How to Find and Trade VCPs / Tight Areas using Deepvue

Hi everyone I hope you are doing well.

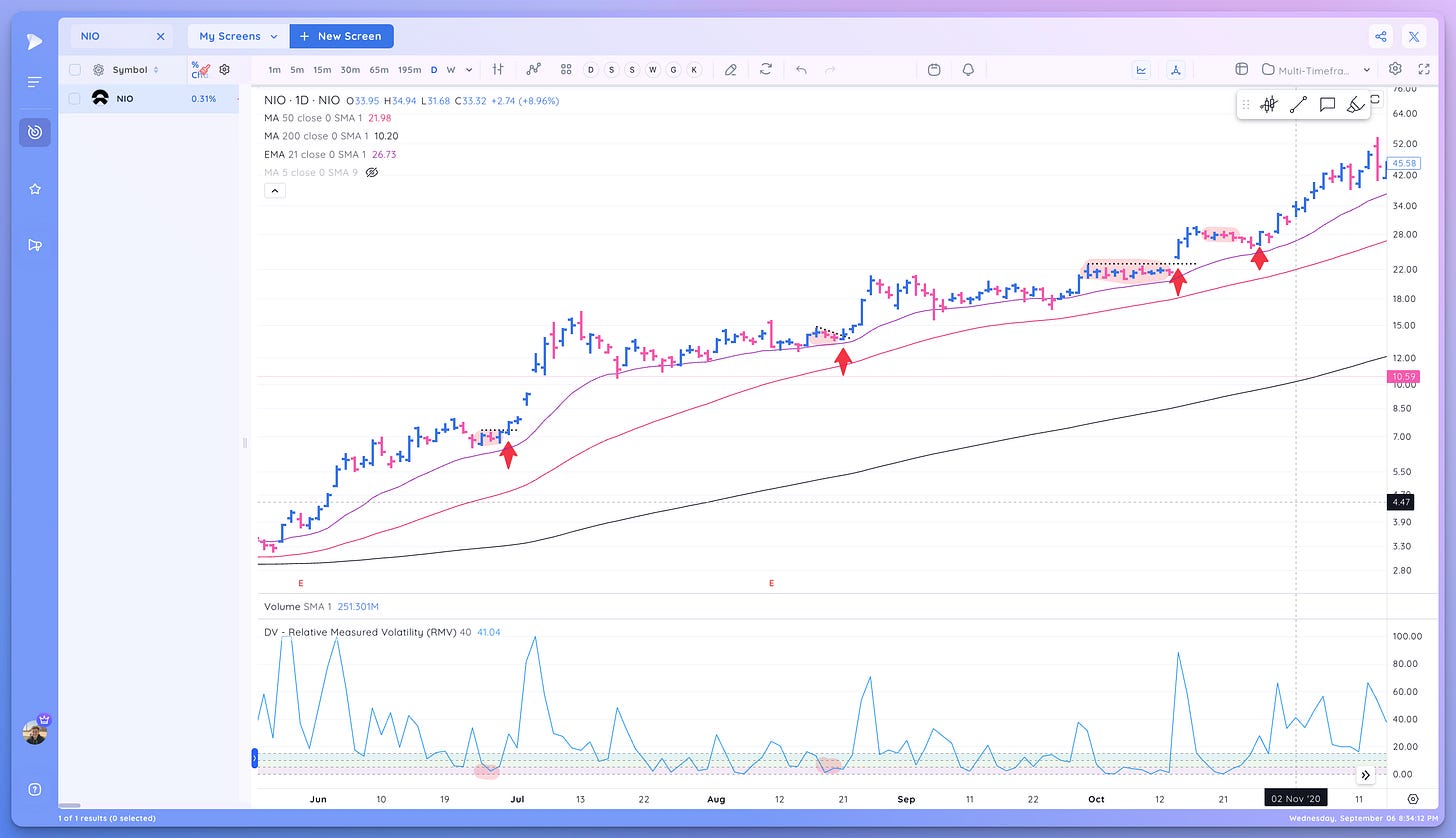

Today I’ll share how I screen and find VCP Setups/Tight Areas using Deepvue. Using the RMV indicator (More on that below) you can, in just a few clicks, get a list of VCP setups.

