How to do a Year End Trading Review & Post-Analysis (5 Steps)

Hey everyone!

With the end of the year coming up I thought I’d discuss how to do a year end review. Feel free to make this process your own since at the end of the day you want to implement a routine that helps you and most importantly, one that you will do consistently.

The 5 Steps I’ll discuss represent the main core of what I do each year. Add or remove steps as it makes sense for you.

Post-analysis is an essential part of trading. Without going through your results you are likely to keep repeating mistakes without realizing them. I recognize that this can be a laborious and also painful process, but if you want to be an excellent trader, you have to put in the work. There’s a reason the top athletes review game film especially after bad losses, it’s what will help them the most in future matches.

If you enjoy this article please go ahead and subscribe to the newsletter to ensure you don’t miss any future resources!

Here are my suggested 5 Steps. Go ahead and alter these as you see fit

Calculate your trading statistics

Review your Equity Curve and compare it to the SPX

Review your best and worst 10 trades

Analyze and mark up the 25 best names from the year

Reflect, identify areas of improvement, and set goals for the next year

Now lets go ahead and dive into each of them

Step 1: Calculate your Trading Statistics

Calculating your trading statistics is an important step to take since it reveals the truth about your trading.

When calculating your trading statistics I would include your:

Batting Average (% of trades that are winners)

Average Gain (in % and $, the average outcome of a profitable trade)

Average Loss (in % and $, the average outcome of a losing trade)

Average holding period for winning trades

Average holding period for losing trades

Gain to loss ratio ( Avg Gain/ Avg Loss)

If you can calculate these statistics based on each setup you use and also time of day of execution you will be able to see clear trends in profitability. Other interesting metrics to track would be the state of the market when the setup occurred.

As I said before you can go as in depth as you want but just in general calculating these stats will give you an excellent understanding of your year and also areas to improve.

There are a few softwares out there that can do this for you but you can also set up a template in excel or google sheets.

For more details about this step I would check out this video:

Step 2: Review your Equity Curve Versus the Market

During this step you want to plot your equity curve from your broker against the S&P500 and the Nasdaq Composite.

Like with stocks, take a step back and look at the overall character of your EC. Is your line very volatile with many jumps and drops? If so you may need to improve your risk management and set rules to become more disciplined with profit taking.

The goal should be to smooth out your equity curve and ideally go flat and limit drawdowns when the market corrects.

You also want to analyze any significant pops or drops in your EC. What positions were you holding? What was the environment like? Did you try a new setup? Were you in 5 stocks that were all extended? Take note of these and think of ways to maximize the amount of EC spikes and eliminate the drops.

Step 3: Review your 10 Best Trades and 10 Worst Trades

During your post analysis review, you want to pick out your best performing and worst performing trades and review these carefully.

Review the decisions you made and consider whether they were the correct ones at the time. Just because a trade ended up being a loser does not necessarily mean you traded the name poorly. Grade your actions not the results.

Replay each trade bar by bar and try to learn something from each one. If you have the time you should review as many of your trades as possible.

