trendline and horizontal pivot.

On a weekly chart, you can see textbook action with an inside weekly bar with a strong closing range.

Also be sure to check out my chart analysis video for more information:

Now what?

For me, because of the current market conditions and feedback on test buys, I did not try SIMO this week. It was on my focus list this week and will continue to be as long as it shows RS and holds strong during this corrective phase.

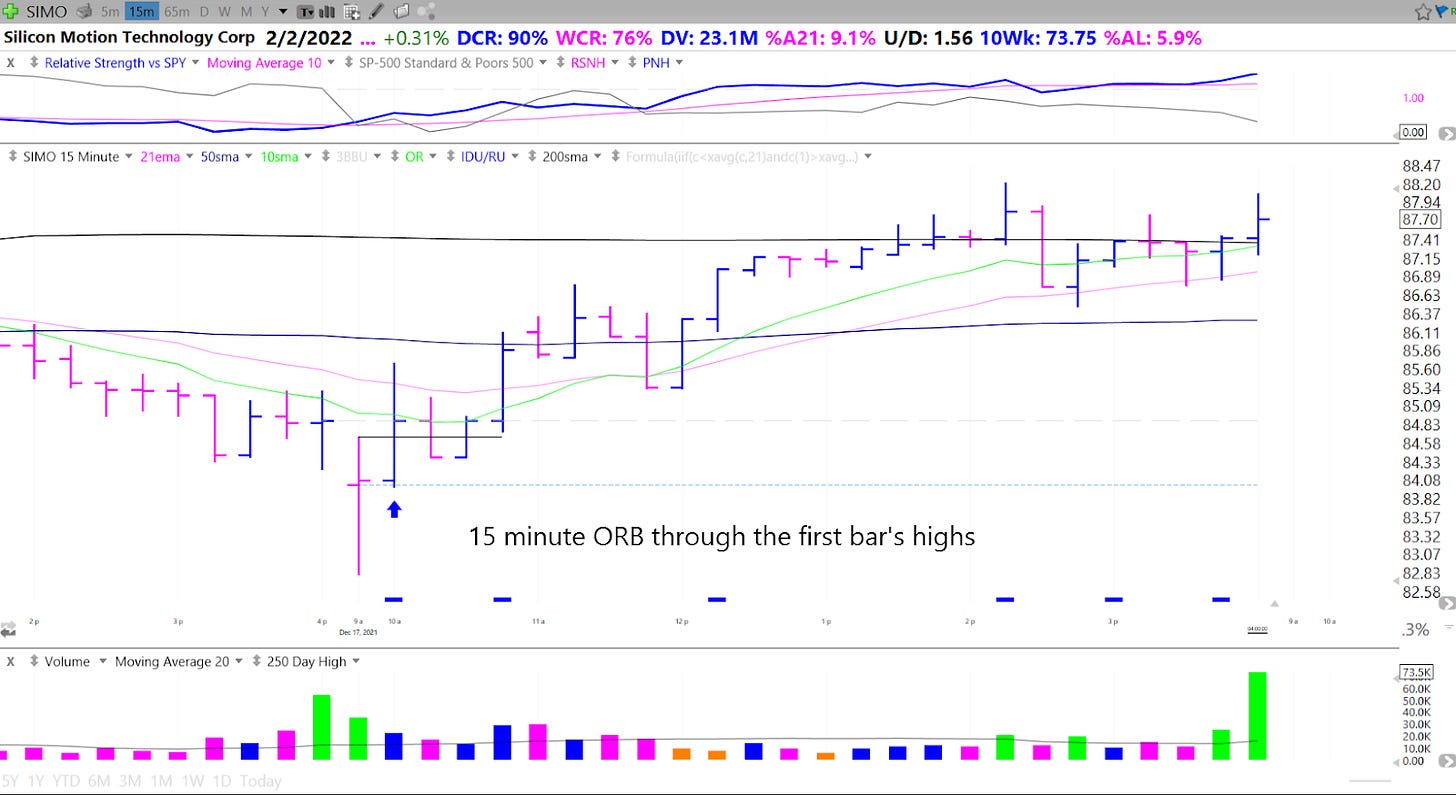

Depending on how aggressive you are you could have absolutely have taken the oops reversal entry today which was also a 15-minute opening range breakout (ORB).

I will continue to stalk SIMO during this correction. Ideally, it continues to build out and go sideways letting the 21ema catch up to the price action.

Key Takeaways:

SIMO is one of the best-looking growth charts out there, holding strong after a stage 2 base breakout. Fundamentally it is one of the leading names within a leading group and has shown earnings, sales, and margin acceleration the past few quarters.

Currently, it is building out a flag just below highs. I am watching for it to build sideways for a week or more as the market figures itself out and then breaks out through highs on volume. All in all, this is definitely a name to have on your focus list.

I hope you all found this helpful! Make sure you are subscribed so you don’t miss out on any future articles! Also, be sure to share this article on Twitter or by email.

Have a great weekend!

Richard

Concise, cogent, and a compelling case. . Great use of charts and fundamentals

Superb analysis Richard!