Hi everyone,

I hope you are having a great Thursday!

In this post I’ll concisely share my thoughts on today’s action.

Later today at 8pm EST I will be doing a Free Webinar with Rai on Stage Analysis and Deepvue.

You can sign up here: https://us06web.zoom.us/webinar/register/WN_ApTMp1IaTzuXNqtGkn4iVg

We will email you the recording if you can’t make it live.

Also, be sure to leave a like on this article and subscribe so you don’t miss any future ones!

Now let’s dive in ↓

Market Action

The QQQ advanced again today but closed off highs. Ideally we get some constructive sideways pullback towards the MAs on lighter volume.

This is now the 5th day in a row of gains.

The IWO put in a downside reversal candle at the 50 sma

Volume

Volume was higher on the NYSE and lower on the Nasdaq

Trends ( Based on QQQ) - All Turn Up

Shortest - 5 Day SMA - UP - Above Rising

Short-term - 21 ema - Up - Above Rising

Intermediate term - 50 sma - Up- Above Rising

Longterm - 200 sma - Up - Above Rising

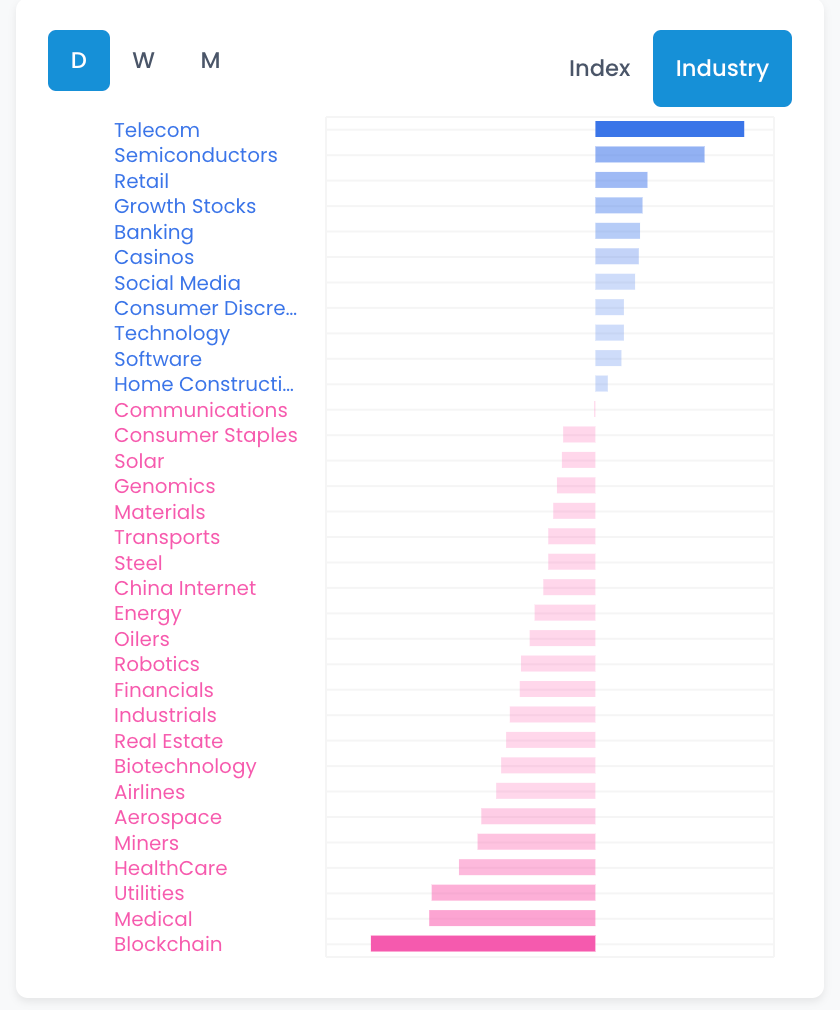

Group/Themes Action

Groups were mixed today. Net net most growth stocks and groups did not make too much progress.

Here’s a Daily Group Performance chart from TraderLion Private Access:

Growth stocks as a whole continue to act well

Key Stocks in Deepvue

NVDA put in a tight inside day. Constructive. Would be great to let the MAs catch up.

TSLA similar type day at the 50 sma level.

