Hi everyone,

I hope you are having a great Wednesday!

In this post I’ll concisely share my thoughts on today’s action. And share a bunch of stock charts that caught my eye. Today

Now let’s dive in ↓

Market Action

In yesterday’s post I wrote “Be prepared for sell off days/profit taking days and know how you will react and your plan. These will come and test your conviction. Whether that is cutting weakest/lowest conviction stuff quickly or staying with longer term rules… know what you will do in advance”

Today we saw such a reversal day.

The QQQ lost 1.5% and broke the lows of the past few days. This can happen quickly when we are short term extended and wedging higher on low volume.

We remain above the rising moving averages but in the short term watch out for more weakness. What would be constructive would be if we can’t push much lower and consolidate sideways letting the 21ema catch up

The IWO now failed the short term range breakout and now looks to fill that gap

Volume

Volume was higher on the NYSE and on the Nasdaq.

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Down - Below Declining

Short-term - 21 ema - Up - Above Rising

Intermediate term - 50 sma - Up - Above Rising

Longterm - 200 sma - Up - Above Rising

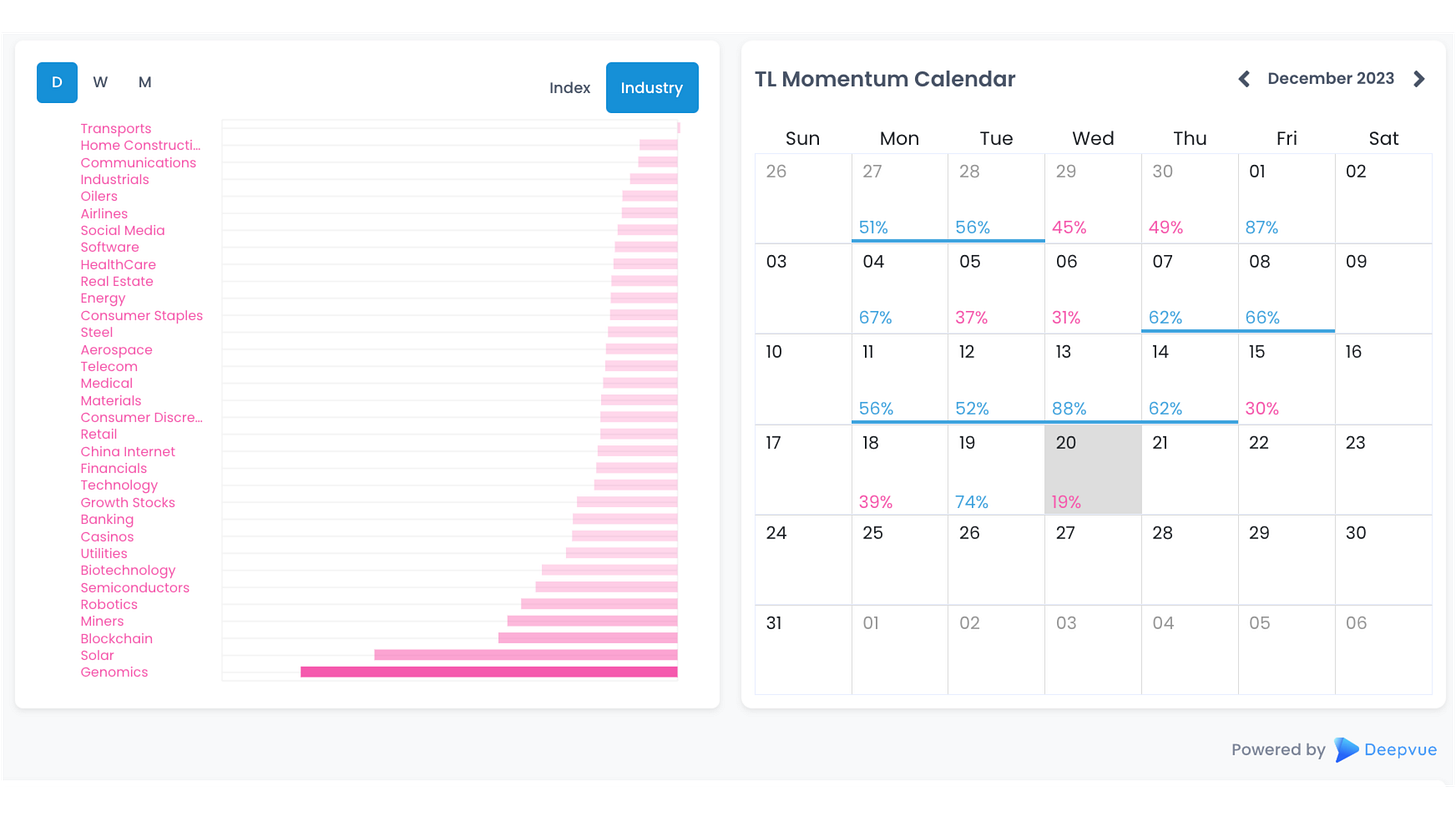

Group/Themes Action

Many growth names down 3% plus.

