Hi everyone,

I hope you are having a great Saturday!

In this post I’ll concisely share my thoughts on last week’s action and share my wide watchlist for next week.

This post is brought to you by TraderLion’s Labor Day Sale.

Do you think your trading would benefit from learning from Stan Weinstein or Oliver Kell?

For the next 37 hours you can join thousands of students who have taken their Masterclasses and leveled up their trading.

"If you want to accelerate your learning curve, sign up. This will take years off of your educational journey."

-Roy Mattox, Portfolio Manager and US Investing Championship Top Performer

"Oliver and TraderLion are changing lives. Took me 20yrs to figure shit out and still picked up so much from him in this past year & w the Master Class that has dramatically changed the game for me in last year. Really grateful to you bro.🙏 "

-Jay Oliviera (PBA Athlete)

All our courses are currently on sale and you can use the coupon code SummerTL for an additional $100 Off this weekend only

Now let’s dive in ↓

Last Week’s Market Action

The QQQ was strong the entire week until it gave some back Friday. We are back above rising moving averages.

Monday - Gap Up, Fade, Strong Close

Tuesday - Powerful Bar through Moving Averages

Wednesday - Follow Through

Thursday - Weakening follow through and poor close

Friday - Gap up and fade, some rally into the close

The IWO showed similar action but was weaker on Thursday and Friday. Still below the 50 sma.

Volume

Volume was lower on the NYSE and Nasdaq.

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Up - Above Rising

Short-term - 21 ema - Up - Above Rising

Intermediate term - 50 sma - Up- Above Rising

Longterm - 200 sma - Up - Above Rising

Group/Themes Action

Decent action across growth groups. Seeing rotation into Bio/Pharma and some software. Oil and Gas stocks still look good.

In my screening I noticed several strong moves/charts from packaged software, cyber security, and semis.

Here’s a Weekly Group Performance chart from TraderLion Private Access:

Key Stocks in Deepvue

NVDA would like it to go sideways above the pivot here

TSLA not a great bar, still basing

UPWK - Nice setup, good gauge for this week how this develops

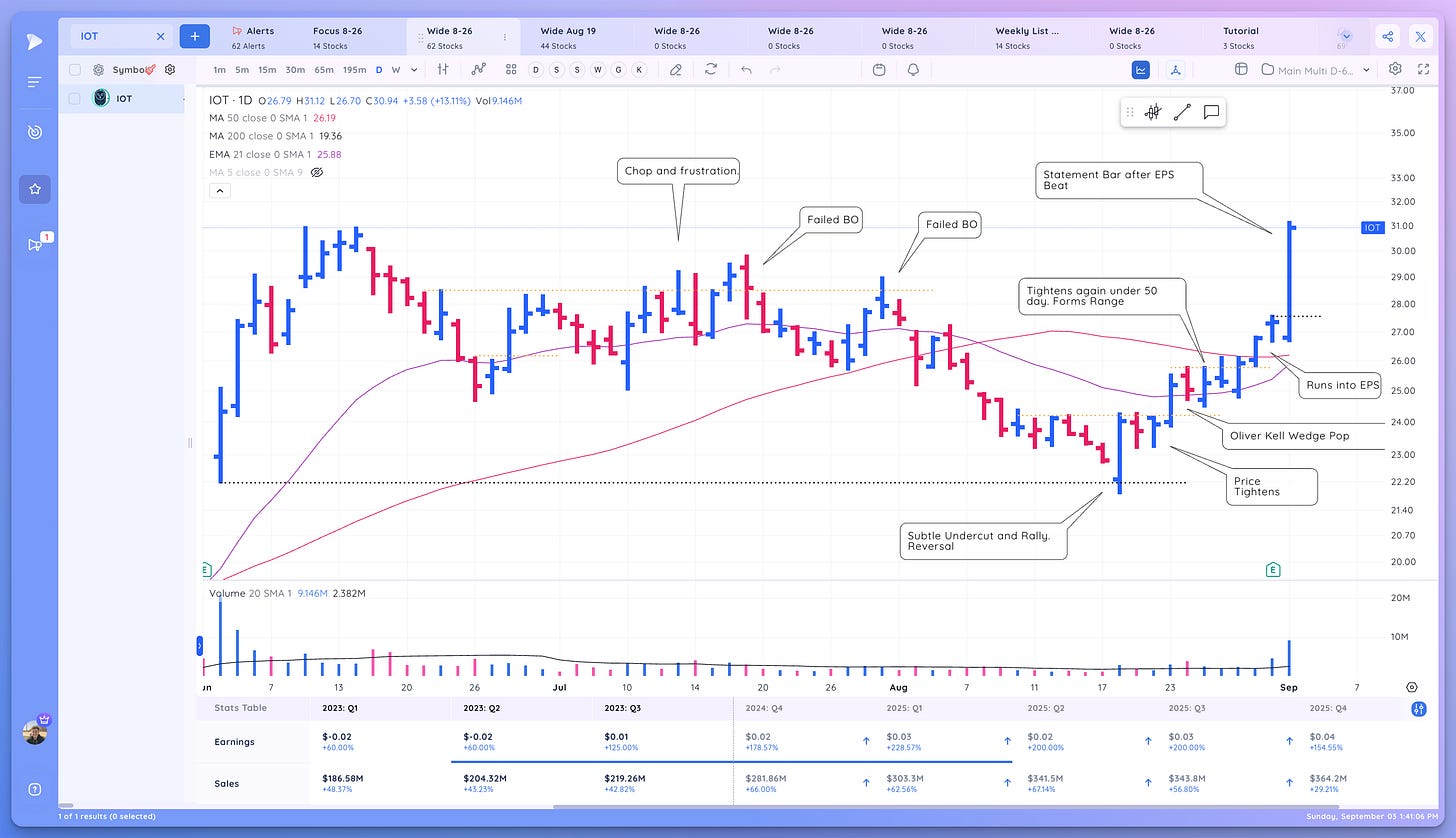

IOT this should be on everyones watchlist. Watch for a setup where you can manage risk

VRT - has that frozen rope look

Wide List in Deepvue

I build this list by going through multiple screens in Deepvue such as my Deepvue Universe Screen, Pure Momentum, Liquid Leaders, and IPOs as well as my Leadership list and previous wide list.

I add any stocks that stand out to me based on their pattern, show of strength, or other interesting characteristics. This is the first step for building my weekly focus list and gives me a sense of market health and group rotation.

AAOI ABNB ACHR AEHR AFRM AI ALGN AMGN ARCH ARRY ASAN ASND AUR BBIO BKNG BMA CRWD CVNA CYBR DELL DLO DPZ DUOL EH ERIE ESTC FN FRHC FRSH FULC GEN GES GGAL GTLB IONQ IOT J JBL LEGN LI LLY LULU MELI MNDY MRTX NTNX NVDA NVO OKTA ON ONTO ORCL PARR PDD PLTR POWL PSTG REGN RIVN ROIV ROKU S SHOP SMCI SN SNPS TSLA UBER UPWK VEEV XP ZS

I’ll post my focus list tomorrow

Weekly Market Thoughts

A strong week for stocks although we maybe be a bit short term extended still. Ideally the indexes drift sideways as we see some consolidation and rotation between potential leadership groups.

Stocks seem to be acting well among multiple groups.

What are your thoughts on the week’s action? (Leave a comment below)

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Cheers!

Richard

Richard supplies us a list of stocks under his purview …. AAOI,ABNB,ACHR,AEHR,AFRM,AI,ALGN,AMGN,ARCH,ARRY,ASAN,ASND,AUR,BBIO,BKNG,BMA,CRWD,CVNA,CYBR,DELL,DLO,DPZ,DUOL,EH,ERIE,ESTC,FN,FRHC,FRSH,FULC,GEN,GES,GGAL,GTLB,IONQ,IOT,J,JBL,LEGN,LI,LLY,LULU,MELI,MNDY,MRTX,NTNX,NVDA,NVO,OKTA,ON,ONTO,ORCL,PARR,PDD,PLTR,POWL,PSTG,REGN,RIVN,ROIV,ROKU,S,SHOP,SMCI,SN,SNPS,TSLA,UBER,UPWK,VEEV,XP,ZS

What’s the common denominator???

Why are these so interesting to Richard???

I think there’s a learning lesson here.

Thanks! What does a "frozen rope" look, mean? Like it's going up in a straight line?