Hello everyone,

This is week 8 of ∞ that I will be posting a written version of my stock market outlook.

Make sure you are subscribed so you don’t miss any future updates or educational articles.

Last Week’s Action

Last week we saw the indexes continue to head higher after a pullback early in the weak. On Wednesday we had a strong expectation breaker and we eventually closed the weak near highs.

We remain above a rising 21 ema and 50 sma although below a declining 200 sma.

Daily chart of the QQQ:

Stocks on the Nasdaq continue to make net new highs. We’ve now rallied 23% off lows. Individual stock action is improving with multiple breakouts in growth areas.

ON

SWAV

The t2108 is already nearly 80 after being below 10 just a few weeks ago.

NYSE % of stocks above their 40 day moving average:

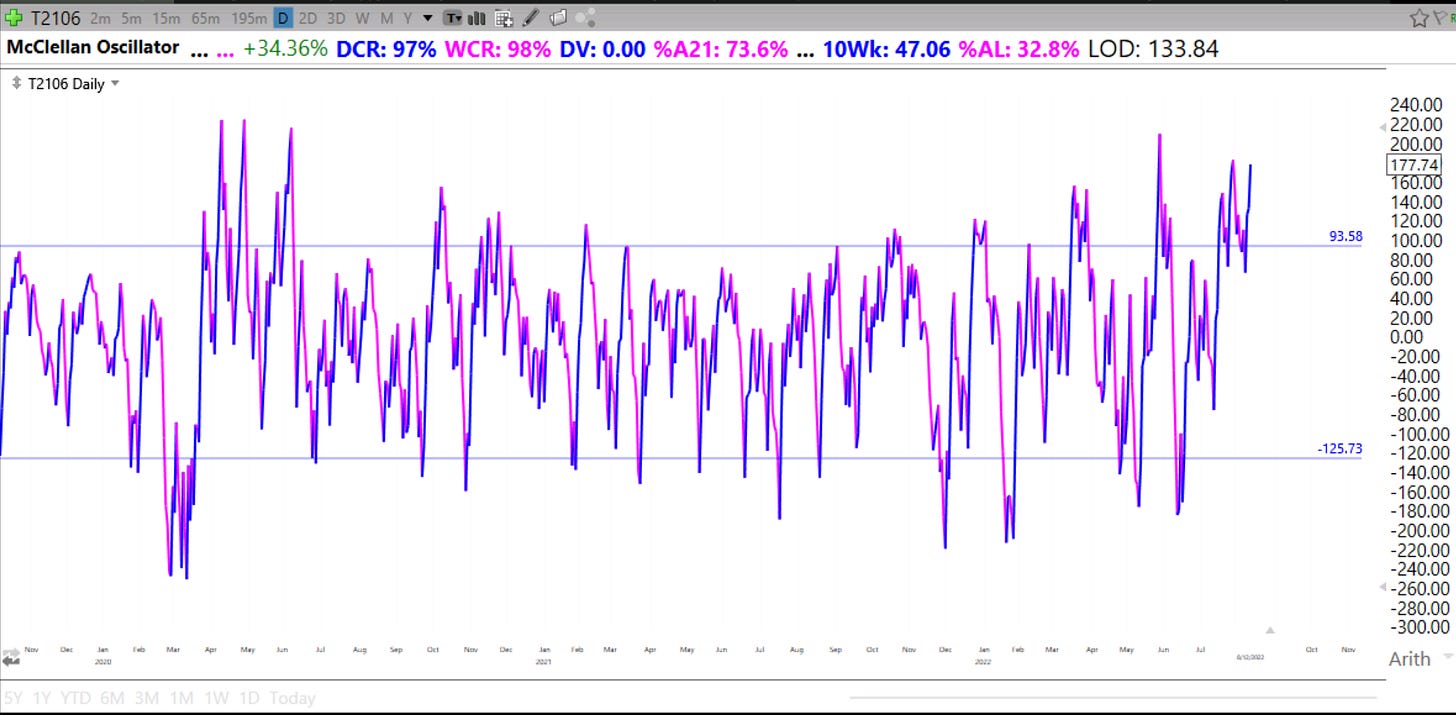

The McClellan Oscillator is also at “overbought” levels.

