Hi everyone,

I hope you are having a great Monday!

In this post I’ll share my wide watchlist and focus list for the upcoming week

If you find this helpful make sure you leave a like and subscribe

Now let’s dive in ↓

Weekly Situational Awareness:

There are plenty of stocks setting up and multiple potential leadership groups. However the IWO in particular looks weak so open to anything.

Looking to manage current positions and see what happens next week.

Wide Watchlist

The first step in my process is to go through my main weekend screens in Deepvue as well as my previous weeks watchlist and pick out stocks that catch my eye, are developing, current leaders, or are showing significant strength.

The Screens I Run

Deepvue Universe Screen (Preset)

Liquid Strength ( Looks for high $ Volume names with strong RS Scores)

Wide IPO Screen ( Looks for recent IPOs in past few years with decent RS Scores

Pure Momentum ( Looks for High Momentum movers with high ADR %)

AAOI ABNB ACHR ADBE ADSK AEHR AFRM AKAM AMGN ANET APP AUR AVAV BILL BKNG BP BRZE CAMT CAT GDC CELH CLS COUR CPRT CRWD CVNA CYBR DASH DBX DELL DLO DO DPZ DUOL ELF ESTC FRSH GLOB GOOG GPN GTLB INSM IONQ IOT KD LBRT MA MELI MNDY MU NBIX NFLX NTAP NTNX NVDA NVO OKTA ON ONTO ORCL PANW PATH PLTR PSTG RIVN ROIV RPT RYTM SAIA SMCI SPLK SU TDW TEAM TLRY TSLA TT TTWO TWLO TWNK UBER UPWK VEEV VMW VRT X XP ZS

The # of stocks on this wide list as well as the groups they are in inform me on rotation and the health of the market.

I also look at the common themes in the charts.

Weekly Focus List.

Here is my Focus List for the week.

ADBE CLS CYBR DLO DO GTLB IONQ IOT KD MELI NFLX NVDA OKTA RIVN TSLA UBER ZS

I make several cuts to my wide list to arrive at this, considering the patterns maturity, strength of recent action, fundamentals, and wether I consider it to be a leader.

My timeframe for these is swing/potential position trade.

I’m looking for logical tight areas where I can easily manage risk against and know if the setup fails. Typically my stops will be at the recent higher low or bottom of range.

Some of these need a few more days to develop.

Charts

ADBE watching to see how it acts after EPS

CLS - tight range but maybe too tight? Do we get a break of the underside and rally?

