How to Journal A Trade (Free Data Collection Template)

Hey everyone,

Today I will be walking you through the process of analyzing one of my trades from last week. I will be honest, this is not a trade that I am proud of and I will be pointing out the mistakes I made so hopefully both you and I can learn from it.

The reality of trading is that everyone makes mistakes and has bad trades. The goal is to learn from these instances and get a little bit better with each one.

If you a haven’t yet make sure to subscribe so you don’t miss any future articles!

Now Let’s dive in!

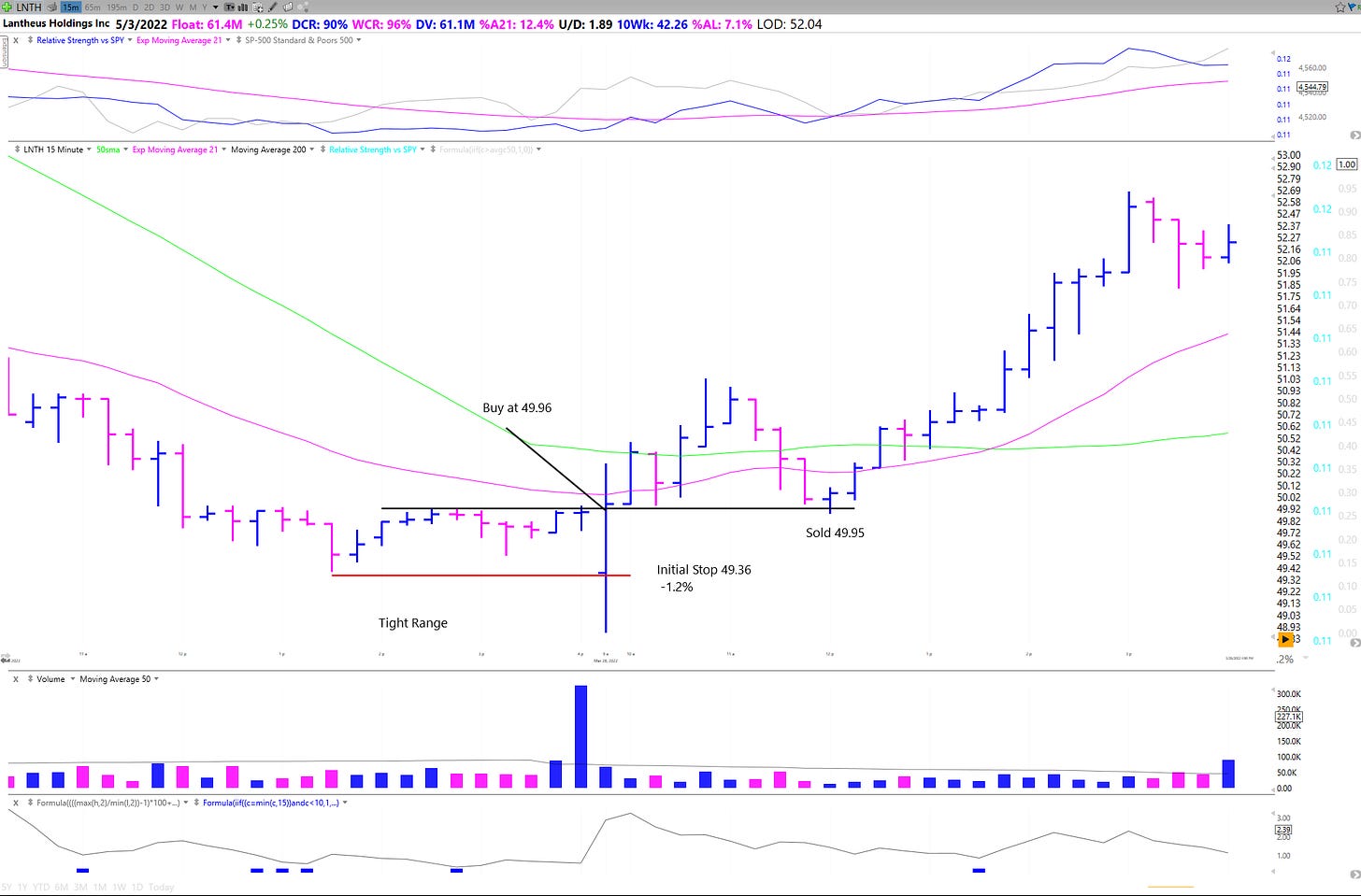

The trade I will be walking through is of LNTH on 3/28. Here is what it looked like on the daily chart on the weekend.

I was focused on this name because on the strength of the prior move on huge volume.

The setup on the daily chart was a pullback to the 21 ema in the thinking that “from failed moves come fast moves”. I wanted to see the stock build a range and break out.

This was on my Daily Focus List because of the 3 tight bars on the 65 minute chart to close off Friday. The high of this tight range was around 50.

On Monday we opened down below this range so I was watching for a break above that tight range. Here is how the day progressed on a 15 minute timeframe.

At this point my portfolio was doing quite well on the day. I had also bought SG GTLB AOSL SEDG. Then we saw a pullback around 10 and I noticed my P&L give back a substantial amount.

I was stopped out of AOSL and SEDG both for controlled small losses. Around this same time I was stopped out of a 1/2 position of GFS.

My fear of giving back all my daily gains overcame my discipline and I moved up my stop to near breakeven on LNTH before my rules said I should (2X initial risk).

