Hi everyone,

With the market in correction, I thought I’d discuss five things you should be doing during this time to set yourself up for success when the next uptrend comes along. Corrections are a natural part of the market cycle and will create fantastic opportunities down the line, we just have to be ready.

Before we get into the article make sure you are subscribed so you don’t miss any future posts!

1. Stay optimistic and flexible.

Corrections are a volatile and frightening occurrence for new investors and traders. However, they are common and a natural part of the stock market cycle. The important thing is to stay calm and follow your investing/trading plan. If you are an investor and use DCA, your timeframe and strategy depend on you carrying on with business as usual. As a trend follower and trader, you want to follow your risk management system and protect yourself during volatile and corrective periods by exiting when the trend changes.

Personally, I turn to mostly cash when the market breaks the 21 ema and 50 sma, market leadership breaks down, and we see other signs of institutional distribution such as breakouts failing. The key is to stay calm and follow your process objectively.

It is also important to stay optimistic and to remember that corrections set up the best opportunities in the market. The deeper the correction, the better.

The depth of the March 2020 correction facilitated a fantastic year for growth traders. As the market rebounded from a 30% deep correction, many growth names rose 200%, 300%, even 500%. When a correction occurs, stay optimistic and think about the amazing new leaders that will rise from the ashes.

Zoom was a great example of correction growth in 2020; it showed RS early on in the correction and went on a fantastic run of over 300% once the market pressure lifted.

Additionally, it is important to stay flexible during a correction. Market conditions can change sharply and we have to be ready when we identify positive character changes such as follow through days. For more on follow through days, check out this article from TraderLion. Keep following your market routines and stay on top of potential leaders that show accumulation signs during the market decline. This homework will serve you well when the uptrend begins. The market trend can shift in just a matter of days so you need to be ready with a buy list when we see groups shape up and the indexes follow through.

2. Protect mental and financial capital.

During a correction as a trader, it’s very important that you protect both your mental and financial capital. As traders, we have to accept that sometimes the absolute best thing we can do is sit on our hands and do nothing. No strategy works 100% of the time and if you employ a trend following based strategy similar to CANSLIM, you need to understand that choppy and corrective markets will cause paper cut after paper cut if you try to get involved before a true uptrend emerges.

This gradual drawdown will not only cut into your account balance, but will also leave you disheartened, and unwilling to act when the trend actually changes. You have to recognize that your trading style has its own optimal environment. For me, this is often when the NASDAQ composite and growth focused ETFs like the IWO are trending above rising 21 emas. If it is not your optimal environment then you must realize that the probabilities are stacked against you and you are trading merely for action instead of wealth. Know what your environment looks like in terms of the action of the indexes as well as setups and leadership stocks.

In addition to this, don’t feel pressured to change your style during downtrends in hopes of making money all the time. It is difficult enough to become an excellent investor, position trader, swing trader, or day trader, and even more difficult to change timeframes and adapt quickly. Have patience; your environment will come around again. Perhaps when you have years of experience in one style you can slowly work on other trading skills. However, the best traders I know are specialists, often in only one trading methodology and even one setup. Before you take a trade ask yourself—is the deck is stacked with you or against you? Is this setup and environment similar to what made you big money in the past? If so then consider the trade, if not then think long and hard before putting your money to work.

When the environment is not right for your style it is best to take a step back from the markets, prevent the frustration from forcing trades, and focus on other passions and hobbies.

3. Watch for character changes and new leaders.

Taking a step back does not mean you should ignore the market entirely. You want to keep doing your weekly and daily routines to ensure you are keeping tabs on promising ideas that appear to be under accumulation.

Watch for stocks that are bucking the downtrend, ideally those that form the right hand sides of bases even as the market is continuing to decline. The relative strength line can be key here. If you see a stock with a rising relative strength line and even better, a stock which has a relative strength line making new highs as the market is correcting, that stock is screaming at you that it could be a leader.

