Hey everyone!

This week I am highlighting Roblox Corp (Ticker Symbol RBLX) as my Stock of the Week. The setup I’ll be discussing is an example of a Post Earnings Gap Consolidation Setup.

This article will analyze RBLX through fundamental and technical lenses and also go in-depth into how you could have traded this name. As always, don’t focus on this particular opportunity, instead focus on the setup and the process. I also want to emphasize that these articles analyze a setup from the past, not for the upcoming week.

And before we get into the analysis of RBLX, make sure you are subscribed so you don’t miss any future articles.

Routines

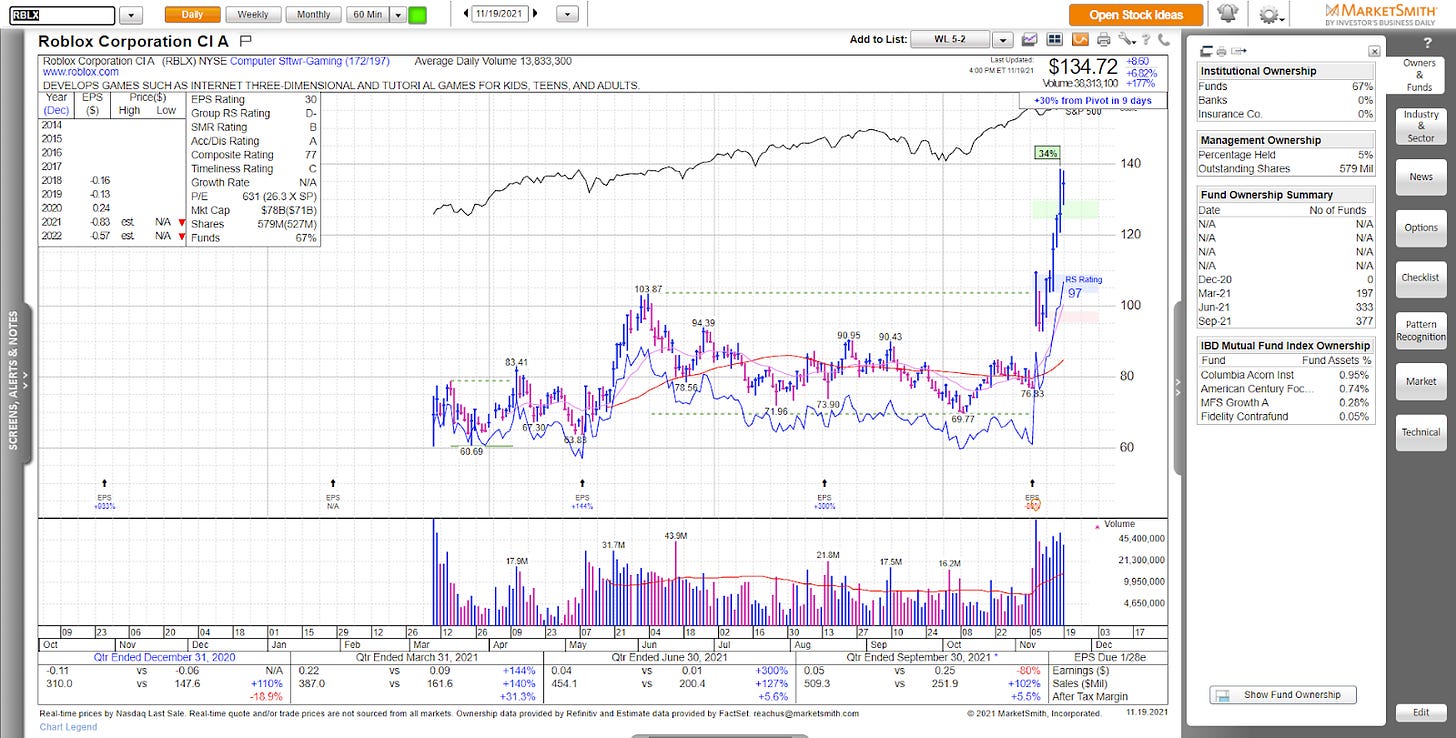

RBLX has been on my radar for quite some time since its IPO base and uptrend. It has also regularly shown up in my IPO Top 50 lists since it came public.

Establishing a routine to keep track of promising IPOs will keep many potential winners in your focus.

