An understanding of price and volume action is essential for judging supply and demand characteristics. This allows you to determine whether a stock is under accumulation or distribution and find proper buy and sell points.

This article is not about memorizing candlestick patterns but instead understanding how supply and demand create patterns over and over again. The Stock Market is an auction, and the large buyers and sellers leave clues for us to find within price and volume.

Before we get into it, make sure you have subscribed to Trading Engineered so you don’t miss any future posts like this one!

Now let’s start with one price bar. I personally use OHLC charts but feel free to use what makes sense to you, they each present the same information. A single bar can represent a minute, 15 minutes, a day, or a year. The higher the timeframe the more meaningful the price move.

I view each bar as a match of tug of war between the buyers and the sellers. Buying pressure tries to pull the stock price up while selling pressure tries to pull it down. The winner is reflected in the closing range.

The closing range (CR) represents where the close is within the range of the high to the low. The closer the CR is to 100% on an up day the stronger the action. After a day with a closing range in the high 90s, the expectation is that the momentum will continue into the next day.

Here is the formula for the closing range. Just multiply this fraction by 100.

It is also important to compare the price action to that of the overall market. If AAPL has a daily CR of 85% when the SPY has a DCR of 15%, that is a clue that AAPL is outperforming within that time frame. This is a sign of Relative Strength.

Also during a base or general market weakness, a weekly closing range of 40% or higher is a sign of strength. You can see this in $NVDA during the March 2020 crash. During 3/4 of the down weeks, it had a relatively strong CR suggesting institutions were supporting it.

Now with every bar, you also want to consider volume. Volume adds weight to what price is doing. A stock up 20% finishing at the highs of the day on higher volume confirms that institutional money is behind the move.

Here is an example of a strong gap up on volume with Zscaler (ZS)

In this case with ZS, after the gap up you had tight price action on lower volume. Here there is a balance between buyers and sellers as supply is absorbed. You also had a strong closing range on this down day.

However if the next day the stock reverses on higher volume that is a negative expectation breaker. You have to take it day by day. Sellers were stronger here with PSNL.

The same is true on the downside. A large down day finishing near the low on high volume is a bad sign and suggests further downside in the coming days.

However, a down day with a decent CR or "low volume" suggests supply is being absorbed, especially if the price action is tight.

But what is “low volume”? I judge volume based on the average of the past 50 days and I also compare it to the previous 10 days. If on an up day volume is higher than any down volume within the past 10 days that’s a subtle sign of accumulation. I color those bars blue.

When looking at a stock chart it's as simple as this, I want to see as many blue bars or above-average up days within the recent action and very few above-average red volume bars.

I also use the Up/Down Volume ratio to judge accumulation. The U/D Ratio is the ratio of up volume days to down volume days in the last 50-day period. You want that to be greater than 1 and the higher the better.

Now let’s zoom out just a little. A stock will go through periods on consolidation/price contraction and then sustained trends. During the uptrends, especially on a weekly chart, you want to see good weekly closing ranges ideally on high volume.

And during the bases and sideways consolidations you want to see lower volume and still good closes ideally.

These pauses/bases are normal as short-term holders take profits and for the moment there is a balance between buyers and sellers. Usually if there are no major signs of distribution and the stock is still early in its run, the stock will continue its uptrend after the base.

During a base, you ideally want to see price coiling tighter from left to right making higher highs and higher lows. At the same time, you want to see volume decrease. This indicates that institutions are absorbing supply and buying aggressively if the stock drops even a little.

This type of base is called a volatility contraction pattern (VCP) coined by Mark Minervini. From a base like this a stock can explode upwards very quickly because all the supply has been absorbed and any increased demand will drive up the stock price.

Not all bases are as clean as NIO’s in 2020, but all constructive bases do at some point show volatility contraction as the stock moves up the right side.

