Hi everyone,

I hope you are having a great Sunday!

In this post I’ll share my wide watchlist and focus list for the upcoming week

If you find this helpful make sure you leave a like and subscribe

Now let’s dive in ↓

Weekly Situational Awareness:

The indexes and semiconductors in particular tooks shots Friday. However there are still quite a decent amount of stocks and groups holding up.

I remain open to anything the next week or two, increased selling, more basing/chop, or developing uptrend. I will let the market and stocks decide.

Wide Watchlist

The first step in my process is to go through my main weekend screens in Deepvue as well as my previous weeks watchlist and pick out stocks that catch my eye, are developing, current leaders, or are showing significant strength.

The Screens I Run

Deepvue Universe Screen (Preset)

Liquid Strength ( Looks for high $ Volume names with strong RS Scores)

Wide IPO Screen ( Looks for recent IPOs in past few years with decent RS Scores

Pure Momentum ( Looks for High Momentum movers with high ADR %)

ABNB ACHR ACI AEHR AFRM AKAM ANF APP ARRY AUR AVAV BN BBIO BRZE BX BXMT CAMT COIN CRNX CRWD CSCO CVNA CYBR DKNG DLR DUOL ESTC FN GSHD FTRE INSM IOT SN LI MCK MELI MLTX MMYT MOD MORN NE NTAP NTNX OKTA OLLI OVV OWL PAAS PATH PDD PLTR PSN PUMP RCKT REGN RIVN RYTM SGML SHOP SIG SPOT TIGR TSLA TTI UBER USM VMW VNO VRT WSM X XP XPEV XPO YETI ZION ZS SDRL MBLY SKWD NXT

The # of stocks on this wide list as well as the groups they are in inform me on rotation and the health of the market. This week there are 81 stocks

I also look at the common themes in the charts.

Weekly Focus List.

Here is my Focus List for the week.

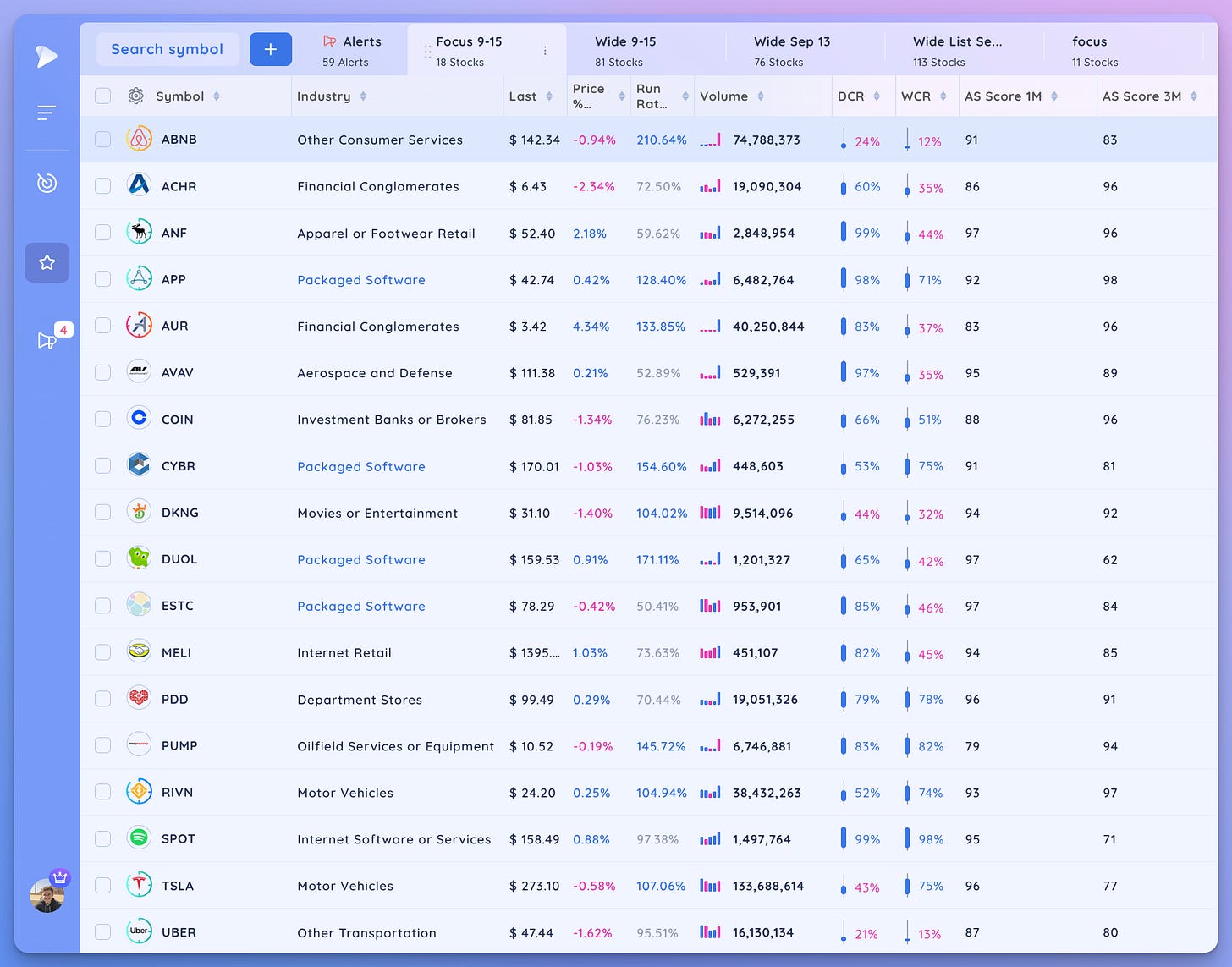

ABNB ACHR ANF APP AUR AVAV COIN CYBR DKNG DUOL ESTC MELI PDD PUMP RIVN SPOT TSLA UBER

I make several cuts to my wide list to arrive at this, considering the patterns maturity, strength of recent action, fundamentals, and wether I consider it to be a leader.

My timeframe for these is swing/potential position trade.

I’m looking for logical tight areas where I can easily manage risk against and know if the setup fails. Typically my stops will be at the recent higher low or bottom of range.

Selected Charts

ABNB Forming the right side of the base and holding the gap

ACHR Coiling, more of a swing trade type name

COIN noticing the tightness around the bottom of the base here

CYBR held well and stellar EPS Sales growth estimates

DKNG moving up the right side of the base

DUOL forming a range up here

PDD The chart looks excellent, added risk with chinese names

MELI forming a range against the base pivot

TSLA watching for a push higher from this range

UBER pulling back to the consolidation pivot area

What are your top ideas for the week? (Leave a comment below)

This post was brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Cheers!

Richard

market has not been healthy for a week or two-- time for a holiday imho till medicine starts to work

--percent of nadaq above 50 and 200 is alarming

Awesome post and great process!