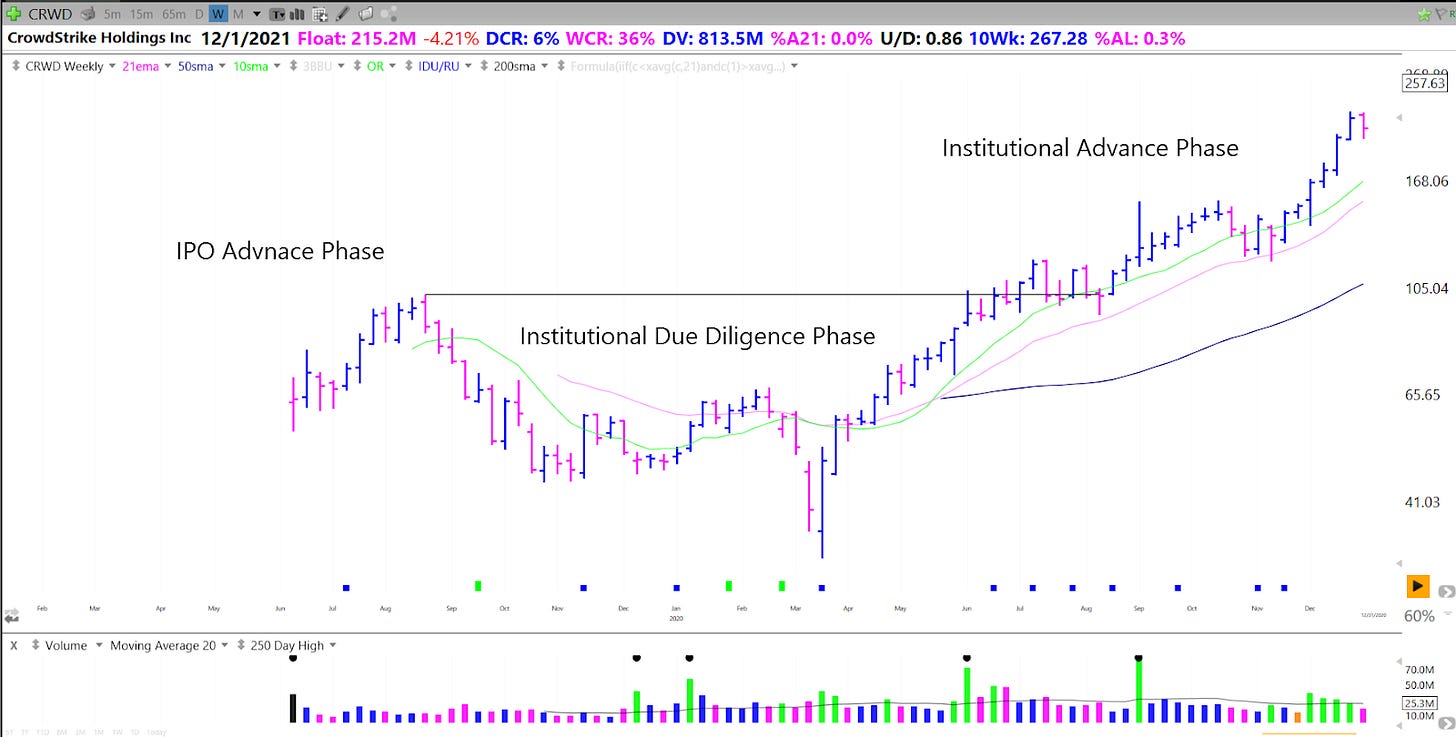

I am especially focused on recent IPOs as they are just beginning their IPO advance phases from their IPO bases or when they are moving up the right-hand side of their first major base during the institutional due diligence phase.

This is all terminology from The Lifecycle Trade which is a highly recommended book see here

In RBLX’s case, it had emerged from its primary base (Institutional Due Diligence Phase) on an earnings gap up and was set up right near all-time highs (More on the technicals in just a minute)

The Fundamentals

Roblox is an online game platform and game creation system. It has shown extremely strong relative strength and is part of the new crop of leaders. However, its overall group is not strong, ranking only 172/197.

Sales Growth is the standout metric for $RBLX with 4 straight quarters of triple-digit growth. In terms of earnings, $RBLX is a bit lackluster with a bad last quarter and uninspiring annual estimates. However, the price reaction from the last earnings gap up suggests institutions are looking at a much bigger picture. Notice the huge increase in average volume since the gap up.

The increasing fund sponsorship and quality fund sponsorship also stand out with now 377 total funds and 4 of the top IBD flagship funds with investments.

Overall, Roblox is a play on the metaverse theme which banks on the fact that we will eventually be living more of our lives online in virtual environments.

The Setup

RBLX already had a strong Earnings Gap going into the week and then pulled back in. It also presented a 2-2 reversal on Thursday which could have been the first low-risk entry point within the post-earnings gap consolidation. Then it rested Friday setting up nicely right under the ATHs.

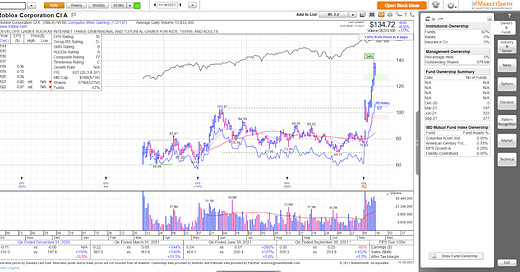

Here is a 65-minute view of the setup going into the week. Both the resistance retest and the 2-2 reversal would have been great early entries even before this week’s setup. The 2-2 Reversal setup also lines up with the key 100 Psychological level.

Execution

Going into the week I was watching the HVC level and the prior day’s high at 110.XX. I had alerts set at these levels and had RBLX on my daily focus list which I keep under 5 names.

Also on that list was ABNB which I, unfortunately, took instead of RBLX ( and sold +2% the next day). This happens and is part of the reality of trading. You can’t catch every setup.

Buying in the first 65-minute bar either as it came back through the low of the prior day’s last 65 min bar or as it confirmed the outside bar, you could have set your stop at the low of the day which would be under a 5% risk. This buy would also have lined up with the HVC pivot

RBLX also had a 15-minute opening range breakout which if you set the stop at the low of the day would have had a risk of less than 3%. The LOD was also less than 50 cents from the top of the base.

Depending on your style and timeframe there were many ways to position on that particular day. From that point, the stock progressed well into new ATHS and up 23% in 4 days.

Key Takeaways:

Never feel like you have missed a stock because they have already had a powerful Earnings Gap up from a base. Stalk for an entry and wait for spots you can manage risk against. Use the 65min for more granularity in terms of pivots and look to the left for important levels the stock will respect. Roblox is just one of the hundreds of future stocks that will show this type of setup. Be ready to catch the next one.

Have a great weekend!

Richard

" Roblox is just one of the hundreds of future stocks that will show this type of setup. Be ready to catch the next one."

Yeah :)

Thanks Richard, Great analysis.

Hello Richard, Thanks for the in depth article doing post analysis. Got a Q regarding HVC, does it refer to historical volatility or something else. I am a newbie, apologies for the silly Q.