Stock of the Week Ford (F) Analysis. Pivot Breakout from Flat Base

Hey everyone!

This week I am highlighting Ford Motor Company (Ticker Symbol F) as my Stock of The Week.

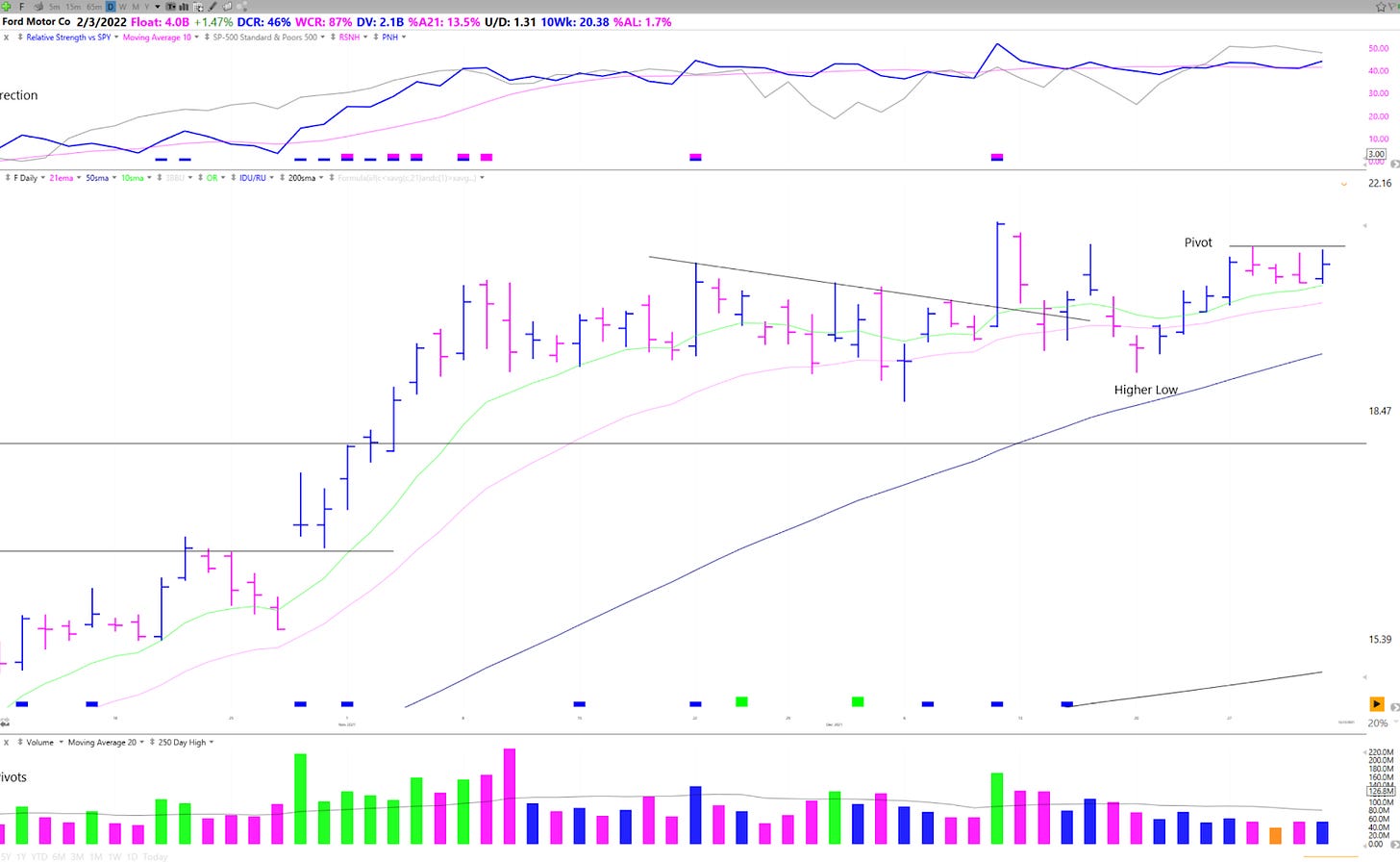

F has been one of the strongest stocks in recent weeks and advanced 14% from a flat base breakout through a pivot at 21.06. This action also marked the start of a relative strength phase since the market has declined around 5% in the same timeframe. Ford is an excellent example of how the N factor (New Product/Service/CEO/Price High) can be a clear price catalyst and can create a market leader. Throughout this fall Ford has continued to emphasize its production of a line of electric trucks. During that same period F pushed up the ride hand side of a 21 week cup, advanced 30% and then formed the recent flat base.