LNTH then had a normal retest of my Pivot and I was stopped out at 49.95.

LNTH ultimately rallied strongly with the market and finished at 52.22 or 4.5% above my initial buy point.

LNTH followed through the next day and closed the week strong, standing out among growth stocks. It finished the week at all time closing highs at 58.36 (+17% from my initial buy point)

Here are the main mistakes I’ve identified from this trade.

Focusing on P&L above process and rules

Moving up my stop/selling a stock before my rules told me too

It’s also good to identify the thing's I did correctly

Strong Stock Selection

High Potential Setup

Good execution of the initial setup

Good initial stop loss

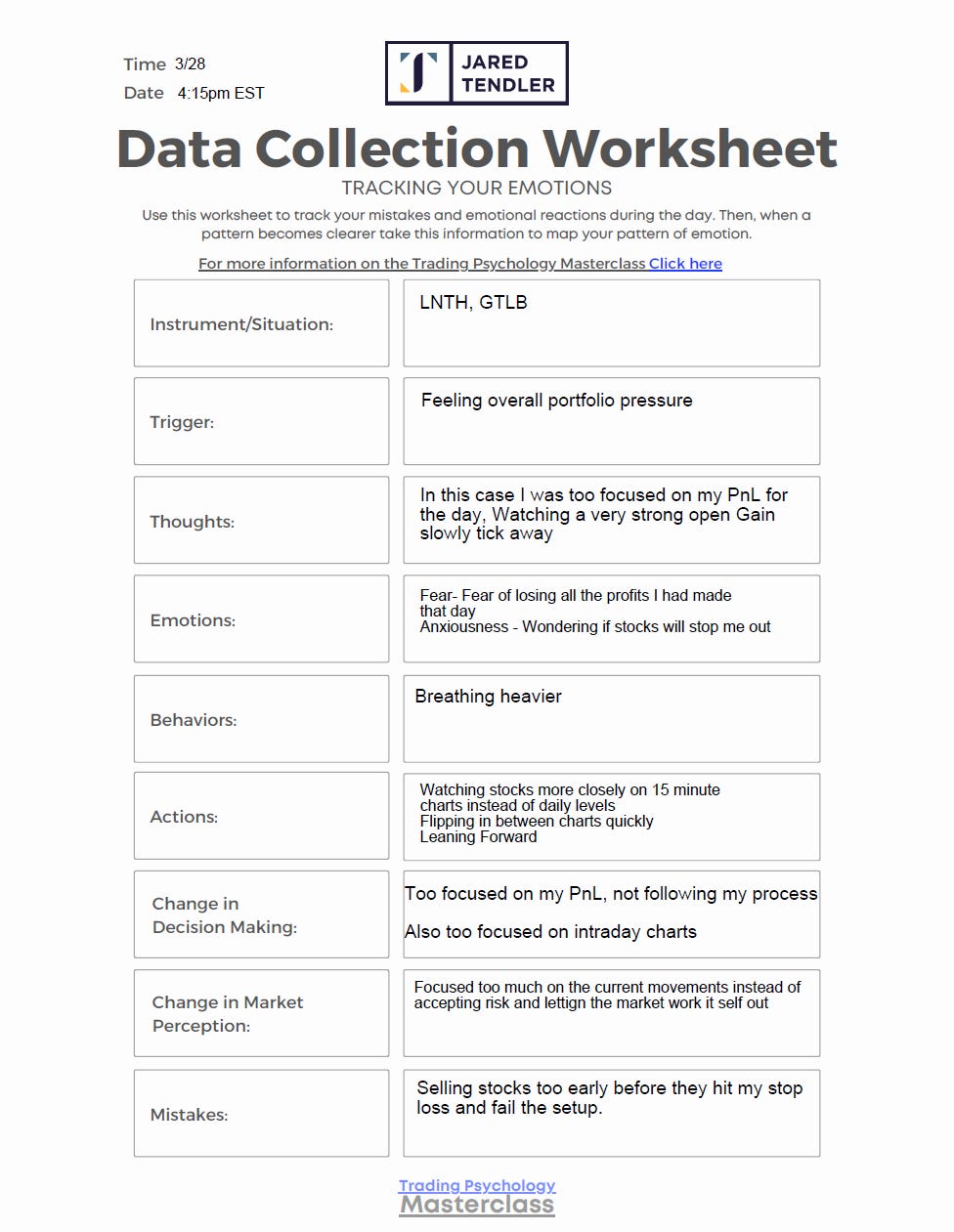

When reviewing Trades, it’s also important to analyze your emotions during your execution and how they impact your decision making. To achieve this, Jared Tendler’s Data Collection Worksheet is excellent and guides you through the process.

You can get it for free here

Here is my copy from this trade:

The goal is to use your emotions, thoughts, and actions as data and be able to recognize when you may begin to make a trading mistake because of your mental game.

After reviewing this trade and tracking my mistakes as well as my strengths, I now have a better understanding of my own abilities and what to look for in future similar situations.

Until you actually review your trade executions it is very difficult to identify potential problem areas.

I would highly recommend to everyone reading this to go through an example trade just how I outlined and fill out Jared’s Template. You’ll learn a lot and it can only help your trading!

Thanks so much for reading! If you found it helpful be sure to subscribe and share on Twitter!

Also let me know any feedback you have on this article and trade! Is this something you would like to see more of?

Have a great rest of your weekend!

-Richard