Hi everyone,

Let’s dive right into today’s (Wednesday’s) action. We’ll cover the general market and then individual stocks that are standing out.

Make sure you are subscribed so that you don’t miss any future articles.

The General Market

After pushing higher initially, the market faded hard on the announcement at 2pm then chopped sideways for the most part the rest of the day.

The QQQ closed down 0.74% on lighter volume than the previous day.

The SPY was down .64% right at the 200 day sma.

The IWM was down 0.66% also near the 200 sma.

The VIX is back below all MAs

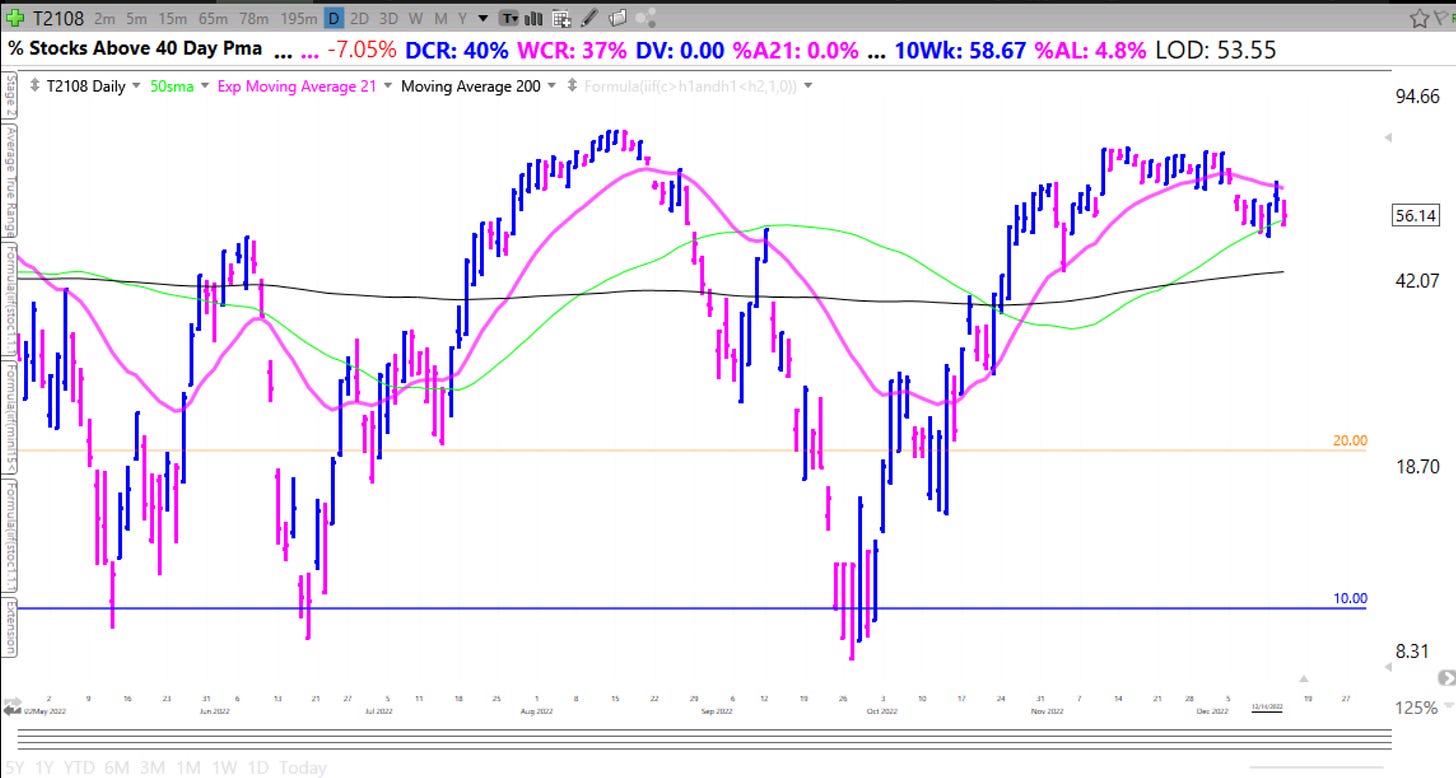

The T2108 is below the 21ema but just above its rising 50 day.

The McClellan Oscillator is in the middle of its range

Trends (3/4 Up) (QQQ)

Short-term: Up (above a rising 5 sma)

Intermediate-term: Up (above a rising 21 EMA)

Mid-term: Up (above a rising 50 sma)

Long-term: Down (below a declining 200 SMA)

Overall Thoughts

Individual growth stocks such as ARRY MRNA… held up better than the indexes.

The market got a bit ahead of itself yesterday and pulled back hard since the gap up. As long as leadership holds up and the indexes hold above their moving averages the rally is intact.

I hope you found this article helpful! Let me know your thoughts in the comments below.

Here is what you can do to help make them possible and support my work.

Leave a like on this post below

Share this post on Twitter using the button below

Have a great week!

-Richard

Good read! Here’s my take.

https://finiche.substack.com/p/inflation-dominates-global-tensions