This article will analyze the stock through fundamental and technical lenses and also go in-depth into how you could have traded this name. As always, your main takeaways from these articles should be about the process. The same setups appear again and again based on supply and demand.

Before we get into the analysis of F, make sure you are subscribed so you don’t miss any future articles.

Routines

Ford showed up repeatedly on my Relative Strength and Price New Highs scans as it emerged from that longer term base. It has since formed a tight flat base and went sideways even as the market experienced a growth correction. This type of action (where it holds the 21 EMA and shows RS) is important to note and track since it is evidence of a beach ball underwater.

Despite a failed breakout, Ford held its structure and formed a higher low. F stayed near all time highs and showed RS during market corrections. You want stocks like F on your focus lists.

The Fundamentals

Ford is part of the Auto Manufacturers group. This was one of the top ten industry groups at the time of F’s breakout.

In terms of quarterly numbers, F has shown great growth recently, though the latest quarter was not so strong. Despite this, the price reaction to the Earnings report shows how the market was interpreting Ford’s prospects.

The recent strong action is most clearly attributed to their push to become the second biggest EV producer by 2023. (Read more https://electrek.co/2021/11/18/ford-announces-plans-produce-600000-electric-vehicles-year-2023/ https://www.nytimes.com/2021/09/27/business/energy-environment/ford-battery-electric-vehicles.html)

Their investment in the EV transition is significant and is an N factor moment. In terms of annual EPS growth, the company recovered strongly from 2020 and increased EPS from .41 dollars to 1.91 dollars. This is also higher than 2019’s numbers which were $1.19. A mild 5% EPS growth is expected in 2022 although recent estimate revisions are upwards.

The Setup

This week Ford presented a pivot at 21.06 within a flat base.

Taking a quick step back to a monthly chart, you can see that Ford had been underperforming for years but after the March 2020 correction it began to outperform the SPX.

The recent flat base also formed just above a significant resistance level that it set in 2011.

Going back to a daily chart you can see how it respected that key prior level. The failed breakout occurred during a period of very choppy action and Ford actually put in a higher low afterwards. It then moved higher and drifted sideways on declining volume below the pivot.

Looking at a 65 minute chart you can see that after the higher low forms F begins to show signs of accumulation as it often tightened intraday on declining volume and then made quick bursts upwards in the mornings.

