Hi everyone,

I hope you are having a great Monday!

In this post I’ll concisely share my thoughts on today’s action and cover NVDA in particular.

This post is brought to you by Deepvue Charts. My Daily Driver for Charting, Alerts, Watchlist Management, and more!

You can watch the full demo of the platform here:

Also be sure to subscribe so you don’t miss any future articles

Now let’s dive in ↓

Market Action

The QQQ showed resilience today, retaking the 50 sma

We remain below a declining 21 ema but this could be the start of the bottoming process of this consolidation. Watching for continued strength and tight action. Today’s lows should ideally hold.

The IWO is weaker but also had a constructive upside reversal

SMH - The semiconductors rallied strongly with a great positive outside reversal.

Note about Volume

Volume was lower on the Nasdaq and about even on the NYSE. I would have liked to see volume expand compared to the down days. The price action was very strong however.

Key Stocks (Well Stock today)

NVDA led the charge today. It undercut the range, key level, and rallied strongly into the close, retaking the 50 sma.

I bought back in as it pushed the intraday range (see below) and took out yesterday’s highs. I’ll look to add if it continues to show constructive action and emerge from a tight consolidation. If it loses today’s lows I’ll be out with a small loss.

We are still below a declining 21ema

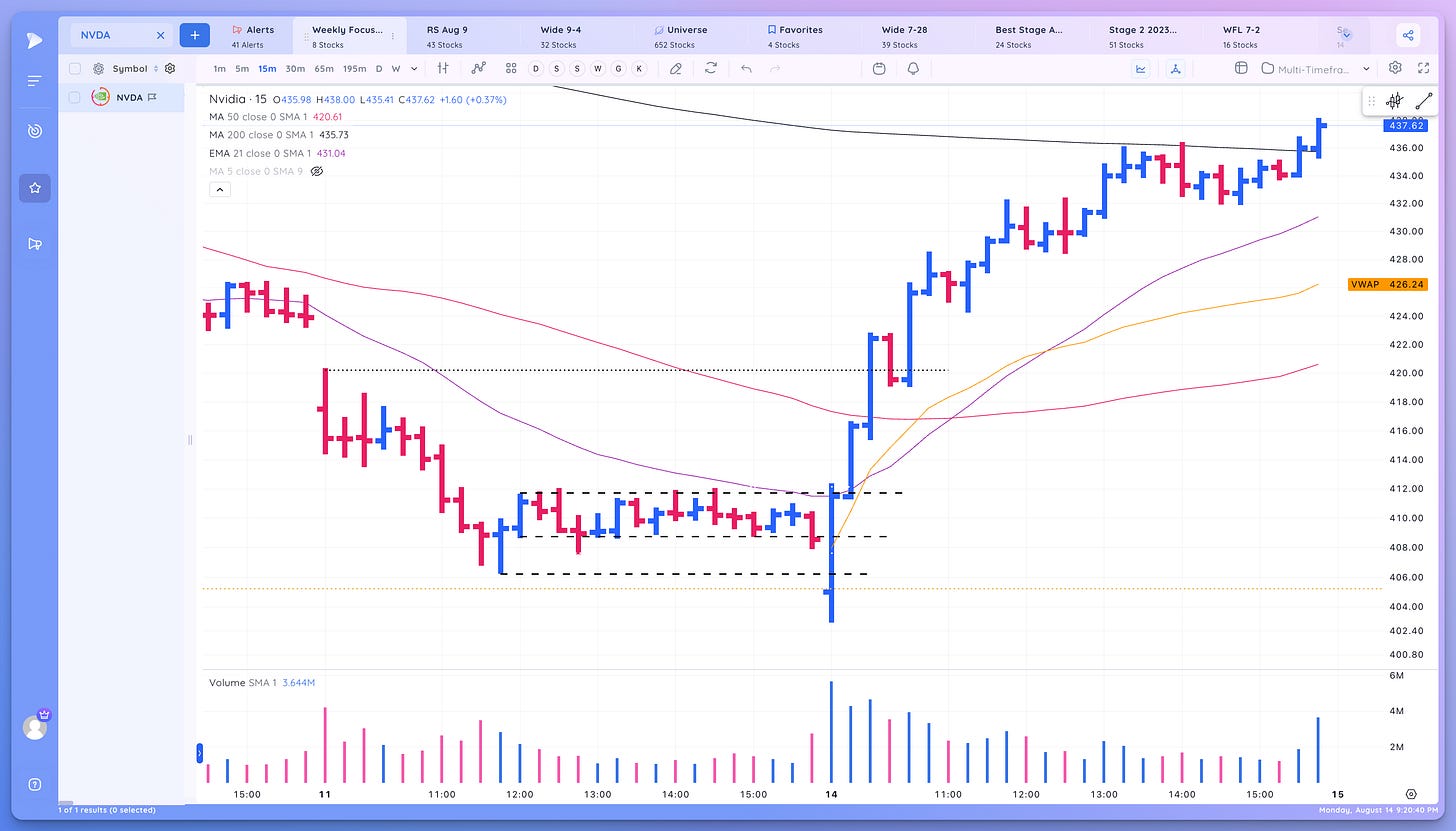

Here’s a 15 minute chart of NVDA. Note the shakeout below that tight intraday range and the yellow key level from the higher timeframe.