I walk through the process of screening for VCPs (Volatility contraction patterns in this Webinar. I also walk through the process in the article below.

Topics:

0:00 The VCP Setup

1:35 What is a VCP Setup

5:32 William O'Neil Cup with Handle

9:44 Tight Areas

11:18 TTD Example

14:20 SHOP Example

18:54 GOOG IPO Base Example

20:52 TSLA Earnings Gap Up Example

23:32 RMV Indicator

27:00 Screening for VCP and Tight Areas

33:30 VCP Preset Screens in Deepvue

Why is identifying tight areas important?

Tight areas coupled with low volume is a sign that an equilibrium has been reached between buying pressure and selling pressure and that supply has stopped coming to market.

From tight areas you can get large moves to the upside or downside that we can take advantage of as traders.

Many of the best traders in history looked carefully for these tight areas, for both as a sign of accumulation as well as for a potential entry point.

William O’Neil, Stan Weinstein, Oliver Kell, and Mark Minervini to name a few.

How can tight areas help with entries?

With tight entries comes clear pivots as well as an easy way to manage risk and judge if a trade fails (falls back under the tight area)

Also, from tight areas moves are often more explosive, allowing you to quickly get at a profit and potentially move up stocks

What is Relative Measure Volatility (RMV)

Very simply, you can thing of RMV as a measure of how volatile a stock is compared to it’s recent price action.

An RMV value of 100 means it is highly volatile (Up or Down)

An RMV value of 0 means it is very tight relative to recent price action

The lower the RMV, the tighter the relative current price action.

The RMV Indicator

The RMV indicator is one of our Deepvue indicators that you can add to your charts as your peruse the markets.

Search for “DV” and it will show up.

By default the indicator considers the past 15 bars to judge relative volatility. You can easily change this depending on your preferences.

Extending it to 100 bars or 50 bars looks at more of the stocks price history and makes the indicator less sensitive.

RMV - 15 Days

RMV - 50 Days

By default we’ve highlighted 3 zones of tightness

You can adjust these levels. Remember the close to 0 the tighter the relative price action.

RMV Examples

The RMV indicator can help newer traders spot tight areas, and even for more experienced traders confirm their visual analysis.

Here are a few examples:

SMCI, 2023

RMV helps show the tight areas within the base and highlighted the tight range at 135 that was a potential entry area.

SHOP, 2016

The RMV indicator helps show the tightness within the base and the handle formation which presented a strong entry point

DOCU, 2020

RMV helped show the tightening action and areas.

CVNA, 2023

RMV highlighted many of the tight ranges.

FSLY, 2023

RMV highlighted many of the tight areas in this move. especially when they are near the 21 ema.

AUR 2023

This was a recent name from my WL, nice RMV compression near the 21ema setting up a pivot through highs.

How I use the RMV

Indicators are a tool. They can help emphasize price action patterns that we deem important and relevant.

It’s important to keep it simple and only use indicators that actually help your process. If you are already at the point where you can spot these tight areas easily then this indicator may add noise to your screens.

However, especially for newer traders, I feel RMV can be a helpful way to objectively identify price tightening which may lead to strong moves.

If the line is declining sharply then volatility is declining, if it’s under 5 then the stock is very tight on a relative basis.

You should always consider RMV in the full context of the chart and stock.

I prefer low RMV when we are near the 21 ema, price is forming a clear range & pivot, and volume is declining during the compression.

Screening using RMV

In Deepvue you can use RMV as a data point and look for stocks with RMV < a certain number to find tight areas.

We also have 2 preset screens that you can use right away to find strong stocks that are developing tight areas.

The Preset Screens in action:

Key Points

RMV is a useful indicator that can help traders identify tight areas and stock that are forming promising pivots.

Always consider its reading in the context of the full chart!

Let me know what you think in the comments.

RMV Indicator Tutorial Video

I hope you found this article helpful!

Cheers,

Richard