Execution

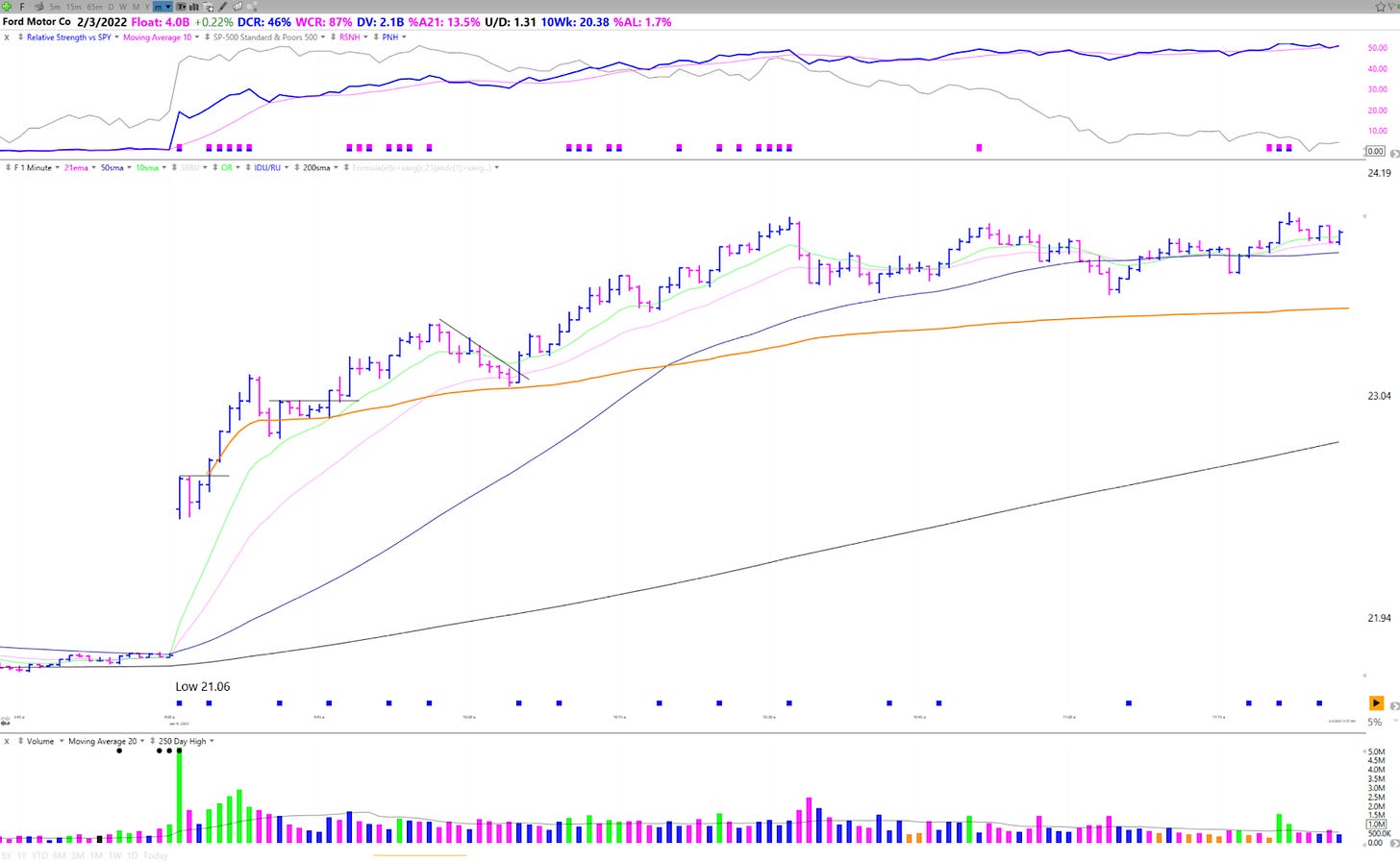

Here is a 15 minute chart of the breakout day 1/3/2022.

Ford initially sold off, recovered, then formed an inside bar. The low of the first 15 minute bar was exactly at the pivot. The first intraday entry, based on my process, would be on strength through the inside bar high. Setting a stop just below the low of the day the risk on this would be about 1.5%.

F continued higher and broke out from the opening range breakout (another potential entry) and held the day’s AVWAP during the entire day. It showed strong action forming an intraday VCP base and breaking out of that into the end of the day.

The next day Ford followed through with a gap up and rose 11%. This was on the largest volume in the past 250 days, a clear sign of institutional demand.

The gap up was buyable in my opinion and for very active traders looking at a one minute chart you can see the opening range breakout and some additional entries as F held the daily AVWAP.

For position and swing traders I do NOT suggest watching a one minute chart. I’m only showing you that timeframe to exemplify how setups are fractal and bases and breakouts occur on all of them. The lowest I’ll go is a 5 minute chart and you can see the 2-2 reversal F formed early on in the session.

Always look top down when it comes to timeframes. The only reason you would even want to look at F on an intraday chart is because it was set up on a monthly, weekly and daily. This is key.

Current Action

Ford has held up incredibly well during this tech selloff. It is also holding the AVWAP from the pivot breakout. Its action from this point is most likely market dependent. If we continue to trend downwards, F will likely break down eventually and fall back into moving averages. However, if we recover, F is a beach ball underwater and if that pressure decreases then it will likely reconfirm through Wednesday's high.

Watch for F to trend sideways on declining volume and hold a rising 21 EMA.

Key Takeaways

F is a great example of the N factor in CANSLIM. Pay special attention to significant new developments at companies, especially when the stock price action changes character. F is also another great example of a stock showing RS during downtrends and a pivot breakout with a gap. Be patient on gaps since they often pull in at the open and wait for a spot where you can clearly manage risk.

I hope you all found this article helpful! Make sure you are subscribed so you don’t miss out on any future articles! Also please go ahead and share this article on twitter!

Have a great weekend!

Richard

Thank you Richard. As Ford transitions to smart cars it will begin to be valued as a tech/information technology company.

Very nice synopsis Richard!