The indexes may feel extended, however, the individual stock action is the most important thing. Do setups continue to develop and work? Or will they roll over and this will become just a bear market rally?

The stocks will tell us.

Here is a list of strong stocks that I am watching closely among others.

ENPH

ARRY

MAXN

DQ

SEDG

ON

GFS

PLAB

CELH

SWAV

HRMY

NBIX

Let me know your thoughts on these and any others you are watching in the comments below

Sentiment

Likely due to the strong weekly close, my Twitter survey was overall quite bullish

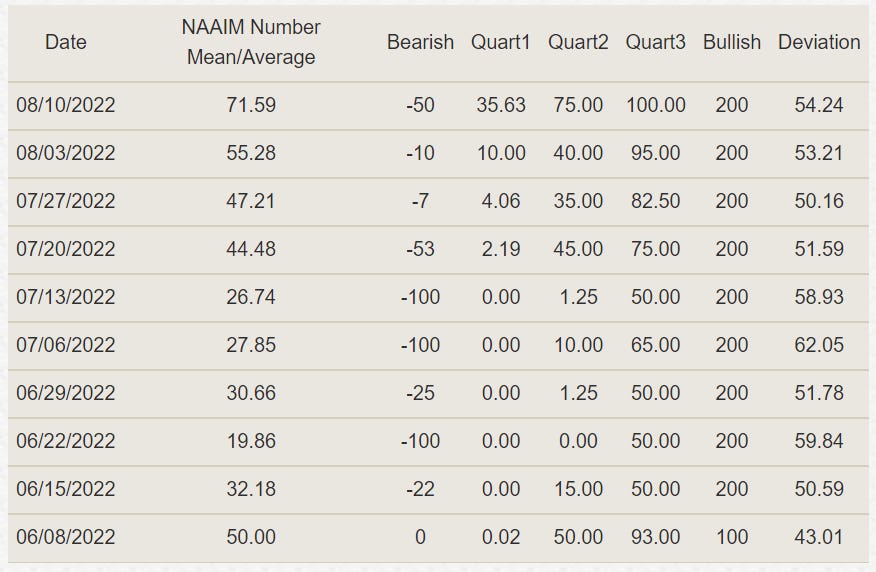

The NAAIM exposure index increased over 70 this past Wednesday. This is getting a bit hot.

The Put-Call Ratio is declining sharply.

IBD transitioned from a Confirmed Uptrend to an Uptrend Under Pressure.

Stock Market Outlook

Overall my stock market outlook is a tradable uptrend within a longer-term downtrend.

I’d love for the market to go sideways for a week and let the 21 ema catch up to price. This would set up many bullish chart patterns.

Remember that the most important thing at the end of the day is to watch the price and volume action of the stocks themselves as well as the indexes. Be ready for anything and manage risk.

What To Look For (Same game plan as the last few weeks)

When it is time for a new bull market we will see divergences as groups decouple from the indexes and show relative strength. Setups will proliferate your screens.

When the market is ready it will be obvious, and it may happen when the news and sentiment is the absolute worst.

The leaders in the next bull market will once again have the potential to quickly double and triple and they will likely be completely new names that are unfamiliar. Try not to become biased and focused on last cycle’s winners.

Follow the sector, industry group strength, and look for the strongest stocks coming out of these strongest areas. As the market bottoms these future winners will likely be completing bases and may even be making new 52-week or all-time highs.

Keep an eye out for turnaround plays with excellent earnings and sales growth as well as recent IPOs within the past 2 years forming out their first proper bases.

Have patience, preserve your mental and financial capital, and be ready. Stocks can shape up faster than we think.

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Have a great weekend!

Richard

Consistently helpful, informative.

Richard, I live in the U.K. and my billing address is in London. Unfortunately, I can not subscribe because my postal code is not recognized. I wish to subscribe...what do I do???