Stock of the Week (Dutch Bros Inc) Trade Review & The IPO Base Setup

This week I will be highlighting Dutch Bros Inc (Ticker symbol: BROS) as my Stock of the Week. BROS broke out of its IPO base and advanced nearly 30%.

This article will analyze the stock through both a fundamental and technical lens and I will also go in-depth into my trades of this name.

As always, your main takeaways from these articles should be about the process. The same setups appear again and again based on supply and demand.

BROS is an example of the IPO Base Setup. This is the first proper consolidation after a stock’s IPO and many past True Market Leaders have made incredible runs from this type of base.

The most notable historical example is Google which doubled off its IPO base lows in under 50 days after a dry-up in volume.

Now let’s get into the analysis of BROS but before we do make sure you are subscribed so you don’t miss any future articles

Routines

To potentially position in a name, you have to have it in the universe of stocks you are watching. I keep a watchlist of recent IPOs and note any that have standout Earnings/Sales growth.

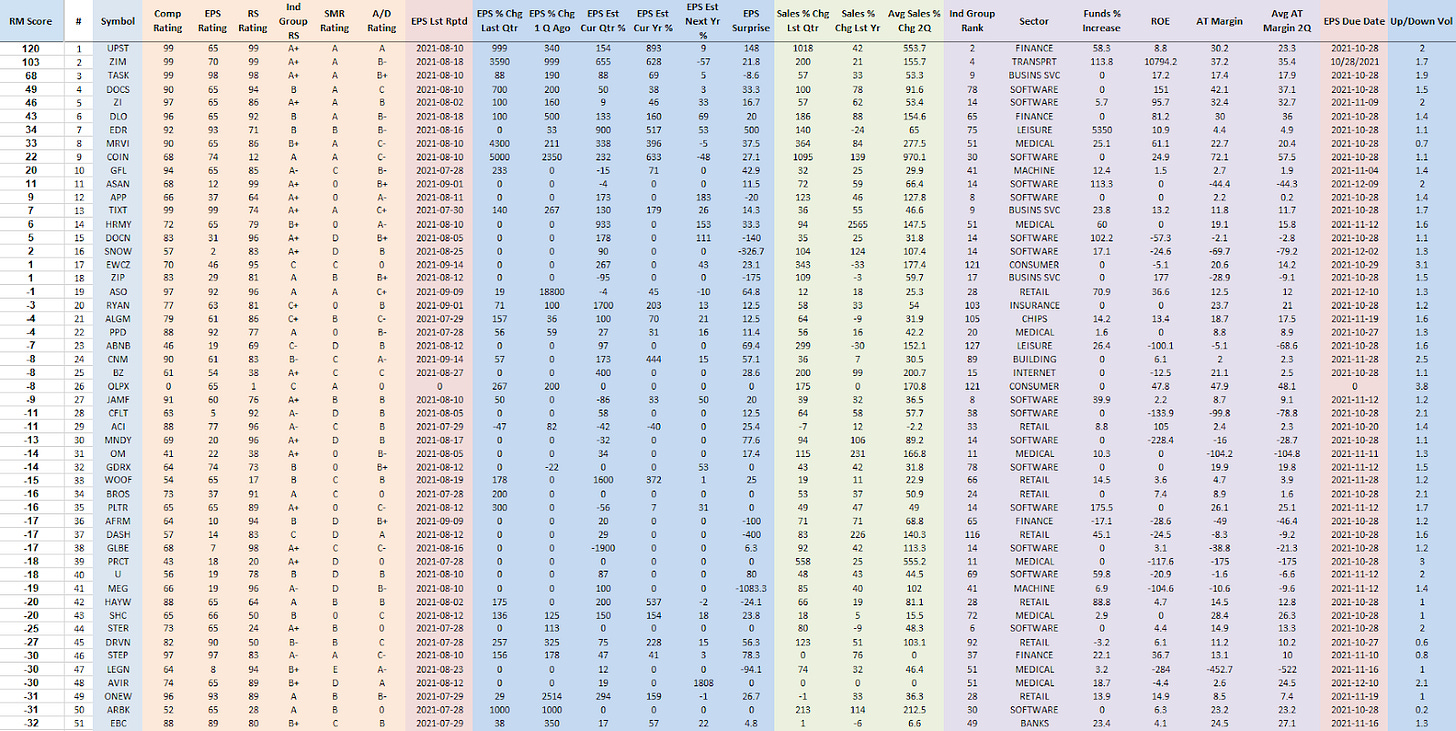

BROS also appeared in my IPO Top 50 List ( #34) which I post each weekend.

This image is from October 2nd. Whenever a new name pops up, I take a look at the chart and look for setups. At this point, I put BROS on my universe list after noticing it setting up inside an IPO Base.

I missed the initial breakout on 10/11 but after that bar, I added BROS to my actionable list for the rest of the week and entered on continuation breakouts (Much more on the technicals & entries later)

The Fundamentals

Dutch Bros is a fast-growing coffee chain on the west coast. I haven’t tried it personally but I’ve heard many anecdotes about extremely long lines at locations indicating a lot of demand.