Step 4: Analyze and Mark up the 25 best names from the year

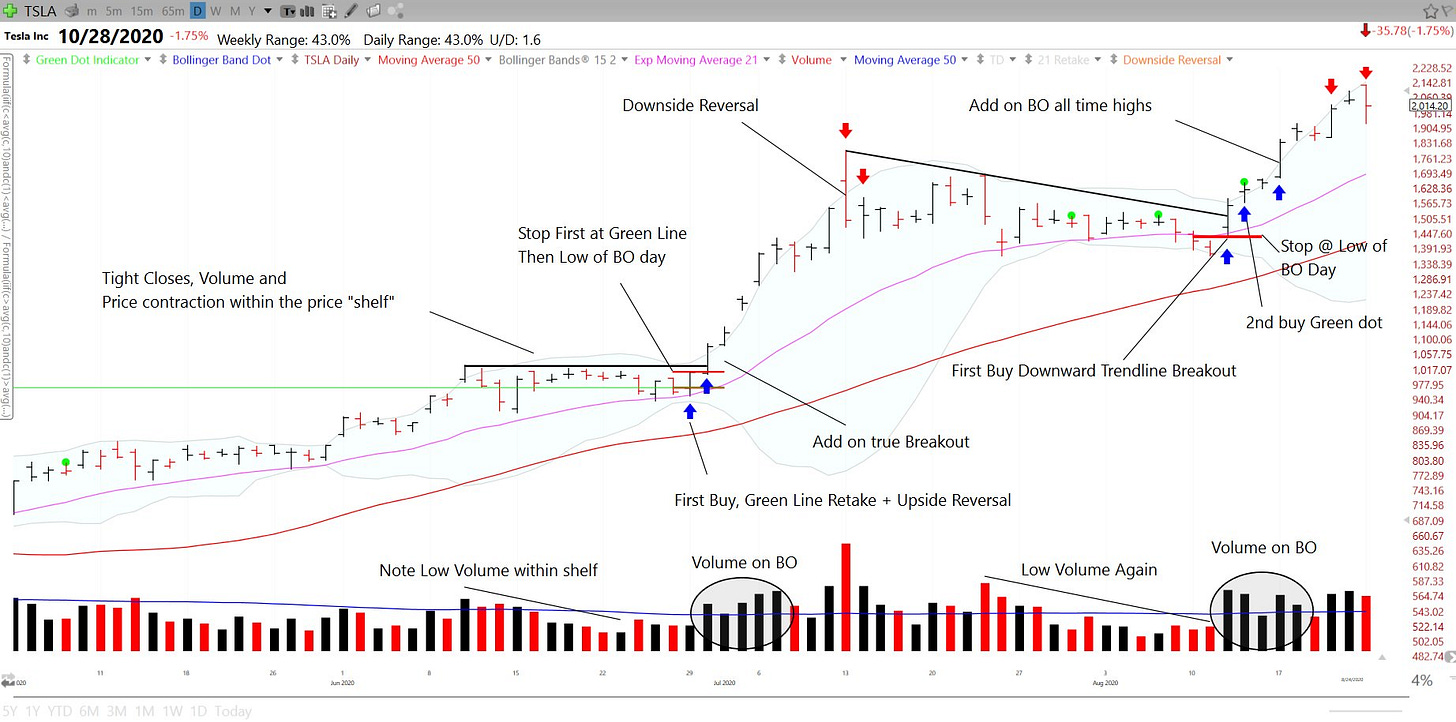

In addition to reviewing your own trades, you should make your own model book from the year. Pick out the 10-30 best names from the year and go through each as if you are trading it in real time.

Treat these as real trades and consider position sizing, stop losses, and position management. Strive to be as intellectually honest with yourself as possible about where you would enter and exit. You will start to recognize commonalities within your trading, take special note of these.

Also, if you didn't trade all these names, consider why not. Did these names slip through your normal routines and scans? Did they break out before the market? Make any new rules or implement any new processes you need.

Here is a subset of leaders I am reviewing for this year

UPST

NET

DOCN

ASAN

SI

BNTX

ZIM

LC

ZS

Step 5: Reflect, Identify Areas to Improve, and Set goals for the new year

You should really have been doing step 5 throughout the previous steps. Try to identify both your strengths and weaknesses. Take your results in context. How was the year in general for your style of trading? Did you push things too hard? Were you watching your positions too closely? Were you overtrading and forcing things when the setups were not working?

Ask yourself all these questions and more and try to come up with new rules to implement which address frequent mistakes. Don’t expect to fix problems overnight. This will be a continuous process where your goal should just be to gradually get better and better.

Key Takeaways

All in all your yearly post analysis routine should be simple enough that you do it and comprehensive enough that you walk away with practical insights. Enjoy the work, it will be what makes you a better trader. You get what you put in.

If you found this helpful please go ahead and share it on twitter !

Have a good one!

Richard