CYBR nice long base and earnings acceleration. Could tighten further

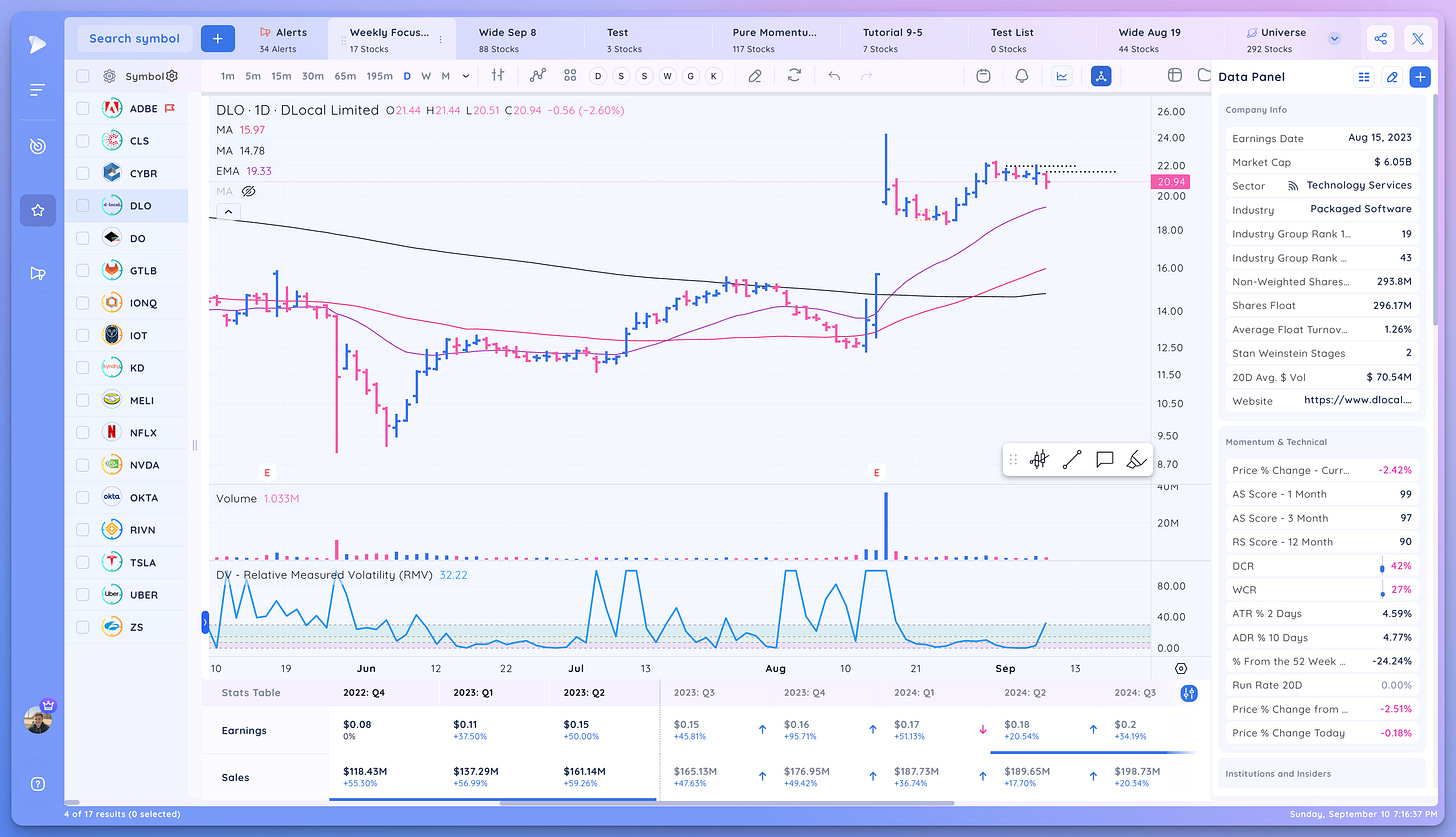

DLO watching for a break higher on volume

DO representing the oil and gas names, watching for a push off the 50 sma area

GTLB watching for a handle to form

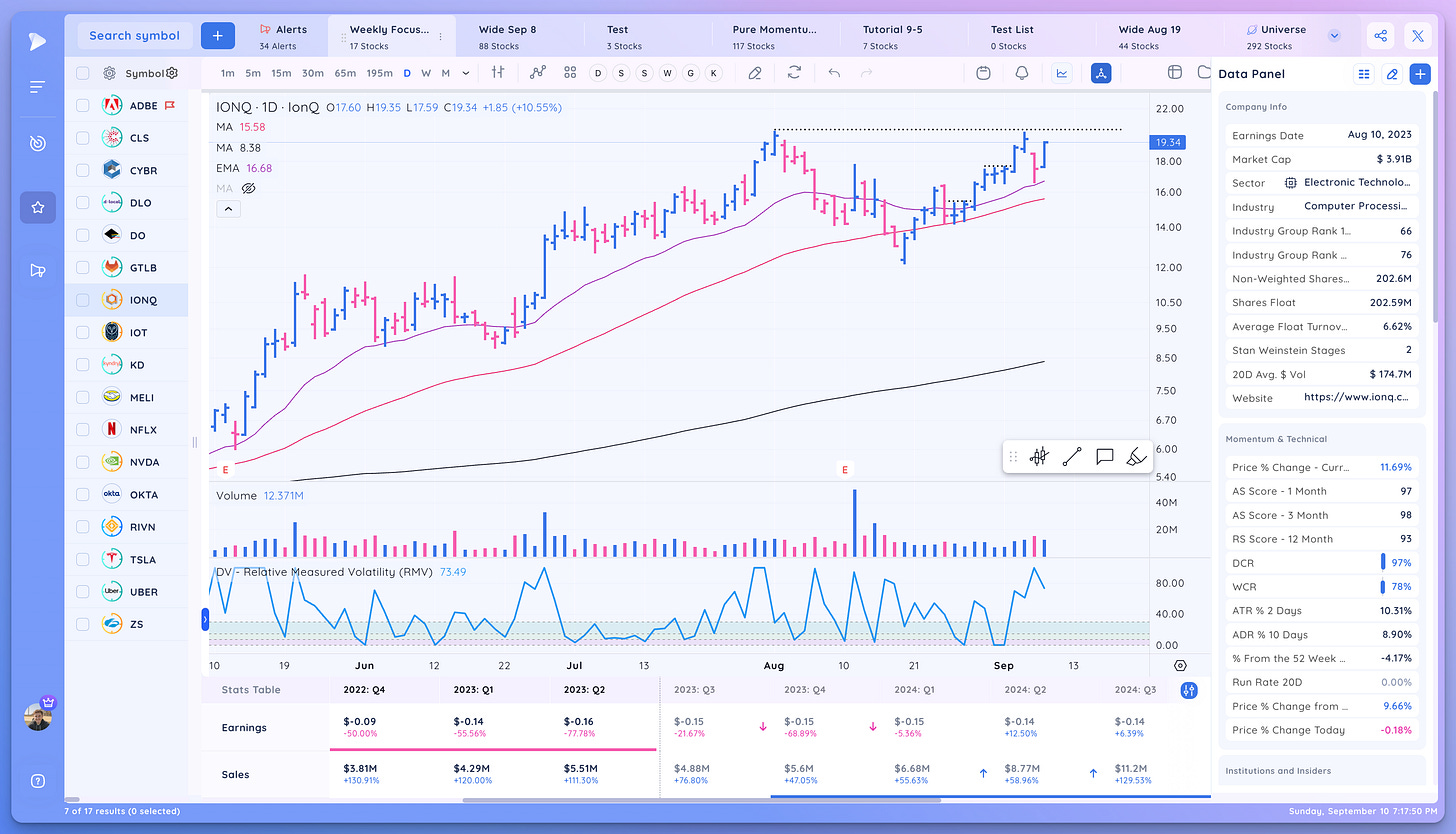

IONQ would like to see this form a tight range here

IOT watching for more consolidation and for it to form a range.

Watching for a move higher on volume. AKAM as well looks good

NVDA wathcign to see if it can hold here near the 50 sma

RIVN watching how it acts at the cheat level

ZS watching for a breakout

What are your top ideas for the week? (Leave a comment below)

This post was brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Cheers!

Richard

I find it helpful and thank Richard