Group performance chart from TraderLion:

Key Stocks in Deepvue

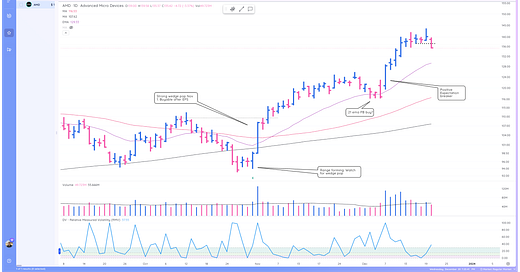

AMD 3 bar break too the downside after a failed push higher yesterday

NVDA downside reversal

DKNG reconfirm down, back at the base pivot area

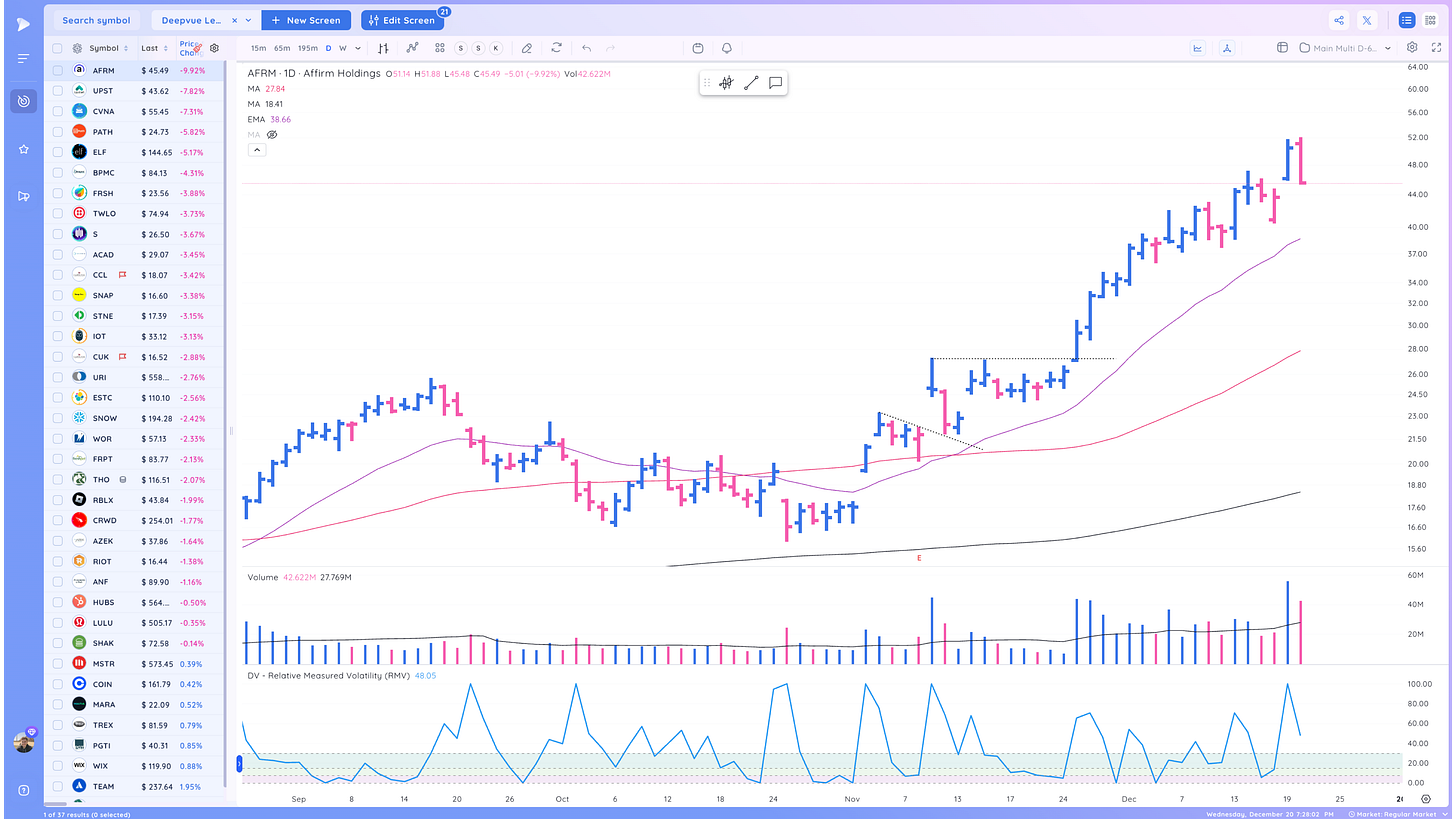

AFRM sharp reversal

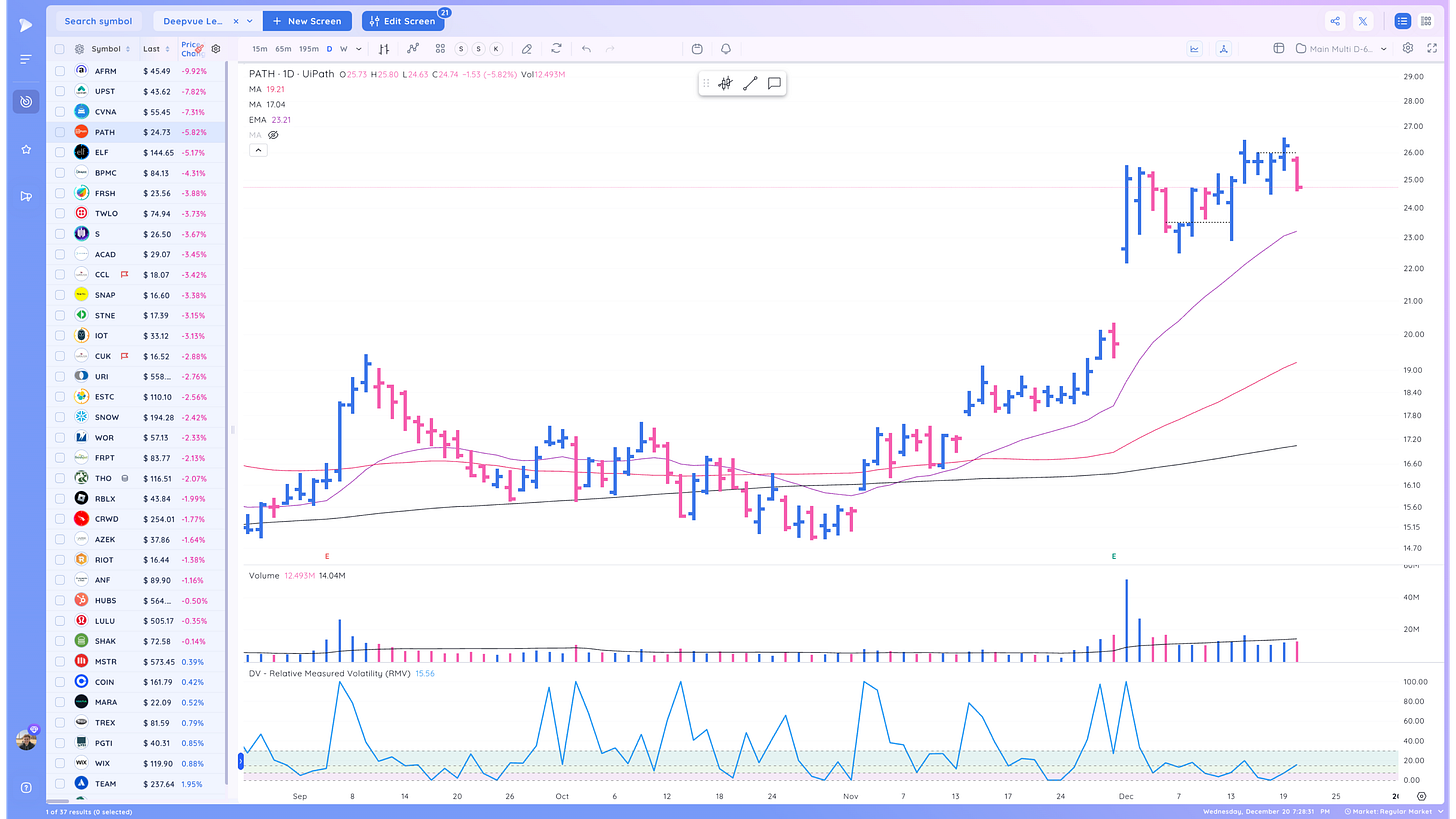

PATH mini expectation breaker

CRWD. Even this and ANF were red

MARA crypto names reversed hard

Market Thoughts

This is a potential tipping point. We were extended and have now had a sharp 1 day pullback. Watch out for further weakness and know your plan. We remain above the moving averages so this could just be the start of a sideways move.

Grade your holdings and know which ones you would cut first.

Be ready for anything.

Reminder:

Risk Management is Paramount

Refuse to enter randomly without managing risk and wait for the spots to develop, they will. Stocks during strong moves always pull back to the 21 ema, 50 sma multiple times.

Have patience, focus on the best stocks with the greatest potential. These will telegraph the rest of the market.

Take it day by day and manage risk along the way. Be ready for anything

What are your thoughts on today’s action? (Leave a comment below)

This post was brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Cheers!

Richard

P.S. We just released a new free resource: The Ultimate Screening Guide

This will help you find top stocks faster and speed up your routines.

I’m thinking the market is pricing in the impact of supply chain shortages on inflation.