Hi everyone,

I hope you are having a great Tuesday!

In this post I’ll concisely share my thoughts on the day’s action. And share a bunch of stock charts that caught my eye.

Now let’s dive in ↓

Market Action

The QQQ followed through down sharply in the morning but closed mid range abvoe the 21 ema

IWO gap was more severe

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Down - Below Declining

Short-term - 21 ema - Up - Above Rising

Intermediate term - 50 sma - Up - Above Rising

Longterm - 200 sma - Up - Above Rising

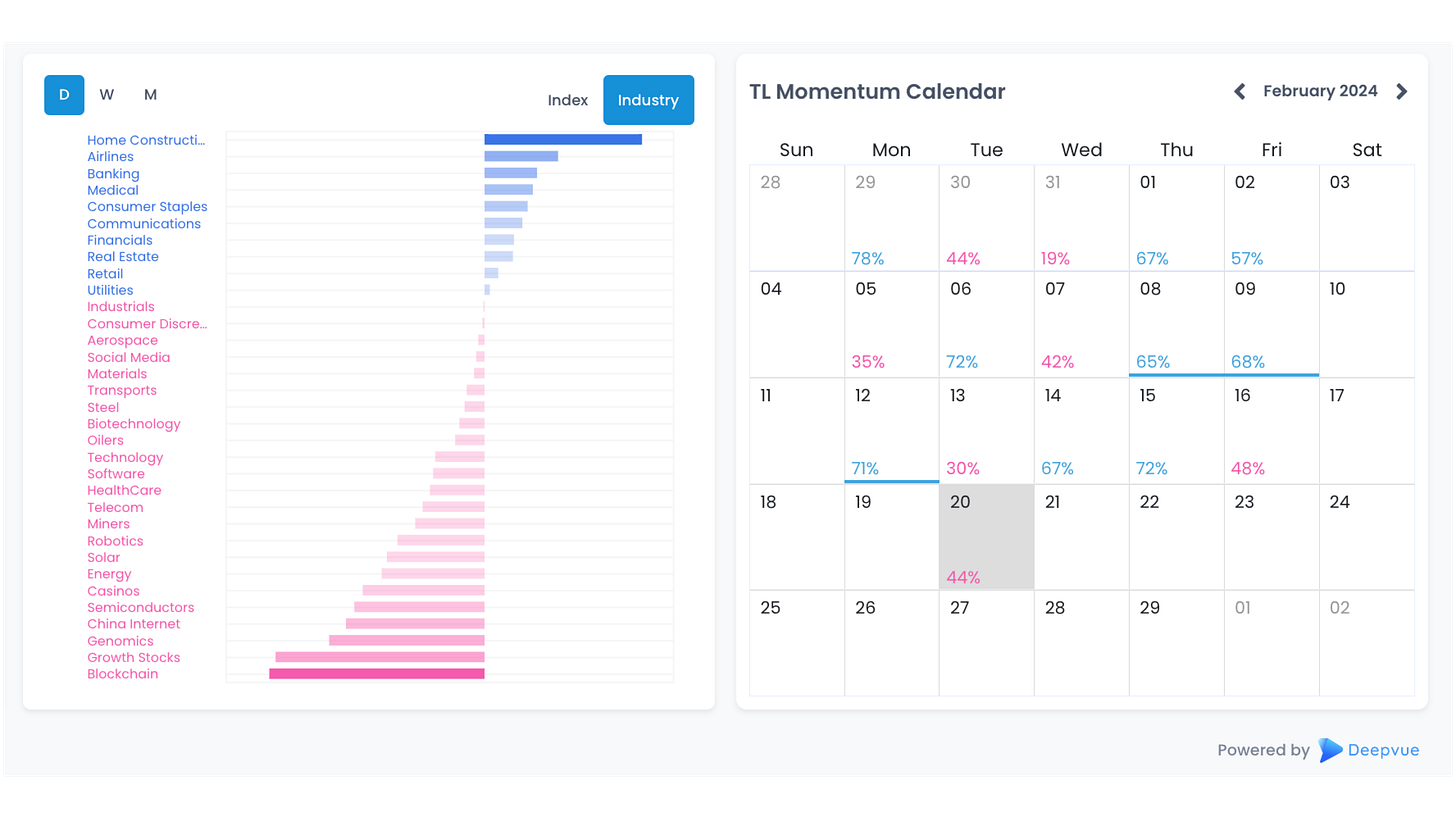

Group/Themes Action

Pressure on the WL and Semis in particular in the morning. Most closed red. Mixed Closing Ranges

Daily Performance charts from the open:

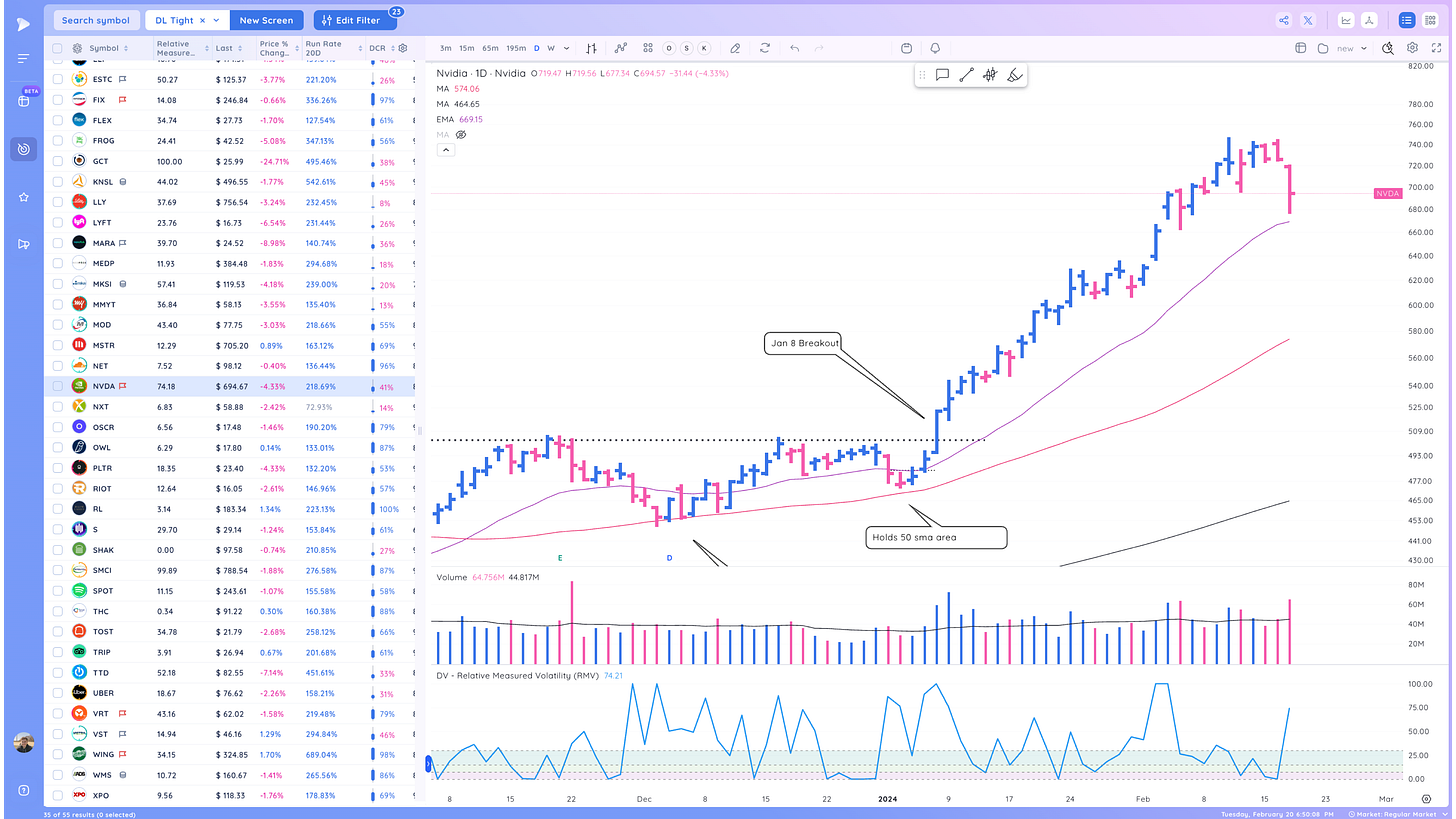

Key Stocks in Deepvue

SMCI followed through down then closed near the open. Volatility remains high

NVDA weakness. Still holding the 21ema but could signal chop or a change in trend

APP watching for a range to form

AMD also a weak day. See if it finds support near the base lows.

COIN forming a handle? Decent close

MSTR and RIOT with similar charts

SHAK holding up really well inside.

CELH forming a range here

NET weak since the gap up but strong close today

PLTR one to watch. Gap down but decent close

Market Thoughts

The close was decent but many names took shots today. Semis have been leading and we will have to see how NVDA handles earnings. Have a list of the top quality names that you would want to buy if they setup amid/after this weakness.

Reminder:

Risk Management is Paramount

Refuse to enter randomly without managing risk and wait for the spots to develop, they will. Stocks during strong moves always pull back to the 21 ema, 50 sma multiple times. Look for a tight and logical entry point.

Have patience, focus on the best stocks with the greatest potential. These will telegraph the rest of the market.

Take it day by day and manage risk along the way. Be ready for anything

What are your thoughts on today’s action? (Leave a comment below)

This post was brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Cheers!

Richard

P.S. We just released a new free resource: The Ultimate Screening Guide

This will help you find top stocks faster and speed up your routines.

There are several price cycle phases taking place today, namely Exhaustion Extensions for NVDA and SMCI and others. It’s interesting to start left and read right to capture them including Reversal Extensions, Base n’ Breaks, Wedge Pops and Drops, and EMA Crossbacks.

The Price Action Cycle material by Oliver Kell is quite helpful to identify these. And thank you for pointing me in this direction. Trade well