Hello everyone,

This is week 4 of ∞ that I will be posting a written version of my stock market outlook.

Make sure you are subscribed so you don’t miss any future updates or educational articles.

Last Week’s Action

Last week we saw several distribution days on the major indexes as they pulled back. However, several areas of the market and groups continue to buck the overall trend.

Weekly chart of the QQQ

In my weekend scans I noticed continued strength and setups in these themes:

Biotech

Healthcare

Pharma

China

Discount Retail

Defense

Food

Beverage

Insurance

Let me know in the comments if I’ve missed any key areas.

The stocks that have been acting well for the most part consolidated, setting up potential pivots for next week

Stock Spotlights

LI is a Chinese EV maker showing strong Relative Strength. I’m watching for a bit longer consolidation here.

GTLB is a recent IPO to watch which is consolidating within its institutional due diligence phase. Excellent revenue growth.

HRMY - Many Biotech / health care stocks look very similar, this is forming a short handle right below all time highs.

Perspective

Looking at the IWO, it’s important to keep in mind the overall context as we are still below a declining 50 sma and 200 smas. Most groups are still in downtrends or have just started basing.

Overall, focus on the pockets of strength and be nimble. Biotech and China are two clear themes that stand out. I’ll be posting my weekly watchlist later today.

Make sure you are subscribed so you don’t miss it!

Sentiment

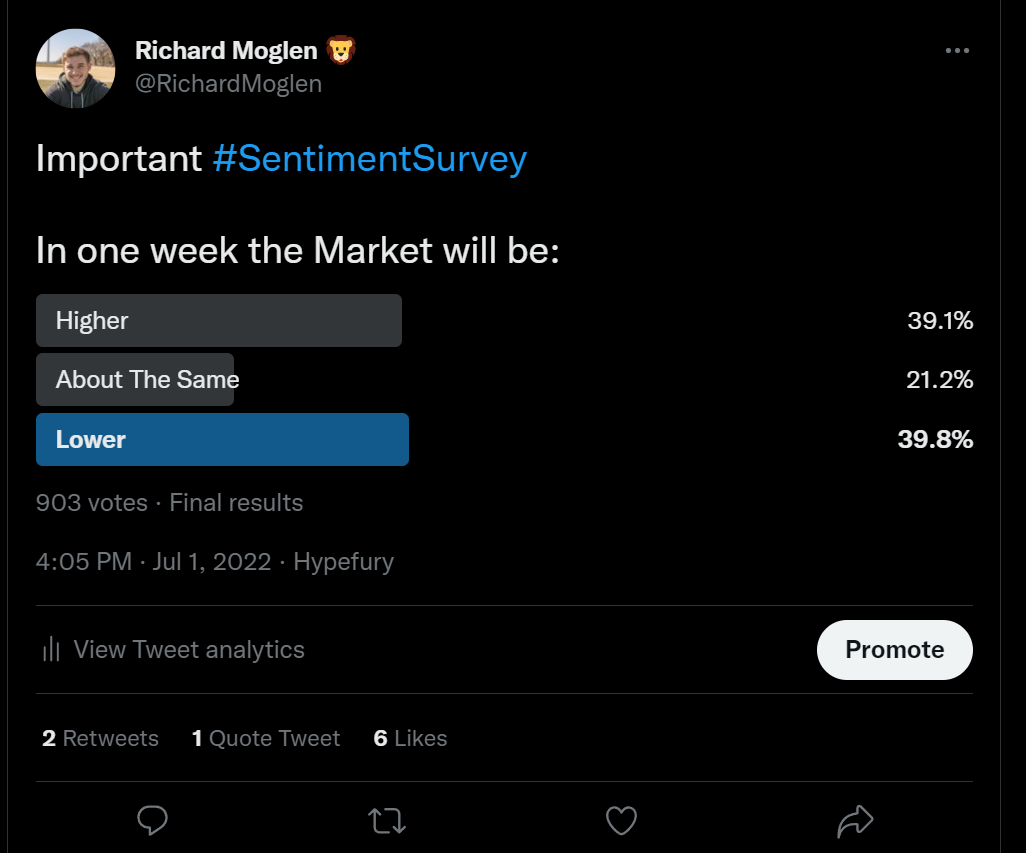

We saw a slight decline in bullishness on my sentiment surveys from 47.5% to 39.1%. Keep in mind sentiment for me is very secondary to the action of the indexes and leaders.

The NAAIM exposure index increased slightly to 30 this past Wednesday.

