Hi everyone,

I hope you are having a great Tuesday!

In this post I’ll concisely share my thoughts on today’s action.

This post is brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

Also, be sure to leave a like on this article and subscribe so you don’t miss any future ones!

Now let’s dive in ↓

Market Action

The QQQ resolved the inside bar to the downside and followed through. The gap area continues to be resistance. We remain below a declining 21ema

The IWO put in another negative bar. That is now 3 heavy down bars in a row

Volume

Volume was slightly lower on the NYSE and higher on the Nasdaq.

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Mixed - Below Rising

Short-term - 21 ema - Down - Below Declining

Intermediate term - 50 sma - Down- Below Declining

Longterm - 200 sma - Up - Above Rising

Group/Themes Action

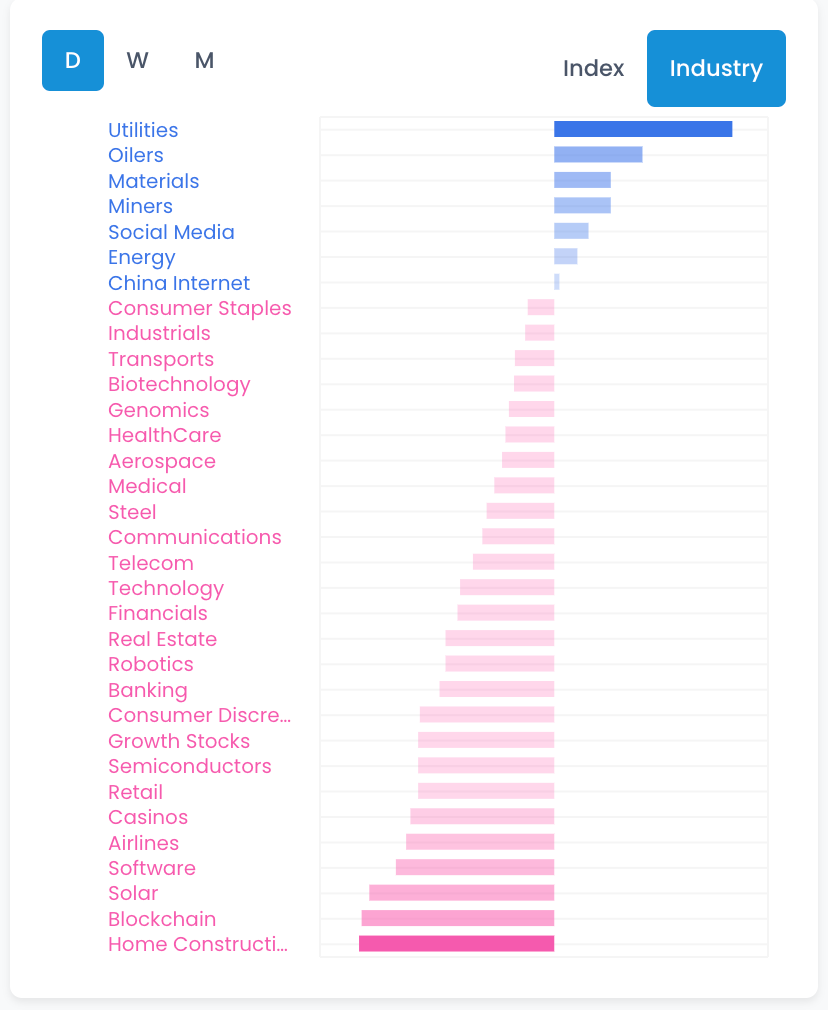

Oil and Energy rallied.

Here’s a Daily Group Performance chart from TraderLion:

Key Stocks in Deepvue

TSLA could not push through the pivot, still holding yesterdays lows

NVDA Faded at the 50 sma

DUOL lost the pivot, see if it can hold and form a range at the 21 ema

RIVN followed through down

CRWD Negative bar

Market Thoughts

Negative action across the board today. It looks like stocks need more time. Continue to monitor stocks holding up in constructive patterns

Take it day by day and manage risk along the way

What are your thoughts on today’s action? (Leave a comment below)

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Cheers!

Richard

S&P500 heading to 3600???

Market has been rolling over for a while. Some breadth measures getting extemely negative (e.g. percentage of stocks below 50 day ma). So, probably an oversold bounce is in the offing. Nothing looks good on the long side, with the possible exception of of energy, but that's also beginning to crack. It's a time to observe closely but do v little (on my time frame).