Higher or Lower?

Hello everyone,

This is week 19 of ∞ that I will be posting a written version of my stock market outlook.

Make sure you are subscribed so that you don’t miss any future updates or educational articles.

Last week the market generally consolidated although we saw a bit more fireworks from individual stocks. The QQQ is above its 21ema and 50 sma, but below the 200sma and 5sma.

Daily chart of the QQQ:

The weekly chart shows the QQQ being rejected at the 30-week moving average. The longer term trends remain down

The T2108 continues to trend above its 21ema

The McClellan Oscillator is back in its range

Sentiment

The NAAIM is at 64

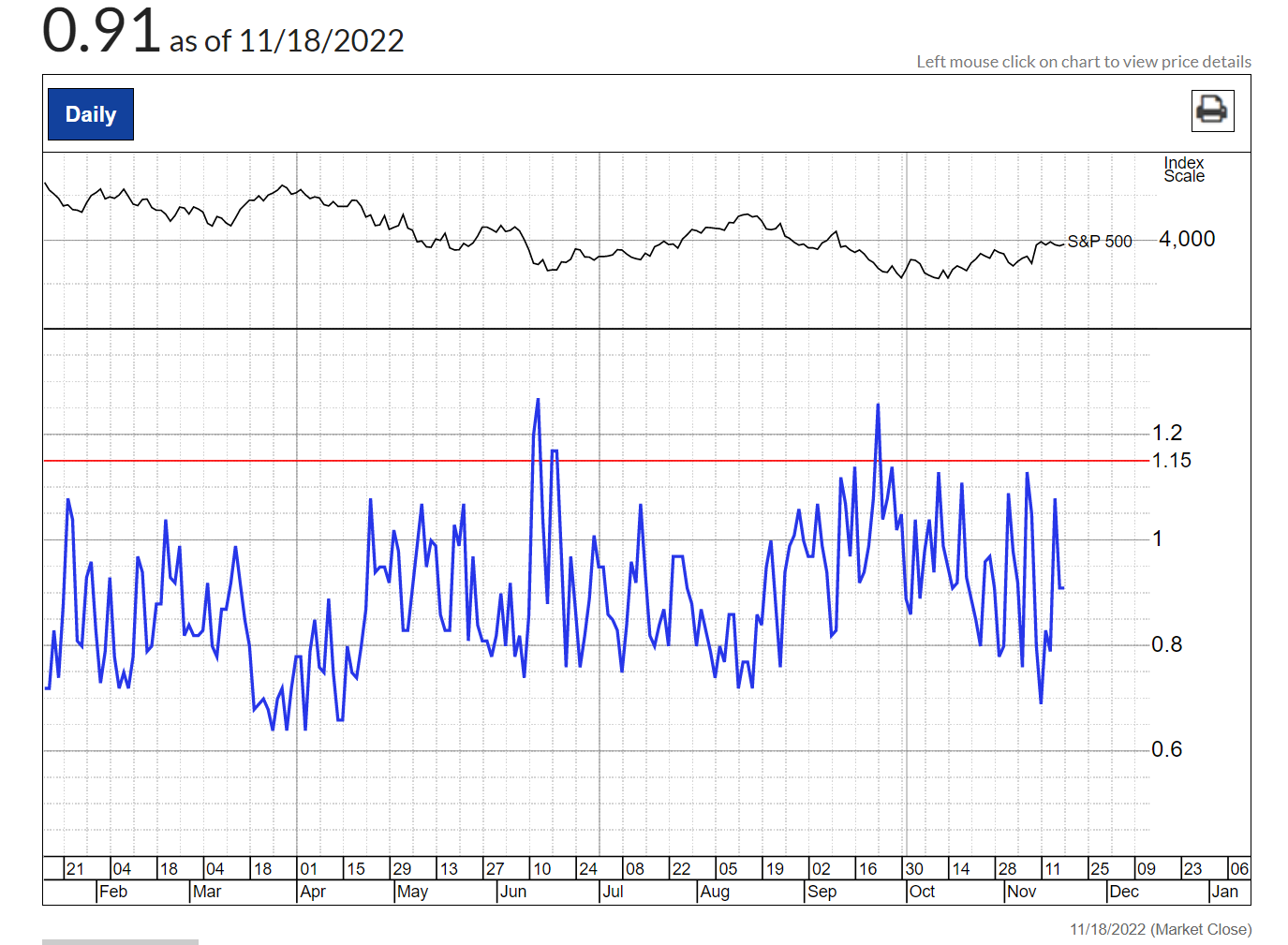

The Put call ratio has been quite erratic

IBD is currently in a confirmed uptrend

Stock Market Outlook

Energy, Solar, Biotech, and now semiconductors seem to be where leadership is. Both solar and semis showed particular strength last week.

We’ve seen some definite strength the past few weeks. What we need now is for the indexes to continue to form higher lows, staying above their MAs and for leadership to continue to strengthen.

Take it day by day and manage risk along the way.

What To Look For (Same game plan as the last few months)

When it is time for a new bull market we will see divergences as groups decouple from the indexes and show relative strength. Setups will proliferate your screens.

When the market is ready it will be obvious, and it may happen when the news and sentiment is the absolute worst.

The leaders in the next bull market will once again have the potential to quickly double and triple and they will likely be completely new names that are unfamiliar. Try not to become biased and focused on last cycle’s winners.

Follow the sector, industry group strength, and look for the strongest stocks coming out of these strongest areas. As the market bottoms, these future winners will likely be completing bases and may even be making new 52-week or all-time highs.

Keep an eye out for turnaround plays with excellent earnings and sales growth as well as recent IPOs within the past 2 years forming out their first proper bases.

Have patience, preserve your mental and financial capital, and be ready. Stocks can shape up faster than we think.

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Have a great weekend!

Richard