Here is a screenshot of the MarketSmith chart of BROS

The growth in terms of both Annual EPS estimates and Quarterly Sales is extremely strong. BROS is also in an overall group that is doing well (ranked 53/197) and sports an RS rating of 98.

BROS also has 33 funds already invested and this has been ticking up almost every day. No IBD flagship funds invested yet.

The P/S and P/E ratios are both very high to be fair. However, this matters much less to me than the strong chart pattern and signs of accumulation. A stock’s trend is more powerful than personal opinions of what a stock should be valued at.

Overall, the growth story is sound with strong numbers backing it up. Next, it's just about finding a spot to enter the trend where you can manage risk

The Setup

As I mentioned previously, BROS is just emerging from an IPO Base. This is the earliest stage I will trade a stock. As I mentioned before, the IPO base can produce some outstanding trends. However, you do have to be aware that IPOs are often more volatile than more mature companies.

From an IPO base, there is often a trend coined the IPO- Advance Phase by the Lifecycle Trade Authors. I would highly recommend reading this book!

Based on their research, the IPO Advance phase should be treated carefully with shorter term sell rules, since it is often a quick run. The longer, more sustained moves usually occur in the Institutional Advance Phase after the first long-term consolidation period.

IPO Base breakouts are tremendous opportunities, but my mindset is usually that I’m renting the stock versus trying to buy and hold for the long term. PATH is an example of an IPO base breakout that didn’t quite work out. Use stops!

You always have to manage risk and know when the setup has failed. After the IPO Advance Phase the stock often enters the institutional due-diligence phase which shows up on the charts as a longer-term consolidation.

With that said, for IPOs I like to ideally buy up the right-hand side of the IPO base to try to avoid getting shaken out by the volatility that often occurs at the standard pivot.

Here are the key elements I saw on the Chart of BROS before I bought it.

First, there was strong initial demand for the stock with a rally right from the IPO day on high volume. This was also a relative strength phase since the overall market was pulling in.

Next, we see the stock start to pull back and form its first base under the AVWAP from the highs. However, the stock’s price action stays tight and volume tapers off constructively. Even with the declining volume, the stock stays reasonably liquid at around 60 Million in dollar volume traded each day.

Then on 10/8 we have the first big clue as BROS forms an inside day on the lowest volume it has ever traded. Very low volume like this along with tight price action often occurs right before a turning point since supply has dried up. In this case, the next day we get a low cheat breakout/wedge pop and BROS puts in a pocket pivot (A positive day where volume is greater than any down volume in the past 10 days)

The 10/11 candle showed that the start of the right side of the IPO base had begun and serious demand was coming in. The AVWAP from highs was also flattening, suggesting that the base may be nearing completion.

At this point, BROS was on my focus list and I was waiting for a spot to get it. After the strong 10/11 bar, BROS put in another inside day on less volume than the prior day. On a shorter-term timeframe, this is a consolidation, and I put the stock on my actionable list for the next day with alerts set.

With IPO bases especially, it’s helpful to look at a 65-minute chart to get more granularity.

You can see how the tight inside days on the daily correspond to contractions in price on the 65-minute charts. My buys were both after inside bars on the 65-minute chart.

Execution

As I mentioned last week in my UPST write-up, I try to only focus on five names each day, especially during the first hour. My first buy on BROS was in the first 15 minutes on the 13th. It was moving quickly on volume and I honestly didn't get a very precise entry. I wanted it through 48.80 which was both a previous short-term resistance point and the AVWAP from the base highs.

The stock almost immediately started consolidating above my cost but held and pushed higher later in the day. My initial stop was below the low of the day about 3.5%.

Buy 2 on 10/18 was executed a bit better. I liked how BROS had pulled back into the range on the left side of the base (around 52) and held. I bought it as it broke the Downward trendline on volume and my cost was 54.18. I treated this second buy as its own position and had my stop at the low of the day with about a 2.5% risk.

Position Management

So far BROS has acted very well showing relative strength, especially on Friday when it held 60 and then broke into new highs. By working my way early up the right side of the base I was able to handle the volatility near ATHs with a decent-sized cushion.

With Friday's candle, my stops are below the Thursday low. My expectations are that we see some follow-through and start a trend above the MAs. If we see negative action and a reversal back through the pivot I will most likely sell or be stopped out. Otherwise, I will wait for the IPO AP to signal its end with distribution days and breakdowns through the moving averages. I would expect there to be tests of the 10 ema and 21 ema along the way.

Video

You can also watch my walkthrough of the BROS chart in the video below

What do you think about BROS? Have you traded this name? Let me know your thoughts in the comments below.

Also, let me know any feedback you have on this article. Was it too long? Too short? Is there anything you would like me to expand upon?

Finally, make sure you are subscribed so you don’t miss out on any future articles!

Take care!

Richard