How to Manage Risk while Stock Trading

3 Key Factors

In the following blog I’m going to be talking about “risk management”, how I interpret the phrase, and apply it practically to my trading.

I’ll also be walking you through how to calculate your total open risk and key factors to consider in determining how much risk to take.

If you enjoy this article please be sure to subscribe so you don’t miss any future posts!

Let’s dive right in…

At its core, risk is the capital you have exposed in the markets at any given time. It’s controlled by the number of positions you have on, the position sizes of each of those positions, and where your stops are for each of those positions (where you will exit).

This resulting dollar value is the total amount you are currently risking & can lose if the market turns against you and stops you completely out of your positions.

For example, if it was a strong bull market and I was completely invested on 100% margin with a 100k account in 5 positions:

This might be an example of a portfolio where you just put on 3 new positions and have two core positions which are trending nicely with stops at the 50 day moving average.

40k in XYX with my stop 5% below the current price

40k in RMI with my stop 15% below the current price

40k in AAA with my stop 3% below the current price

40k in R with my stop 8% below the current price

40k in RNDM with my stop 10% below the current price

Then my total risk at the given moment is 40000* (.05+.15+.03+.08+.1) OR $16,400

This represents 16.4% of your principal and a high open risk amount. If all your positions stopped you out this would be your account drawdown.

For another example, here is another 100k portfolio structure that could be during a correction or very choppy environment where recent trades have not made any traction, volatility is high, and trends are short lived:

10k in XYX with my stop 4% below the current price

8k in RMI with my stop 5% below the current price

15k in AAA with my stop 2% below the current price

67k in Cash

The total risk here is 15000*.02+8000*.05+10000*.04 or $1100 or 1.1% total risk.

This is an example of perhaps 3 pilot trades with smaller position sizes which allow you to test the waters but would only draw your account down by 1.1% if they all get stopped out.

So in short, “Managing risk” means adjusting one of the 3 factors described above to ensure that your total risk is acceptable given your risk tolerance, style, conditions of the market, extensions from moving averages, volatility, profits on the year… and any other factors you want to consider.

Depending on your style you can focus on using one or more of the key factors to manage risk. For instance, day traders may trade large positions but only one or two at a time with very tight stop losses.

Investors on the other hand often try to manage risk by increasing diversification (# of positions) and lowering positions sizes. However, they often do not sell out of positions based on the market conditions or raise stop losses and thus risk is not necessarily managed. Additionally, they may find that stocks are not nearly as un-correlated as they thought.

In short, your total open risk allowance should fluctuate depending on the market conditions. Factors to consider are the trend of the major indexes, health and breadth of market leadership, and the results from your past 10 trades.

As conditions improve, you build up a cushion and things are working, you can increase your total risk. As conditions worsen, size down, take fewer trades and raise your stops to decrease your overall drawdown potential.

Trading is not an on or off business, think of risk/exposure as a dial that you can turn in response to how things are going.

As Minervini says: You want to be trading your largest when you are trading your best and your smallest when conditions/your trading is at its worst.

This allows you to profit from strong uptrends and then take a step back and experience a shallower drawdown when we enter a correction/chop period.

Managing risk in this way ensures your survival, allowing you to profit from every bull market in the future and protect yourself during corrections and bear markets.

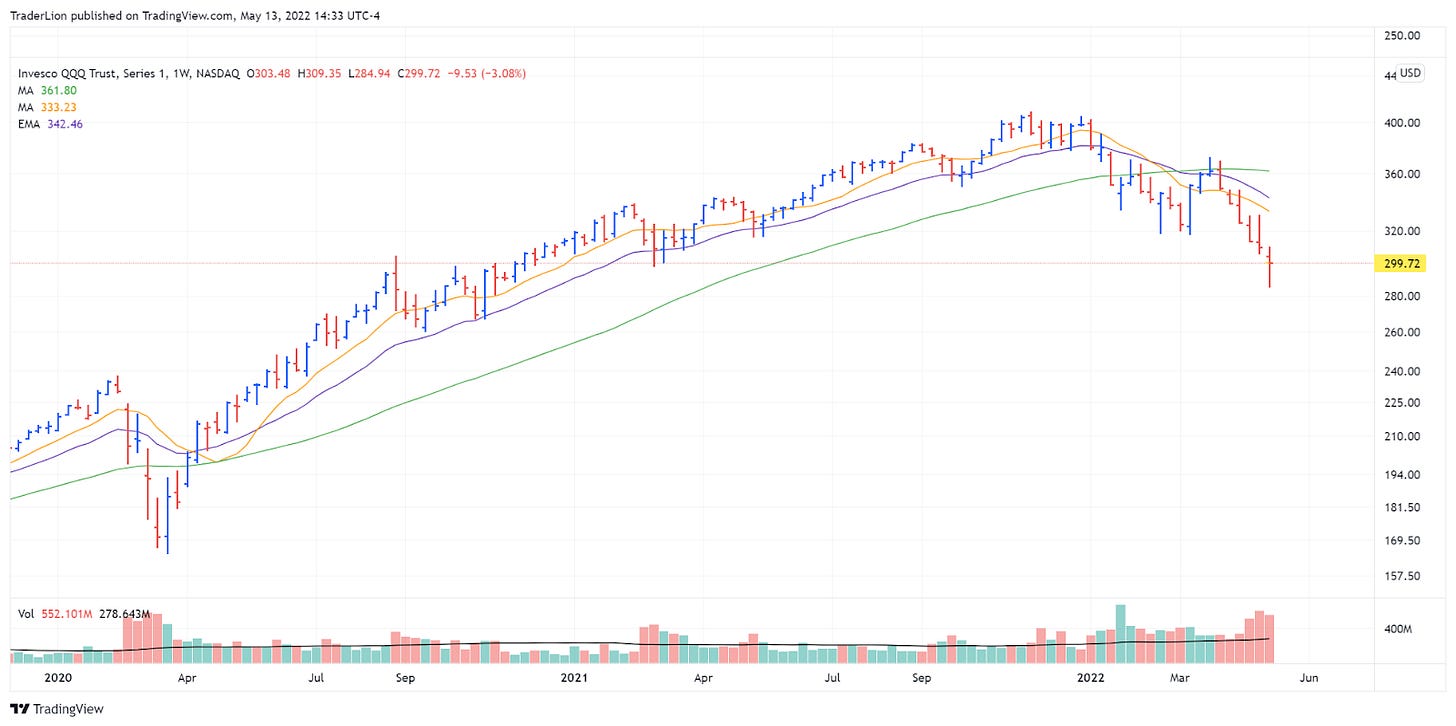

So ask yourself when conditions look like this, how should you be managing risk?

QQQ Weekly Chart:

Maybe some pilot trades to test the waters? But until we start trending above MAs keep overall long exposure low?

Again it all depends on your style and timeframe but you have to manage risk relative to your performance to stay in the game and perform.

I hope this article was helpful. If you did please go ahead and share it with others!

Take care!

Richard