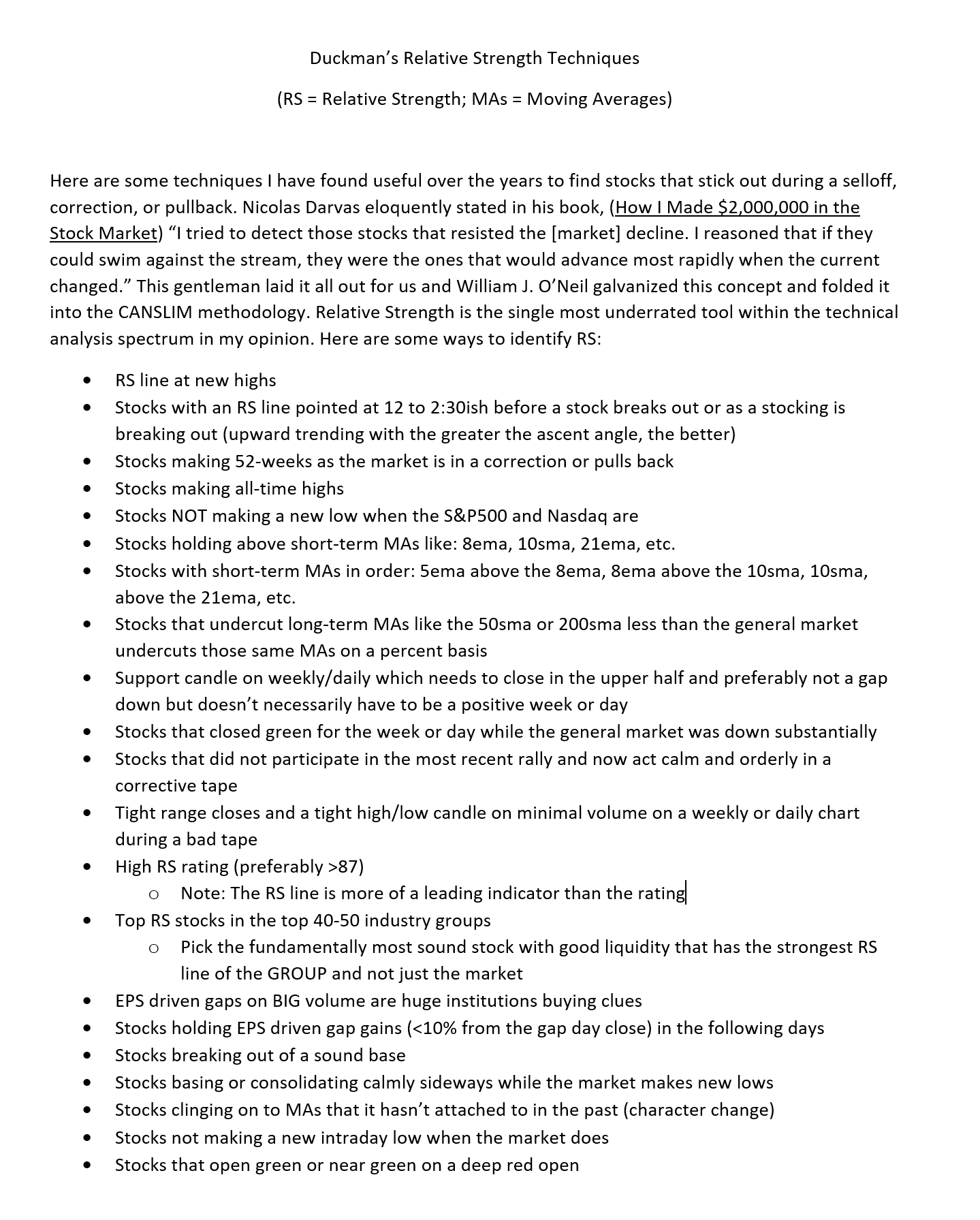

There are many other ways to identify relative strength. I would suggest reading through this document created by Duckman1717:

Stocks showing significant relative strength are what we refer to as beach balls underwater. These are stocks under significant accumulation by institutions who are using the correction as a time to rebalance their portfolios into their highest convection ideas. These type of stocks most likely have fantastic stories, earnings and/or sales growth, and increasing fund ownership. Stocks that show RS and are breaking out of sound bases before or just as the market is bottoming and following through should be the first stocks you buy and test out the health of the market with.

NET was a great example, it was making price and relative strength line new highs just as the market was starting it’s new uptrend.

4. Read books and study

This goes hand in hand with protecting your mental capital. Instead of forcing trades when the environment is not favorable for your trading style, read books, watch videos, study a setup or your own trading data to identify areas of improvement.

Book recommendations:

How I Made $2,000,000 in the Stock Market, Nicolas Darvas https://amzn.to/2Rmu39u

How to Make Money in Stocks https://amzn.to/33cpYqX

Trade Like a Stock Market Wizard: https://amzn.to/3sQmo0n

Think and Trade Like a Champion: https://amzn.to/32Mwnt2

Mindset Secrets for Success: https://amzn.to/3ew1bmZ

Momentum Masters: https://amzn.to/3xk2uy6

How to Trade in Stocks https://amzn.to/3eicKQ7

Reminiscences of a Stock Operator https://amzn.to/3h65PuX

Trading in the Zone https://amzn.to/2QTis1Q

The Mental Game of Trading: https://amzn.to/3xWiWoO

Market Wizards https://amzn.to/3tk5zuI

The New Market Wizards https://amzn.to/33gh1Nq

Video Recommendations:

There are many great videos out there on trading but I’ll humbly recommend my own Market Chat interviews which feature market participants with many different timeframes from investors all the way to day traders.

https://www.youtube.com/playlist?list=PLPfme2mwsQ1FHSrVFNp5zhxXGCIjwW_cG

Do a study:

Study Earnings gap ups, study what factors contribute to a successful base breakout, study the charts of the best performing stocks in the past three years. You will learn new techniques and gain experience that will serve you well in future markets.

5. Take a step back and do other hobbies.

Lastly, take the time you usually spend watching positions carefully and go out and spend more time with friends and family doing things you enjoy. This could be golf, chess, hiking, cooking, whatever you are most passionate about.

For me, I’ve recently taken up bouldering which I’m really enjoying. It feels great to push yourself, learn new things, and see hard work pay off. Go enjoy your hobbies and try to get a full mental reset so when the market uptrend resumes you will come back refreshed and ready to take advantage of it.

Key Takeaways:

Your main takeaway from this article should be that corrections are a natural part of the stock market and create fantastic opportunities. The key thing is to protect your mental and financial capital and be ready when the next uptrend resumes. Spend time doing other things you love and study to become a better trader.

Sometimes the best thing for us to do is take a step back, go fishing, and come back refreshed.

I hope you enjoyed this! Please share this article on twitter or with a friend if you think it would help them.

Take care!

-Richard

Hi Richard, thank you for taking the time to write these articles, they're a great help & very informative.

A quick question, open to anyone really. I'm using Tradingview, and I'm struggling to find the correct type of RS indicator (the type Richard mentions in this article) to use on my charts, does anyone who uses Tradingview have any recommendations, please?

Great article and very, very timely! Thanks again for all your efforts.