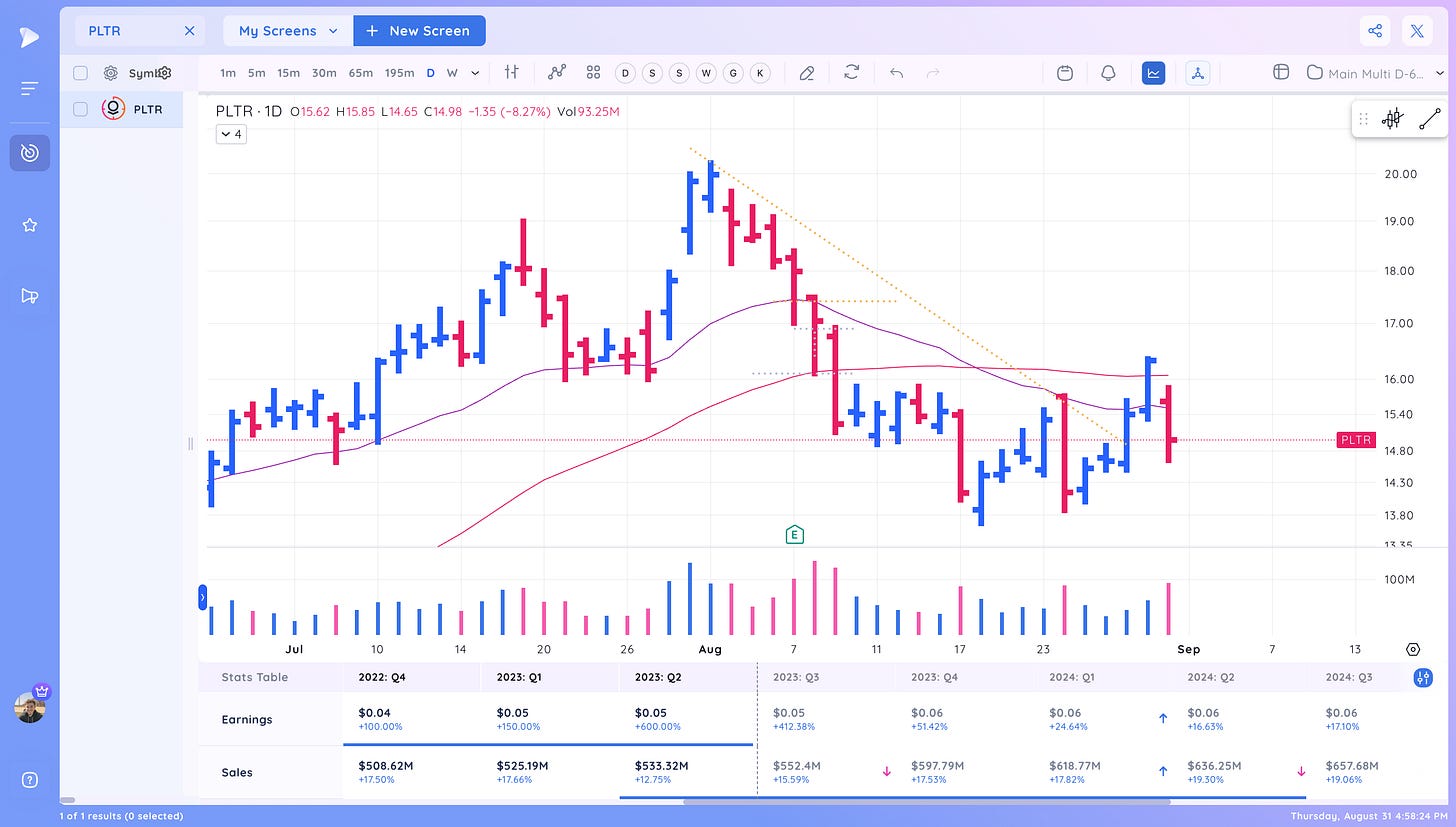

PLTR negative action and expectation breaker.

KD nice breakout. Focus list stock

CEIX very tight. Should move one way or another soon

RYTM Same here

UBER nice follow through

Market Thoughts

Decent action from most names.

However, we are up 5 days in a row now so prepare yourself for a potential profit taking day soon. Some stocks feel a bit short term extended. Watch where the money is rotating.

The market, especially in the beginning of a new uptrend, can feel short term extended for a long time. Judge individual stocks on their own merit

There will be a test and pullback, how stocks act on that day and how they close should provide valuable info about the true leaders. A pullback back into MAs on lighter volume would be normal and healthy

Continue to manage risk as always!

What are your thoughts on today’s action? (Leave a comment below)

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Cheers!

Richard

Good review!!

Well, looking for which sectors continue to have relative strength vs. their own markets, only three. Home Builder, Consumer discretionary, Oil and Gas exploration.

Technology losing steam since June.

Transportation losing strength since July.