Hi everyone,

I hope you are having a great Thursday!

In this post I’ll concisely share my thoughts on today’s action.

Be sure to leave a like on this article and subscribe so you don’t miss any future ones!

Now let’s dive in ↓

Market Action

The QQQ had a volatile day but ultimately held the 50 sma and closed off lows. The short term pullback/sideways move continues.

The IWO is in much rougher shape as it had a negative bar and has now been fully rejected by the declining 21 ema

Volume

Volume was higher on the NYSE and the Nasdaq.

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Up - Above Rising

Short-term - 21 ema - Up - Above Rising

Intermediate term - 50 sma - Mixed- Above Declining

Longterm - 200 sma - Up - Above Rising

Group/Themes Action

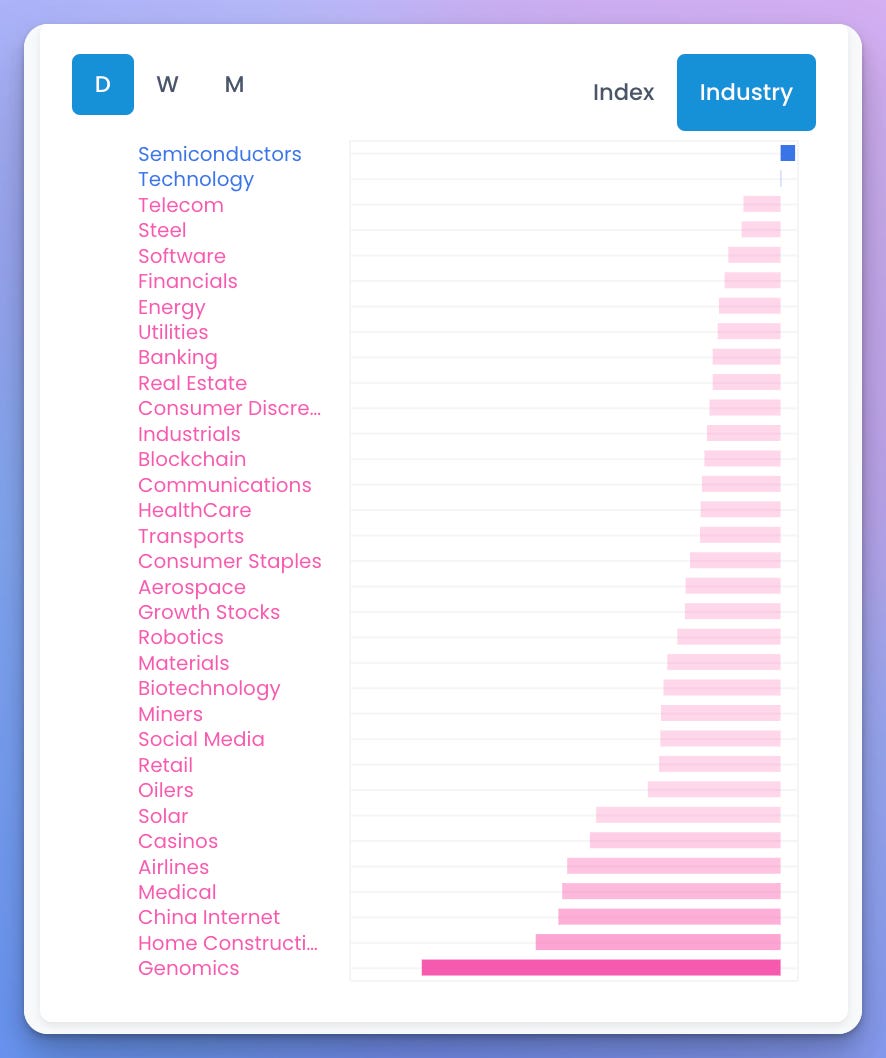

Most of the names on my focus list were red today. On my wide list the top performers were commonly from the semi & software area.

Cyber, Semis, Software remain my focus groups

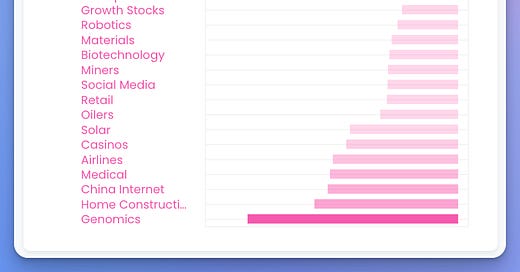

Here’s a Daily Group Performance chart from TraderLion:

In the Deepvue Universe. Oil and Gas names dominate a sort by DCR

Key Stocks in Deepvue

TSLA pulled back to the 21 ema

CRWD still screaming strength

NVDA held green. Ideally forms another pivot

PLTR nice 3 day range forming

DUOL nice close off lows

ESTC pushed higher but then failed

CAMT move from inside day

KLAC nice move off base lows. needs consolidation

Market Thoughts

Almost the same message as yesterday: Ideally we continue to drift sideways and let moving averages catch up and set up new pivots. Some more selling today but things are holding up for the most part.

The IWO bar is not great, would like to see that recover.

Take it day by day and manage risk along the way.

What are your thoughts on today’s action? (Leave a comment below)

This post was brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Cheers!

Richard

P.S.

This Saturday, Rai and I will be hosting a webinar on Daily Routines and how to execute trades.

This includes how we sort intraday, build daily focus lists, identify rotation, and screen for new ideas.

You can register with this button:

Nice quick catchup. Thanks

Richard Is there a way to see what Deepvue has in genomics vs biotechnology? Also, CTRA is not an integrated oil company, it is an exploration and production company with a small salt water disposal gathering system.