OXY Stock and Chart Analysis

Hey everyone,

This Friday, the market was down significantly, pulling back towards its 21 ema.

However, one stock really stuck out to me and the overall theme Friday suggests a potential short-term character change.

Before we go any further, make sure you are subscribed to Trading engineered so that you don’t miss any future educational posts such as my stock market outlook which will be up later today

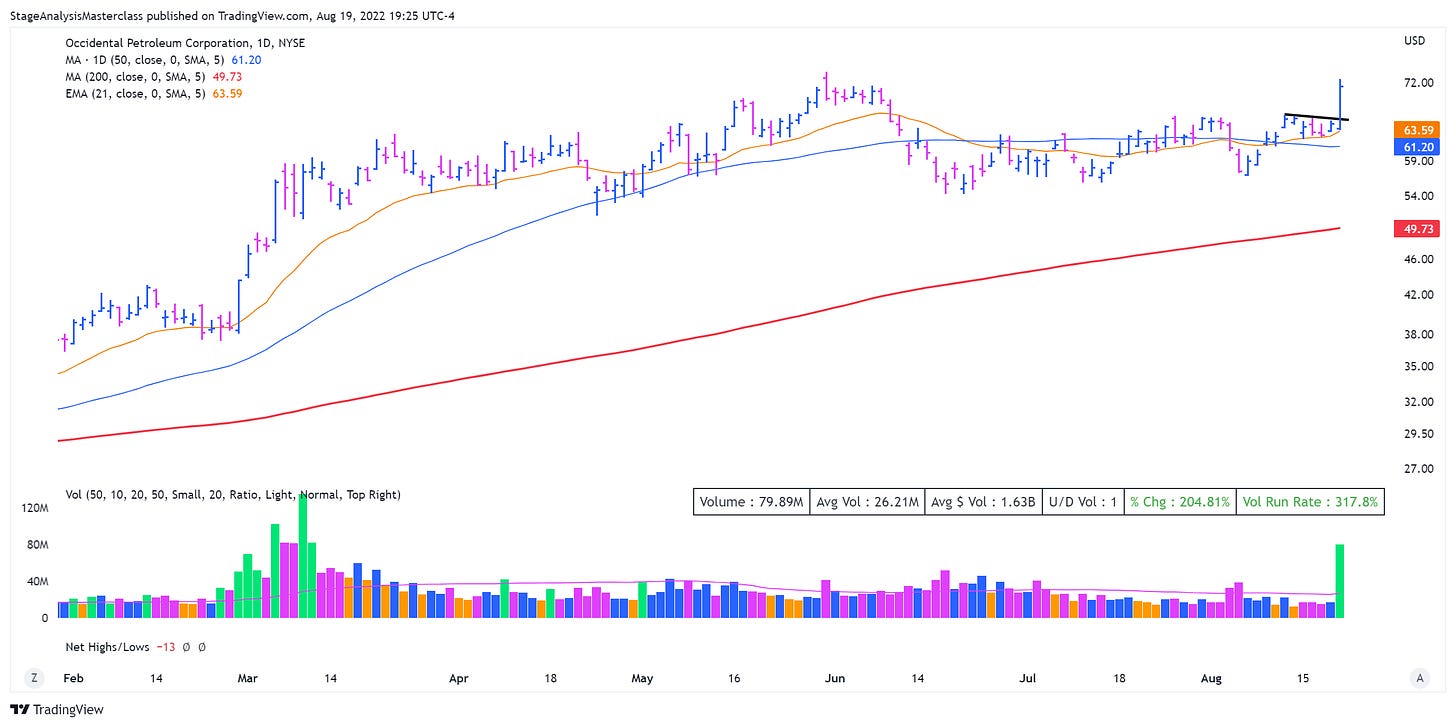

Friday, OXY broke out of its handle in a nicely formed base above a rising 200-day moving average. It rose nearly 10% on 3X its daily average volume.

Oil and Gas / Energy names as a whole showed relative strength Friday although OXY was the standout. This breakout was somewhat news driven with Buffett announcing that they will look to acquire a 50% stake.

OXY has reported fantastic earnings and sales growth over the past few quarters. You also have fidelity increasing their stake.

Focusing on the setup, OXY formed an excellent 5% deep last contraction within an overall sound 26% deep base. This is exactly what I look for in terms of a VCP. The stock pulled back into the 21ema on well below-average volume.

On a 65-minute chart, you can see the last contraction in detail

Here is a 5minute chart of today’s breakout

Notice the strong action off the open, pullback on lighter volume, and then the push upward on higher volume through the trendline break on the higher timeframe.

Then the stock progressed somewhat before breaking out through an intraday trendline which is when the volume really started to flow in.

OXY ended up closing extremely strong, especially considering the QQQ and SPY were down over 1%.

If you missed it (like I did) Look for other stocks in the same theme that are set up for a potential move. For instance, EQT is one from my focus list.

Additionally. If OXY is going to become a huge leader, there will be multiple spots to get in. Maybe even Monday it forms an inside day with a nice intraday setup such as a range breakout. Or it could go sideways for a few days in a short-term flag before a breakout into new all-time highs.

Remember that there will always be another opportunity. On the long side, focus on the strongest stocks in the strongest groups with a proper setup and a logical place to manage risk. Some of the best entries occur when the sector is just starting to regain momentum.

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Have a great weekend!

Richard