Stock of the Week Olaplex Holdings (OLPX) Analysis. Pivot Breakout & Undercut and Rally

Hey everyone!

This week I am highlighting Olaplex Holdings (Ticker Symbol OLPX) as my Stock of the Week.

OLPX is a recent IPO that has been very choppy within its IPO base. However, after a recent shakeout below all the lows within the past month or so, it pushed strongly up the right hand side of the base and formed a pivot at 27.32. On Thursday of last week it blasted through this pivot as well as a downward trendline from the highs within the base, moving 12.6% in 2 days from low to the highs.

This article will analyze the stock through fundamental and technical lenses and also go in-depth into how you could have traded this name. As always, your main takeaways from these articles should be about the process. The same setups appear again and again based on supply and demand.

Before we get into the analysis of OLPX make sure you are subscribed so you don’t miss any future articles.

Routines

OLPX has been on my radar because it is a profitable IPO with strong fund ownership. It has repeatedly shown up on my Top 50 IPOs list that I create using sorting algorithms from MarketSmith Data.

I would highly recommend tracking recent IPOs since they can often provide excellent short term trades up the right hand sides of their first stage bases.

The Fundamentals

OLPX is part of the cosmetics/Personal Care group which is ranked 69/197. The entire group is fairing well and trading at all time highs.

Olaplex creates products which promote healthy and strong hair. Here is the MarketSmith Chart:

OLPX is profitable and has reported significant growth the past few quarters. Growth has slowed down a bit the most recent quarter but in terms of EPS, Sales, and Margins OLPX is quite strong. The Margins especially are impressive. OLPX also boasts a ROE of 48%!

The Setup

OLPX is a recent IPO so what we were looking for here is a setup where you can manage risk as the stock is moving up the right hand side of its first major base.

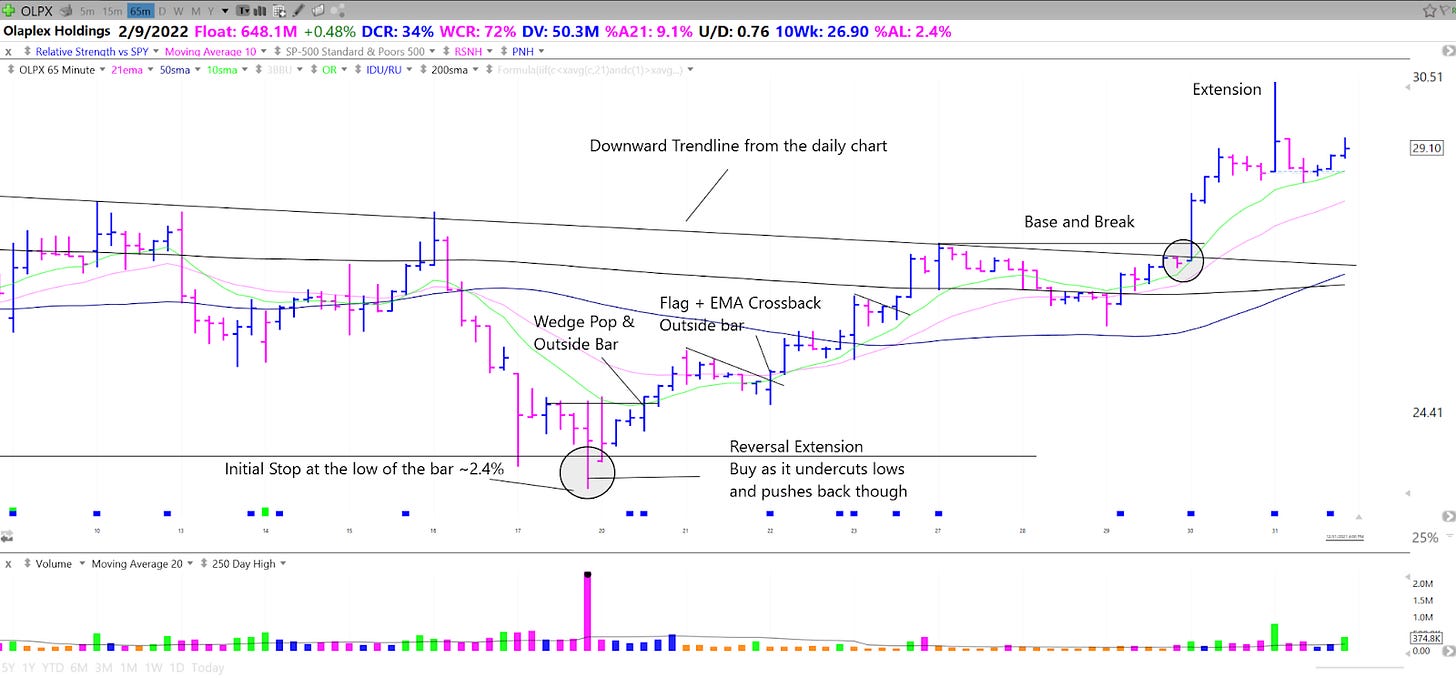

On the chart below, I’ve circled two potential setups depending on your style. The first is an Undercut and Rally and the second has a confluence of a few setups including a downward trendline break and a pivot breakout.

First discussing the Undercut and Rally, let's bring the chart down to a 65 minute chart. Notice how this undercut occurs at during a reversal extension on the highest volume since the IPO bars.

If you liked the story and were stalking this one this would have been a great spot to start a position and test the waters, OLPX rallied quickly from this point. Your initial stop would have been just below the low of that bar which was an initial 2.4% risk. Buying a reversal extension takes skill and a lot of focus.

You could have also waited for the wedge pop or the ema crossback both of which occurred on bullish outside bars.

The second setup is the pivot breakout on the daily chart. This translates to a base breakout on the 65 minute chart. Finding these intraday setups which coincide with setups on the daily and weekly timeframes is always my goal and from experience they lead to the fastest and strongest moves.

Taking a closer look at the 65 minute base I love the shakeout and volume profile.

Moving back to the daily chart you can see how this lines up with a bullish outside day which sets up the breakout through the pivot and downward trendline.

For execution on the 12/30 breakout, you would have had to be watching OLPX very closely since it took off quickly, either with alerts or with a buy stop though the pivot. It progressed quickly yielding a max of 12.6% in less than 2 days, great for a swing trade or the start of a position trade.

15 minute Chart:

It got a bit ahead of itself Friday morning and is back in a basing period on a lower timeframe and formed a wick on the daily chart.

Key Takeaways

You should always keep track of IPOs since they present great opportunities for quick swing trades. In this article we discussed two main setups, first the Undercut and Rally and then second the Pivot Breakout.

I hope you all found this helpful! Make sure you are subscribed so you don’t miss out on any future articles! Also go ahead and share this article if you learned something!

Have a great weekend!

Richard