Hey everyone!

This week I am highlighting Apple (Ticker Symbol AAPL) as my Stock of the Week. AAPL’s proper buy point was from the launching pad set-up up the right side of the base a few weeks ago but since it is so strong (albeit extended), I figured I should analyze the chart as it’s a great example of setups I like to focus on.

This article will analyze the stock through fundamental and technical lenses and also go in-depth into how you could have traded this name. As always, your main takeaways from these articles should be about the process. The same setups appear again and again based on supply and demand.

Before we get into the analysis of AAPL, make sure you are subscribed so you don’t miss any future articles.

Routines and Context

I would currently classify AAPL as an institutional favorite. It is no longer in it’s hyper-growth phase but can still make decent moves from proper bases. When the market faces trouble and becomes choppier, names like AAPL often are where institutions put their money because of their liquidity and the durability of their business.

AAPL has already had multiple True Market Leader runs and continues to be a long term leader. Here is a weekly chart showing it’s trend since IPO.

As for routines, AAPL is one of the stocks I look at every week for market clues because it makes up such as large part of the QQQ and SPY.

The Fundamentals

You might be familiar with the story of Apple :) They have some cool products worth looking into called iPhones and Macbooks which keep customers in their ecosystem. They may sound strange but they might just be the next big thing.

AAPL has consistently grown their annual earnings which has led to its outperformance year after year.

Recently, Apple has posted significant Quarterly Earnings and Sales growth. AAPL also has an outstanding ROE of 147%. Annual estimates are not dramatic with only 8% growth expected in 2023. The fundamental story is sound but as mentioned before this is not a stock you would expect to make a 200% run in a few months. It’s a mature company which is almost the value side of tech.

The Setup

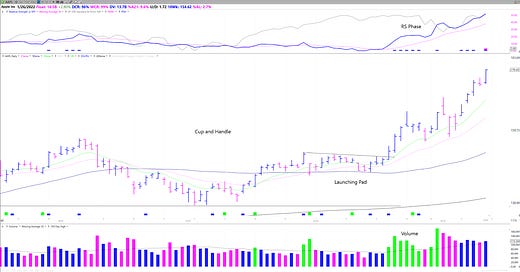

Let's start with the big picture. Apple made a strong run from it’s covid correction lows. Since then it had been forming a base on base structure, essentially going sideways for nearly a year. This culminated in a 11 week Cup and Handle base above the high from 12 months ago.

Weekly Chart:

Looking at a daily chart, AAPL formed a textbook pivot from the cup and handle/VCP pattern. This handle was also a well formed launching pad set-up, which is when the stock consolidates above multiple moving averages up the right side of a base.

Notice how volume comes in right on schedule as AAPL breaks out through the 151.88 pivot (the 11/15 high) as well as the downward trendline, As the best breakouts do. AAPL makes progress immediately and is up 7% in the next 3 days.

On the breakout you could have set your stop at the low of the prior day (149.34) which would be less than 2% away from the pivot buy. Due to the tight stop you could have easily sized into this trade given how it AAPL is so liquid trading 13 Billion in $ Volume every day.

As the stock makes progress throughout the day and the next few days you could have moved up your stop to the low of the breakout day or used the 10 ema. Once you have a profit cushion you have many options.

At the breakout also take note of the relative strength line and how it breaks above its 21ema, starting an RS trend.

At this point the market enters a pullback/correction but notice how AAPL shows immense relative strength and holds near the 10 ema even as many growth stocks are falling 20% or more from highs. It was supported by institutions as they liquidated other names who had higher multiples.

This past week, AAPL continued to show RS and made new price highs nearly every day. It is currently nearly 10% above it’s 21 ema, which is historically very extended looking back to 2016.

It will likely correct either through price or time relatively soon although keep an open mind that this could be a blow off top type situation. I would be selling some shares into strength, moving my stops up aggressively, and watching for an undercut of the 10 ema. AAPL is very strong but extended from the proper buy point.

Key Takeaways:

AAPL is a liquid leader that has shown immense RS in this choppy environment, holding the 10 day ema after a breakout a few weeks ago from a cup with handle. It’s a great example of a launching pad setup and textbook price and volume action after a strong move through a pivot. At the moment it is acting very strong but is extended and I would expect some shakeouts and volatile moves.

Make sure you are subscribed so you don’t miss out on any future articles! And please share this on twitter or by email if you enjoyed!

Have a great weekend!

Richard

Congrats on another stellar article about everyone's fave stock = $AAPL coolsville Richard! ❤ Apple is actually my claim to fame stock 'cause I bought it for $12.99 in 2003 and never sold until 2017ish. $$$$$

I LOVE Apple products as a Professional Illustrator and Graphic Designer. Steve Jobs was a dynamo hero of mine and his newly reclaimed company was struggling plus close to bankruptcy. I wish like crazy, I would've bought more shares but instead I bought shares of LameBrain $CSCO 'cause it was supposedly safe plus Dullsville out the ying huh…♫

I survived my first Stock Market Dot•com crash and it was wickedly wild! The worst thing I had back then was hope which ROCKS in real life but not in the heartless Stock Market. ᕙ(`▽´)ᕗ

Happy Holidayz to a hardworking gem of a person…(>‿◠)✌