Trends from early-stage bases can last much longer than anyone believes. The most powerful stocks, the True Market Leaders often seem “overbought”, or “over-valued”. As William O’Neil said:

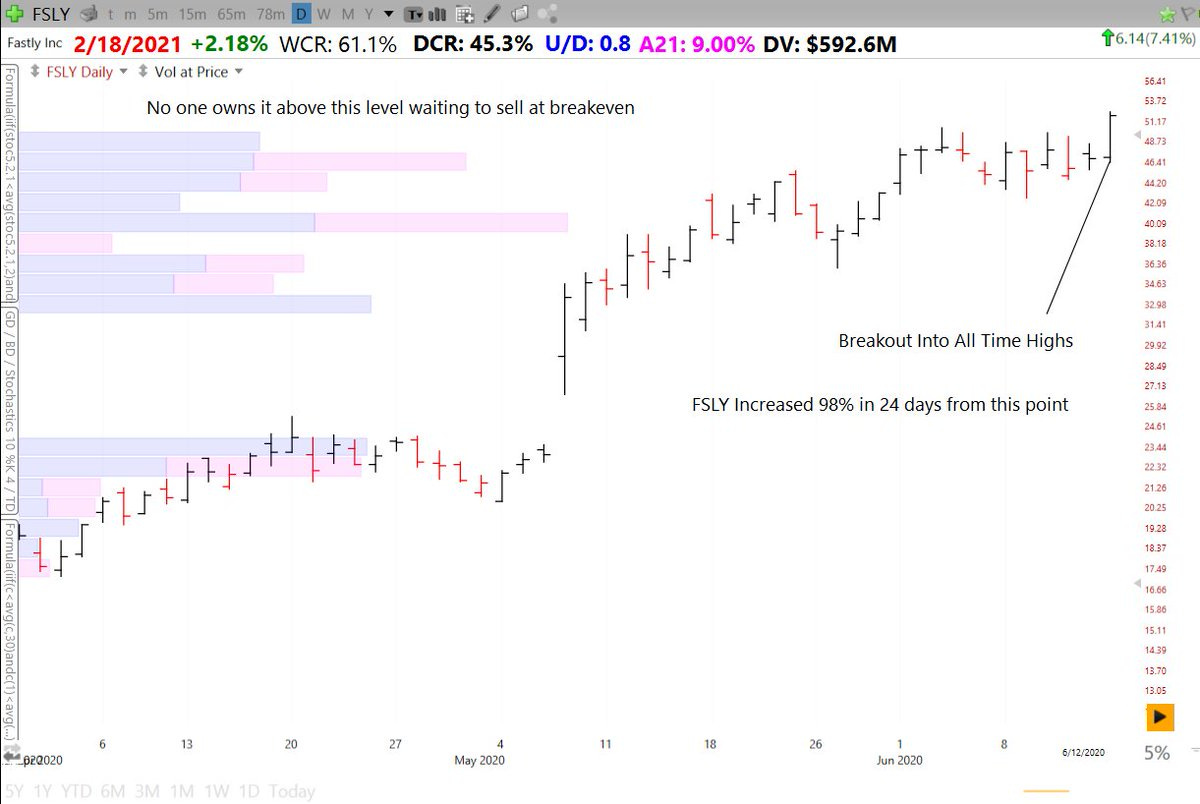

This may seem counterintuitive but it’s all due to supply and demand. When a stock is hitting all-time highs everyone who owns it and is buying more is in the green. The only reason selling occurs is to cash in profits.

However when a stock is well of its highs, as soon as it tries to rally upwards it hits selling from everyone who bought higher tying to sell at breakeven, this is called overhead supply. These stocks may eventually work through this supply, but it often takes a while.

So in summary, supply in demand is what drives price and volume action. Learning to recognize whether buyers or sellers are in control takes time but once you can do that you increase your odds of finding stocks under accumulation and buying when demand overwhelms supply.

I hope this was helpful. If you did please go ahead and share it with others!

Take care!

Richard