Then the powerful reversal back through the range and push higher the whole day above the daily AVWAP

There were several possible entry tactics today, with the larger setup being an undercut and rally of the higher timeframe level.

Undercut and rally of key level ~405

Oops reversal through yesterday’s lows at 406

Rally through bottom of intraday range at 408

Break through intraday range and & 15 min 21 ema at 411

15 Minute Opening range breakout at 412

Through yesterdays high at 420

Remember and this is really key, we are able to look at intraday entry tactics because there is a setup on a higher timeframe - Undercut and rally of a key level

Will today’s lows hold? It was strong price action but anything can happen.

What I do know is that if it breaks today’s lows my setup was invalidated and I’ll be stopped out for a small loss and back to watching for an entry in the leader.

Trends ( Based on QQQ)

Shortest - 5 Day SMA - Mixed - Above declining

Short-term - 21 ema - Down - Below declining

Intermediate term - 50 sma - Up- Above Rising

Longterm - 200 sma - Up - Above Rising

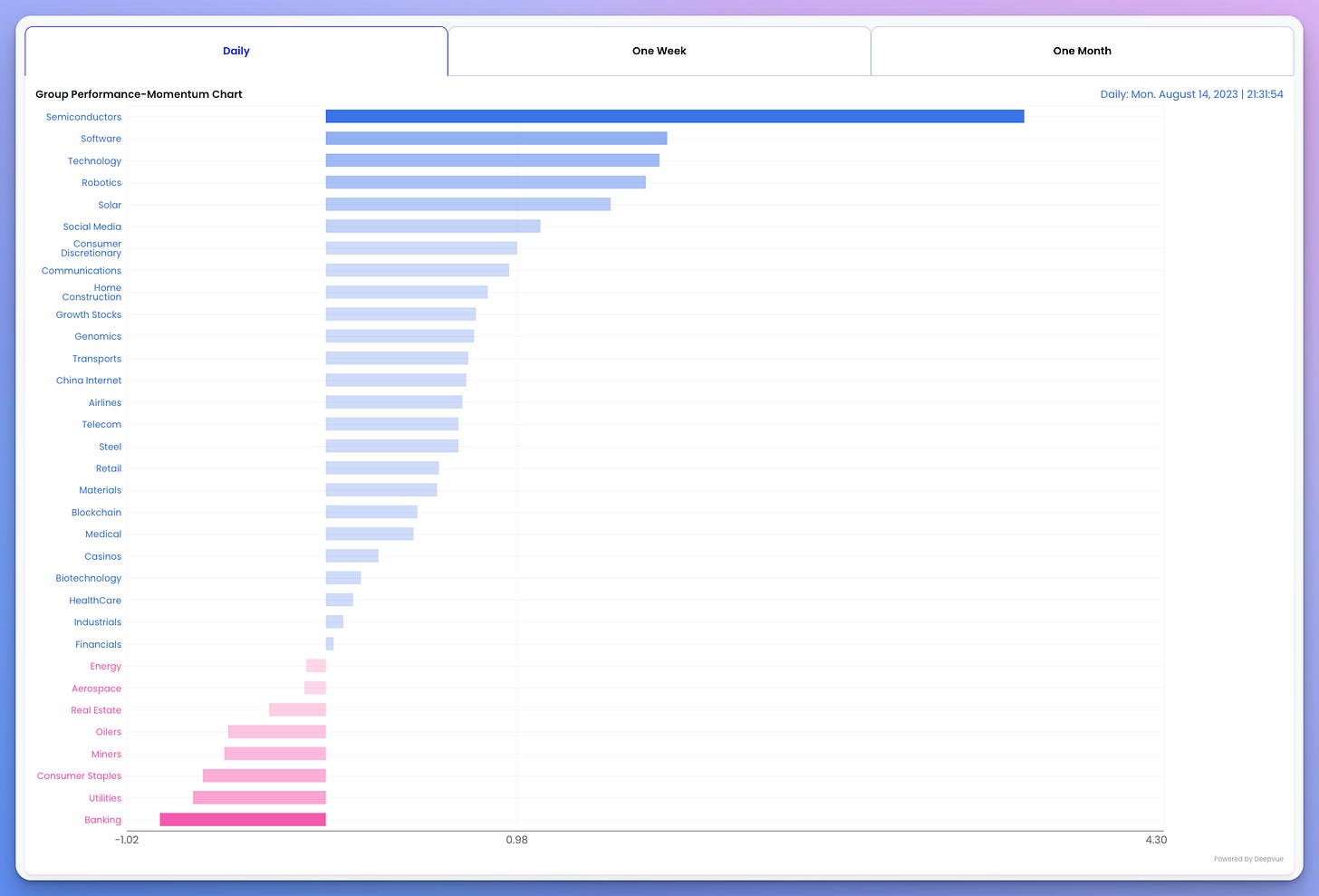

Group/Themes Action

Looking through my list the biggest theme I noticed was rotation back into semis and growth

Here’s a Group Performance chart from TraderLion Private Access:

Market Thoughts

It’s amazing how one day can feel like it changes things. Growth and the leader NVDA were strong.

However, it could change just as fast the other way so be ready. If the constructive action continues there will be plenty more opportunities to enter leaders as they complete the right sides of bases.

No rush and manage risk!

Share Your Market Thoughts

What do you think about this market? What stocks stood out to you today?

Let me know below in the comments. And leave a like!

I hope you found this article helpful!

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Have a great weekend!

Richard