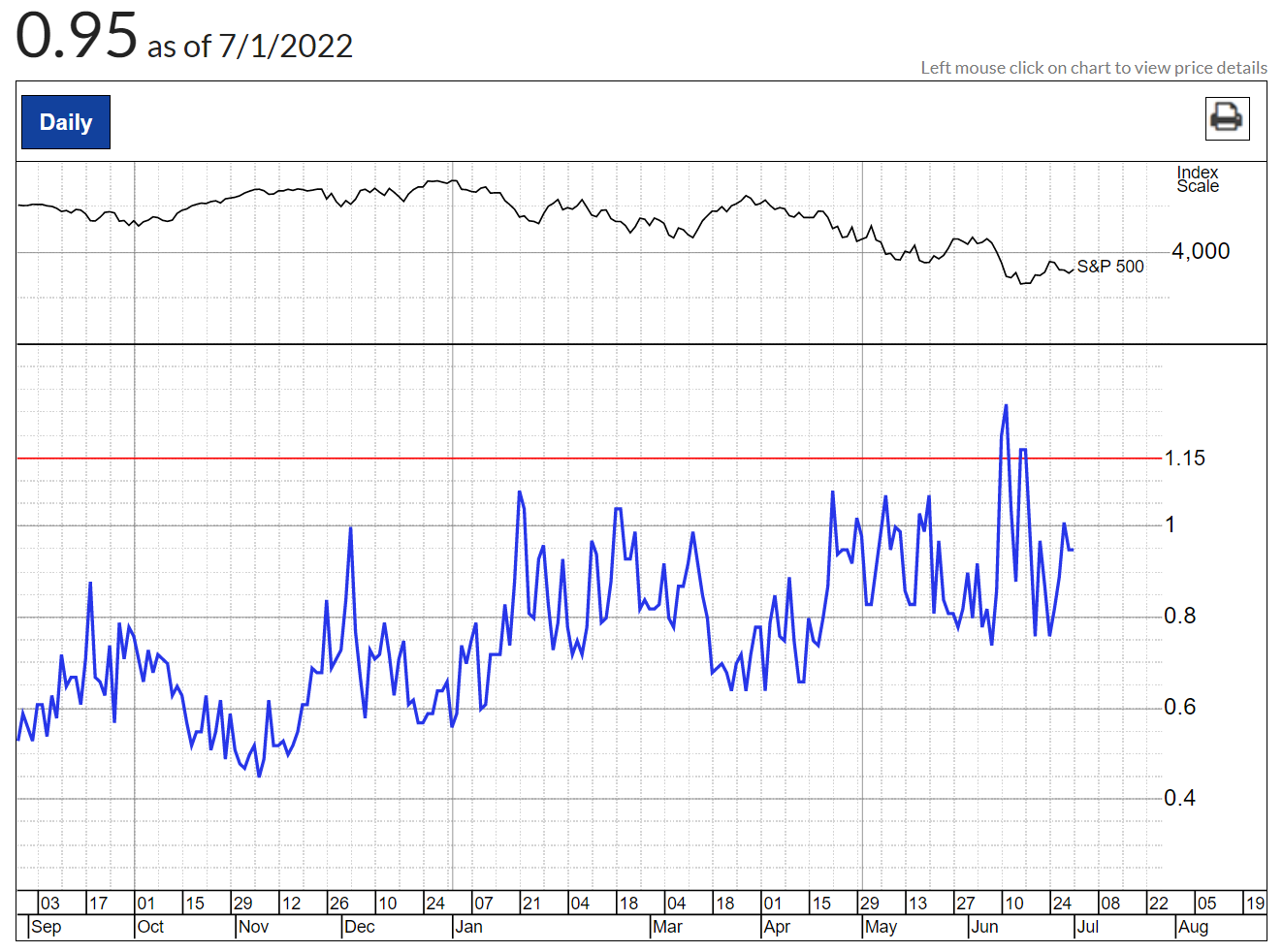

The Put-Call Ratio is still back under 1.15

IBD transitioned from a Confirmed Uptrend to an Uptrend Under Pressure.

Stock Market Outlook

Overall my stock market outlook is still a Beginning Uptrend. I’ll be watching how groups and leadership develops.

Remember that the most important thing at the end of the day is to watch the price and volume action of the stocks themselves as well as the indexes. Be ready for anything and manage risk.

My focus is on the sectors and industries that have been bucking the downtrend and are forming higher lows.

*Important* - Be aware that biotech is an area which can be extremely volatile and where stocks can gap down significantly. Manage risk through position sizing and overall exposure.

What To Look For (Same game plan as the last few weeks)

When it is time for a new bull market we will see divergences as groups decouple from the indexes and show relative strength. Setups will proliferate your screens.

When the market is ready it will be obvious, and it may happen when the news and sentiment is the absolute worst.

The leaders in the next bull market will once again have the potential to quickly double and triple and they will likely be completely new names that are unfamiliar. Try not to become biased and focused on last cycle’s winners.

Follow the sector, industry group strength, and look for the strongest stocks coming out of these strongest areas. As the market bottoms these future winners will likely be completing bases and may even be making new 52-week or all-time highs.

Keep an eye out for turnaround plays with excellent earnings and sales growth as well as recent IPOs within the past 2 years forming out their first proper bases.

Have patience, preserve your mental and financial capital, and be ready. Stocks can shape up faster than we think.

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Have a great weekend!

Richard

Another sector although a slow mover is utilities - given the current inflation environment this is seen as a safe haven like staples.

Super clear and concise as always. Great read Richard!